New data shared by Daan Crypto Trades shows that Bitcoin remains tightly correlated with global liquidity trends, and that relationship may now be shifting again. His chart compares Bitcoin’s price to the Global Liquidity Index, highlighting a near-perfect overlap between the two.

According to the chart, global liquidity formed a local top in early October, precisely when Bitcoin also printed its peak and reversed. Over the past week, the liquidity index has started to push higher again. If this climb continues, Daan argues it could improve conditions for Bitcoin and other risk assets, which have struggled during the recent liquidity squeeze.

The visual shows liquidity (yellow line) and BTC price moving almost in lockstep across 2021–2025, reinforcing the idea that macro liquidity remains the dominant driver of Bitcoin’s major cycles.

Short-Term Holders Face Record Losses

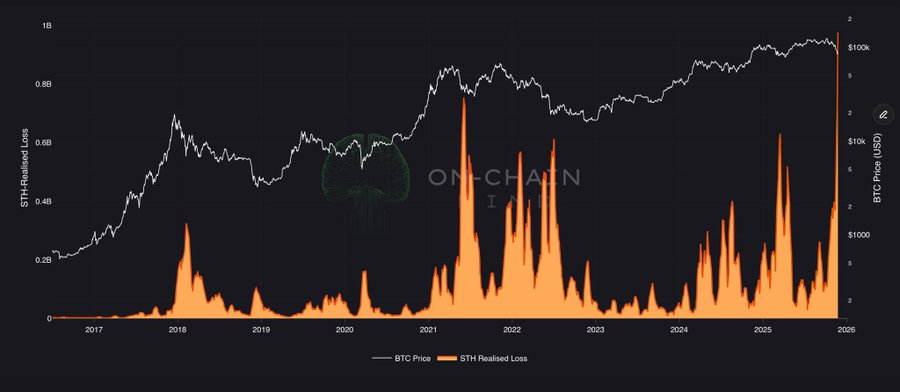

While the liquidity outlook is improving, on-chain stress has reached historic levels. New data from Bitcoinsensus reveals that short-term Bitcoin holders are now realizing over $900 million in daily losses, surpassing even the China mining ban capitulation and the FTX collapse.

The chart shows a massive spike in STH realized loss, matching levels typically seen at deep market capitulation points. Each previous surge in the orange loss bars occurred near major bottom formations, suggesting that the current pain could signal exhaustion among panic sellers.

According to the chart, Bitcoin’s price (white line) remains significantly above prior cycle lows, yet short-term holders are experiencing losses on a scale greater than previous crashes. This mismatch highlights how aggressively leveraged and reactive newer market participants have become during the recent correction.

A Market at a Turning Point

Taken together, the two data sets show a market under intense pressure but potentially nearing a structural shift. Liquidity is improving just as realized losses spike to extreme levels, a combination historically associated with transitional phases rather than prolonged downside.

If global liquidity continues to rise, Bitcoin may find support more easily in the weeks ahead. But until selling pressure cools and volatility stabilizes, traders should expect elevated uncertainty around key levels.