Market Growth Projections and Regulatory Urgency

US Treasury Secretary Janet Yellen forecasts a significant expansion of the stablecoin market, projecting a growth from its current $300 billion valuation to $3 trillion by 2030. This anticipated tenfold increase underscores the urgent need for robust regulatory frameworks to govern this rapidly evolving sector.

Yellen's projection highlights the massive potential for market expansion, which is expected to influence global crypto regulations and increase attention on financial stability and consumer protection measures. The envisioned growth necessitates the development of secure payment infrastructures that are aligned with stable and liquid reserves, preferably held in U.S. Treasuries.

Lessons from Past Crashes and Future Regulatory Pathways

The TerraUSD crash in 2022 served as a critical cautionary tale in stablecoin discussions. This event highlighted the essential need for regulatory measures to prevent similar financial dislocations in growing markets and emphasized the importance of robust risk management practices.

With the projected stablecoin expansion, increased scrutiny over reserve management practices and their influence on broader financial markets are expected. Experts stress that bolstered regulations could stabilize the rapidly evolving digital finance landscape, thereby securing safer environments for investors.

Coincu's research team suggests that the impending regulatory changes may influence fiat currency dynamics and crypto-asset demand. These developments are crucial for shaping the future of digital finance and ensuring its integration into the global financial system.

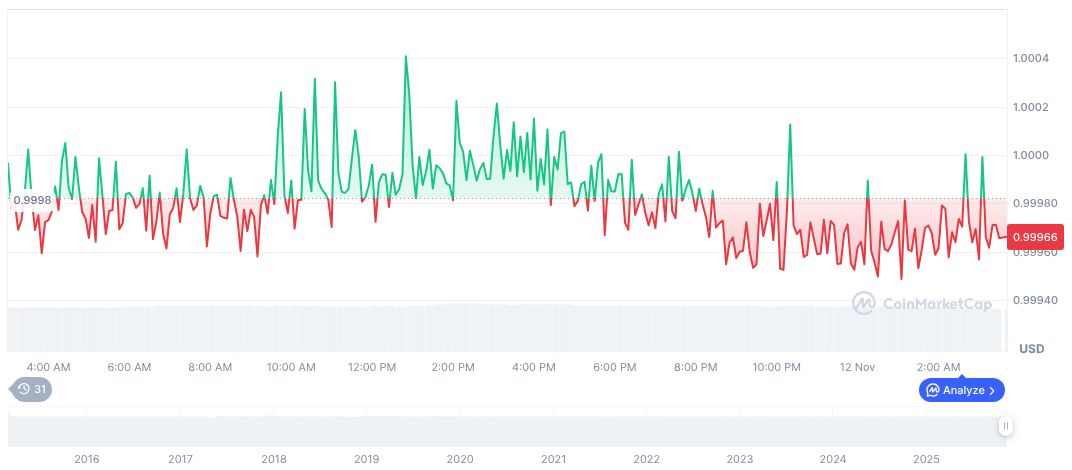

Current Market Data and Stability

Tether USDt (USDT) currently maintains a price of $1.00 with a market capitalization of $183.50 billion, representing a market dominance of 5.37%. Despite a 24-hour trading volume that has receded by 10.24%, the coin has demonstrated stability over several time frames. Recent data indicates negligible price fluctuations in recent months.