Key Developments in Japan's Stablecoin Project

The Financial Services Agency of Japan has approved a yen stablecoin project involving major banks, set to begin in November 2025. This collaboration aims to improve compliance and facilitate practical application within the year.

The participating major banks include Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho. This initiative is expected to enhance Japan's digital finance landscape by improving cross-border transactions and increasing the liquidity of yen-backed stablecoins, potentially challenging the dominance of dollar-backed alternatives.

Official Endorsement and Project Goals

The Financial Services Agency has officially approved and endorsed the experimental issuance of a yen stablecoin. This venture, involving Mitsubishi UFJ Bank, Sumitomo Mitsui Banking Corporation, and Mizuho Bank, will commence in November 2025. It marks the first project under the "Payment Improvement Project" (PIP), with a strong focus on compliance verification and practical stablecoin operations.

The yen stablecoin initiative is anticipated to offer a significant challenge to the market dominance of dollar-backed stablecoins such as USDT and USDC. By utilizing blockchain technology, these financial institutions aim to refine cross-border payment systems and contribute to Japan’s fintech advancement.

Market feedback on this development has been cautiously optimistic. While some observers view it as a potentially transformative event, others have voiced concerns regarding the regulatory hurdles that may arise. To date, there have been no major public statements from executives at the involved banking institutions, underscoring the official nature of communications surrounding this project.

Historical Context and Market Position

This joint stablecoin project by major Japanese banks is a direct response to previous initiatives, such as the MUFG Coin tests. These earlier efforts helped pave the way for current regulatory standards and highlighted the critical need for a blockchain-based payment solution within Japan.

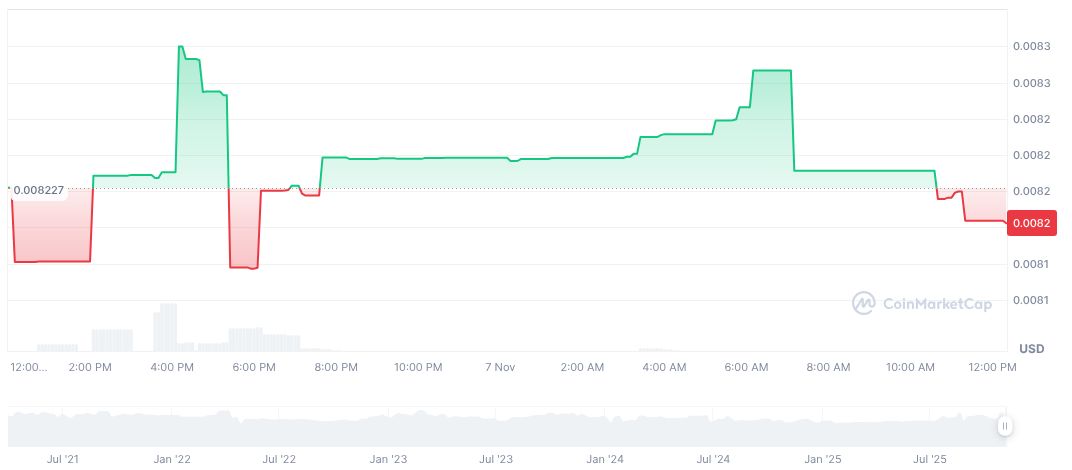

Currently, the JPY Coin (JPYC) maintains a stable value of $0.01, showing minimal change in market dynamics. It has zero market cap and dominance according to CoinMarketCap. While the 24-hour trading shows a slight 0.33% price increase, its current market value remains negligible, indicating JPYC's role as a symbolic offering pending further developments.

Insights from the Coincu research team suggest that the introduction of a yen-backed stablecoin could significantly enhance liquidity within the market. It is also expected to provide a robust alternative to stablecoins that are currently dominated by the US dollar. Regulatory support and ongoing technological innovations within the blockchain ecosystem are anticipated to bolster the adoption of this new stablecoin across global crypto financial markets.