Japan is moving closer to mainstream stablecoin adoption as its largest banks collaborate on a new digital payments experiment.

The Financial Services Agency (FSA) has formally endorsed a pilot initiative that brings together Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), and Mizuho Financial Group, three of Japan’s biggest financial institutions, to issue yen-backed stablecoins for corporate use.

A New Era for Corporate Settlements

The project aims to overhaul Japan’s traditional corporate payment systems by leveraging blockchain technology to reduce transaction costs, speed up cross-border transfers, and simplify settlement workflows.

Together, the participating banks serve a network of over 300,000 corporate clients, many of whom still rely on conventional bank-to-bank payment rails that can be costly and time-consuming.

The stablecoins will be issued on the Progmat platform, MUFG’s tokenization and stablecoin issuance infrastructure, which has been designed to meet Japan’s rigorous financial compliance standards.

Mitsubishi Corp. to Lead Initial Adoption

According to early reports, Mitsubishi Corp., one of Japan’s largest trading conglomerates, will become the first major corporate user of the yen stablecoin. The company plans to deploy the asset for internal settlements and global trade operations, both of which involve complex multi-jurisdictional transactions.

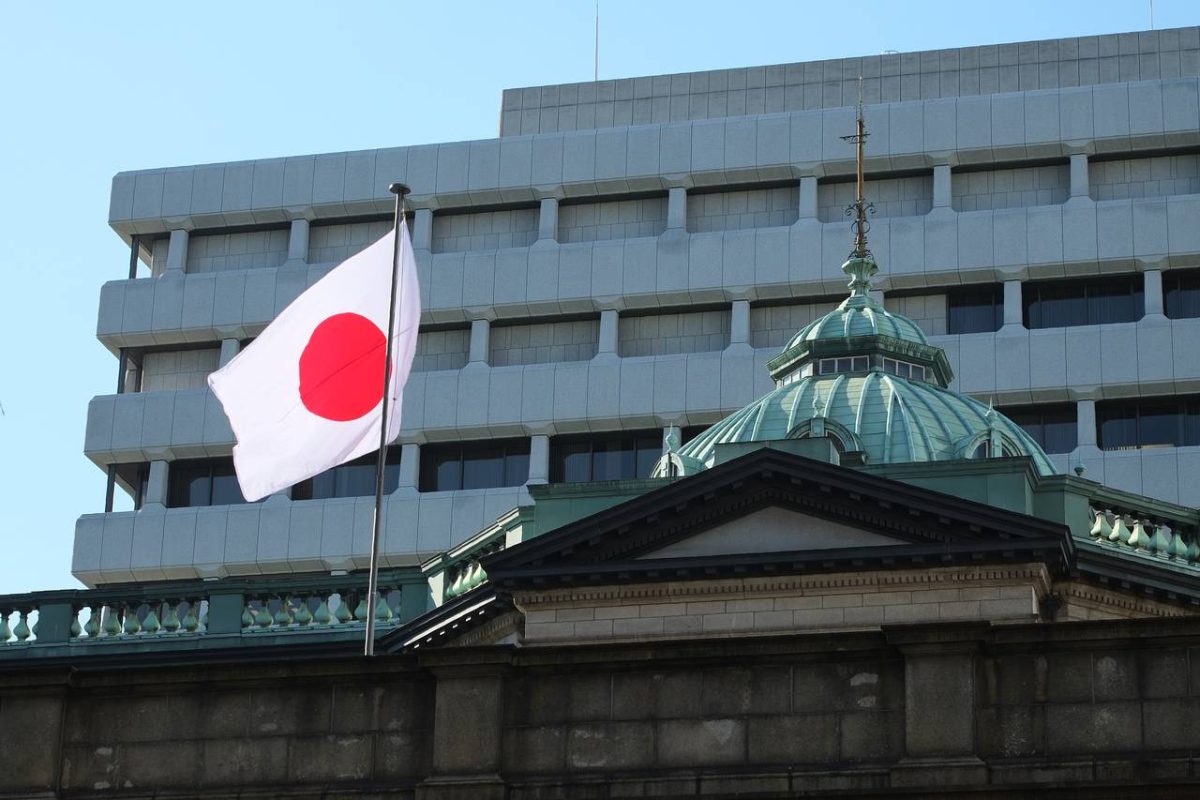

Regulatory Support Strengthens Legitimacy

The FSA’s direct support adds weight to the initiative, confirming that the pilot aligns with Japan’s 2023 stablecoin regulations, which require full reserve backing and licensed custodianship for all issued tokens.

Officials described the collaboration as part of a broader “Payment Innovation Project”, signaling Japan’s growing intent to blend regulated finance with blockchain infrastructure.