JPMorgan's Significant Stake in BitMine

JPMorgan Chase has taken a substantial position in BitMine Immersion Technologies, with its recent SEC filing confirming nearly 2 million shares valuated at $102 million as of September 30, 2025. This highlights growing institutional confidence in Ethereum-based assets, potentially affecting market dynamics, given BitMine's significant Ether reserves and continuing sectoral influence.

JPMorgan Chase has revealed a substantial $102 million investment in BitMine Immersion Technologies via a 13F-HR filing to the SEC. This move highlights JPMorgan's strategic positioning within the Ethereum infrastructure. The acquisition reflects a significant shift in focus towards Ethereum's regulatory and market strength, bolstered by BitMine's vast ETH reserves. This aligns with increasing institutional interest in Ethereum. Investor reactions show growing confidence in Ethereum's market prospects. Key figures, such as BitMine's Tom Lee, emphasize Ethereum's reliability as a legally compliant platform, potentially accelerating institutional adoption.

BitMine's Dominant ETH Holdings and Market Impact

BitMine Immersion Technologies currently holds over 3.24 million Ether, accounting for over 2% of Ethereum's total supply, a key factor in enhancing its reserve-based market influence.

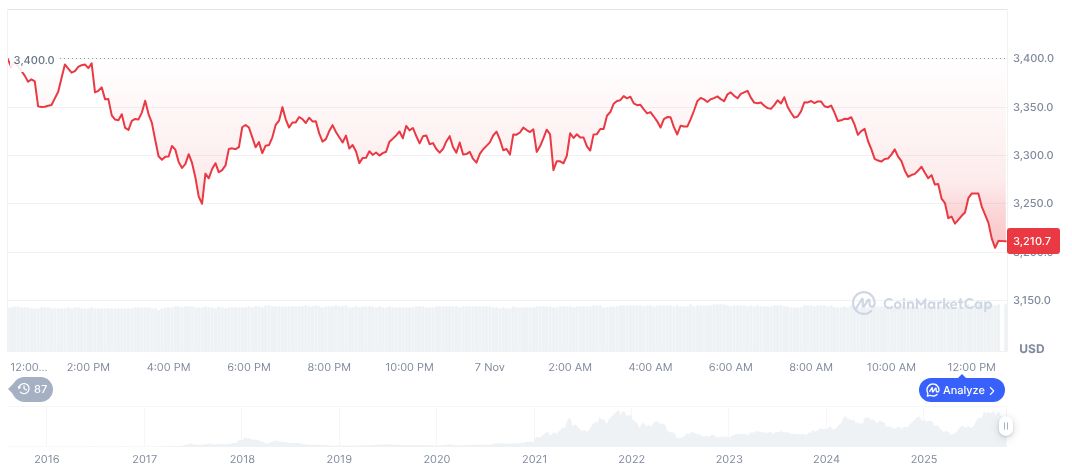

Ethereum (ETH), priced at $3,474.02, maintains a market cap of 419.30 billion with a 12.09% market dominance as of November 8. According to CoinMarketCap, its circulating supply stands at approximately 120.70 million ETH. The recent price has varied by 4.36% over the past 24 hours.

The Coincu research team suggests that this institutional alignment may lead to more regulatory clarity, affecting Ether's price stability and broader market spectrum. Tom Lee's stance reinforces Ethereum's leading role in future financial applications. As Tom Lee, Chairman of BitMine Immersion Technologies, noted, "Ethereum is the preferred choice because it’s had zero downtime since inception – it’s the most legally compliant and secure blockchain."