World Liberty Financial (WLFI) has re-entered the spotlight this week, with its price experiencing a significant 29% surge shortly after Bitcoin's recovery to $85,000. This upward movement was not solely a reaction to Bitcoin's performance; several key factors converged to rapidly shift market sentiment.

WLFI Rebound Supported by Strong Demand

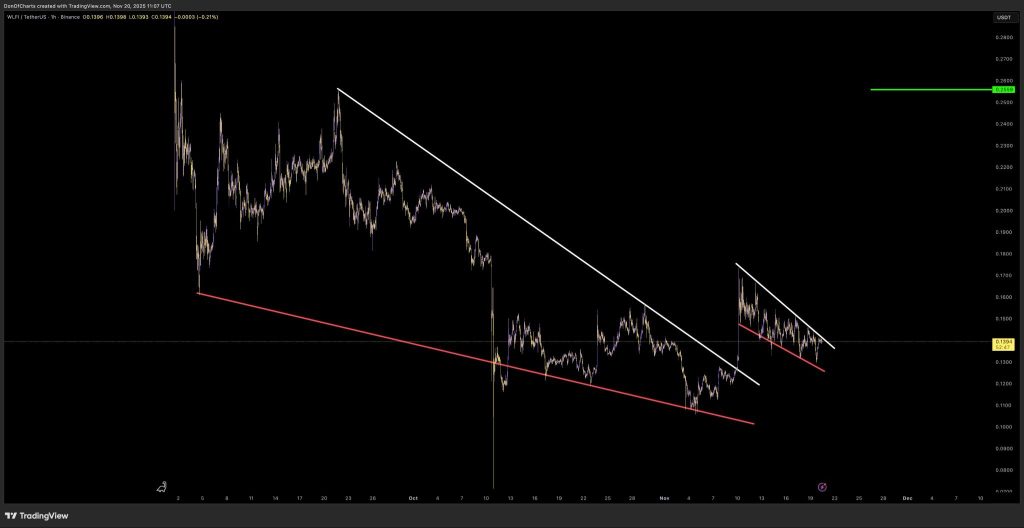

The price trajectory of WLFI clearly indicates a rebound built on robust support. The WLFI price has repeatedly found a floor at the $0.12 demand zone, a level that has consistently acted as a reliable support for buyers. The 4-hour chart illustrates the swift shift in momentum following a rejection at this zone, propelling the price back towards the $0.14–$0.15 region.

Analysts have highlighted how demand returned aggressively immediately after Bitcoin's recovery. This rapid surge validated the existing support level and served as a reminder to the market that buyer interest remains active.

Token Burn and New Integrations Bolster WLFI's Momentum

The recent rally was also influenced by a significant supply-side event. WLFI executed a token burn of 166.6 million tokens, valued at approximately $22 million, after identifying and removing assets associated with a phishing wallet. This burn has permanently reduced the circulating supply, providing a notable boost in confidence for the WLFI community. Such actions are crucial as they demonstrate the project's commitment to safeguarding its ecosystem.

Investors have clearly responded positively to these developments, with the market performance confirming their impact. However, the WLFI rally was not solely dependent on the token burn. The project has also recently integrated Chainlink CCIP, enabling seamless cross-chain transfers between the Ethereum and Solana networks. Furthermore, WLFI's participation in the Solana Liquidity event in Hong Kong has placed it at the forefront of discussions regarding the expansion of DeFi liquidity. Given the resurgence in DeFi trading volumes, the timing of these developments has been particularly advantageous.

These strategic advancements have contributed significantly to the momentum driving the current rally, providing fundamental backing to the technical signals observed on the charts.

Chart Analysis Suggests a Potential Structural Shift for WLFI

Technical analysis indicates that the WLFI price has been trading within a long-standing descending resistance trendline for several weeks. However, each subsequent pullback has shown diminishing intensity, a common precursor to sellers losing momentum. Currently, the WLFI price is positioned just below this trendline, suggesting a critical juncture where a directional decision is imminent.

A successful breach above the $0.16–$0.17 resistance area could pave the way for the next significant price target around $0.255. Surpassing this level would represent a substantial shift in market structure and potentially trigger a more pronounced rally. With increased trading volume accompanying such a breakout, discussions about a new all-time high could become increasingly realistic.

Anticipation Builds for a Potential WLFI Breakout

The WLFI chart has exhibited descending wedge patterns for months, with each prior breakout attempt resulting in a discernible price movement. The current wedge formation mirrors these previous patterns, with the WLFI price consolidating just below a clear downtrend line. A decisive move above the $0.16–$0.17 range could establish $0.255 as the next primary resistance level, aligning with analytical projections.

The sustained strength of Bitcoin remains a crucial factor for WLFI's performance, and maintaining the $0.12 support level is essential. However, for the first time in a considerable period, the technical setup appears more constructive than purely reactive. While a new all-time high is not guaranteed, the possibility is evolving from speculation to a more tangible discussion.