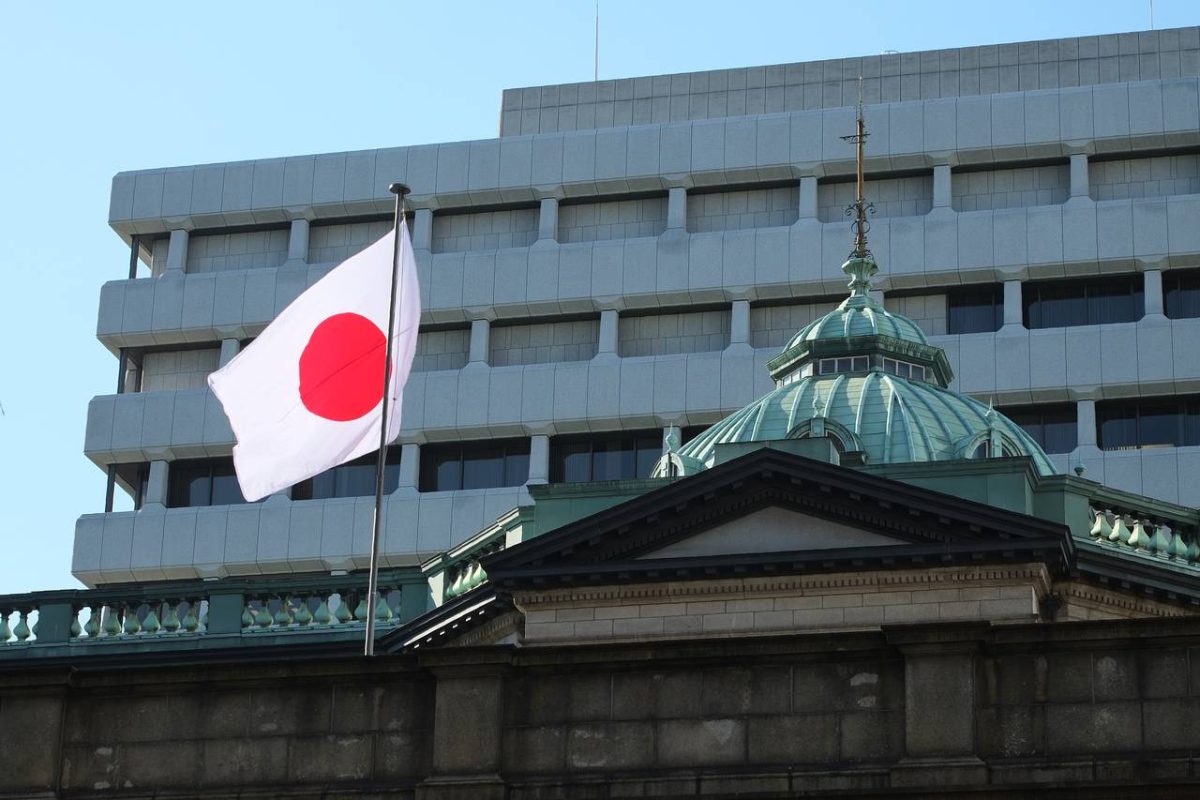

Japan’s Financial Services Agency (FSA) is taking another major step toward strengthening investor protection in the digital asset sector. The regulator is preparing a new mandate requiring cryptocurrency exchanges to maintain liability reserves, bringing the industry closer to the standards imposed on banks and traditional brokerages.

New Reserve Requirements to Protect Customer Funds

Under the upcoming framework, exchanges operating in Japan will be required to set aside capital reserves specifically designed to cover losses stemming from hacks, fraud, system failures, or other operational risks. The goal is to create a reliable financial buffer that ensures customers remain protected even during extreme security incidents.

This type of safety requirement has long been a cornerstone of traditional finance. By applying similar standards to digital asset platforms, the FSA aims to reduce systemic vulnerabilities and increase market stability.

A Response to Japan’s History of Major Crypto Incidents

Japan’s regulatory tightening is shaped by past crises that exposed weaknesses in exchange governance. The Mt. Gox collapse in 2014, which resulted in the loss of hundreds of thousands of Bitcoin, remains one of the largest failures in crypto history. More recently, the DMM Bitcoin hack of 2024, involving over $300 million in stolen assets, renewed pressure on authorities to impose stricter safeguards.

These events reinforced the necessity of requiring exchanges to hold robust financial reserves to absorb unexpected losses and shield customers from catastrophic outcomes.

Part of a Broader 2026 Regulatory Overhaul

The FSA plans to formally submit legislation to parliament in 2026, where the reserve requirement will become part of a wider restructuring of Japan’s digital asset rules. This overhaul includes:

- •Reclassifying cryptocurrencies as “financial products”, giving regulators broader authority.

- •Exploring lower tax rates for crypto gains, addressing long-standing criticism from traders and institutional players.

Together, these reforms aim to modernize Japan’s crypto legal architecture and provide clarity for both investors and service providers.

Aligning With Global Financial Standards

By pushing exchanges toward holding capital reserves, Japan is moving the crypto industry closer to traditional financial-sector norms, where stringent capital and liquidity requirements protect consumers and maintain market integrity.

The move underscores Japan’s commitment to balancing innovation with responsible regulation, a stance that increasingly positions the country as one of the world’s leaders in structured, investor-friendly crypto oversight.