Interactive Brokers has rolled out a major update that allows eligible clients to fund accounts around the clock using stablecoins, removing one of the longest-standing bottlenecks in global trading.

The feature enables near-instant deposits, allowing users to access more than 170 markets within minutes, even on weekends and holidays.

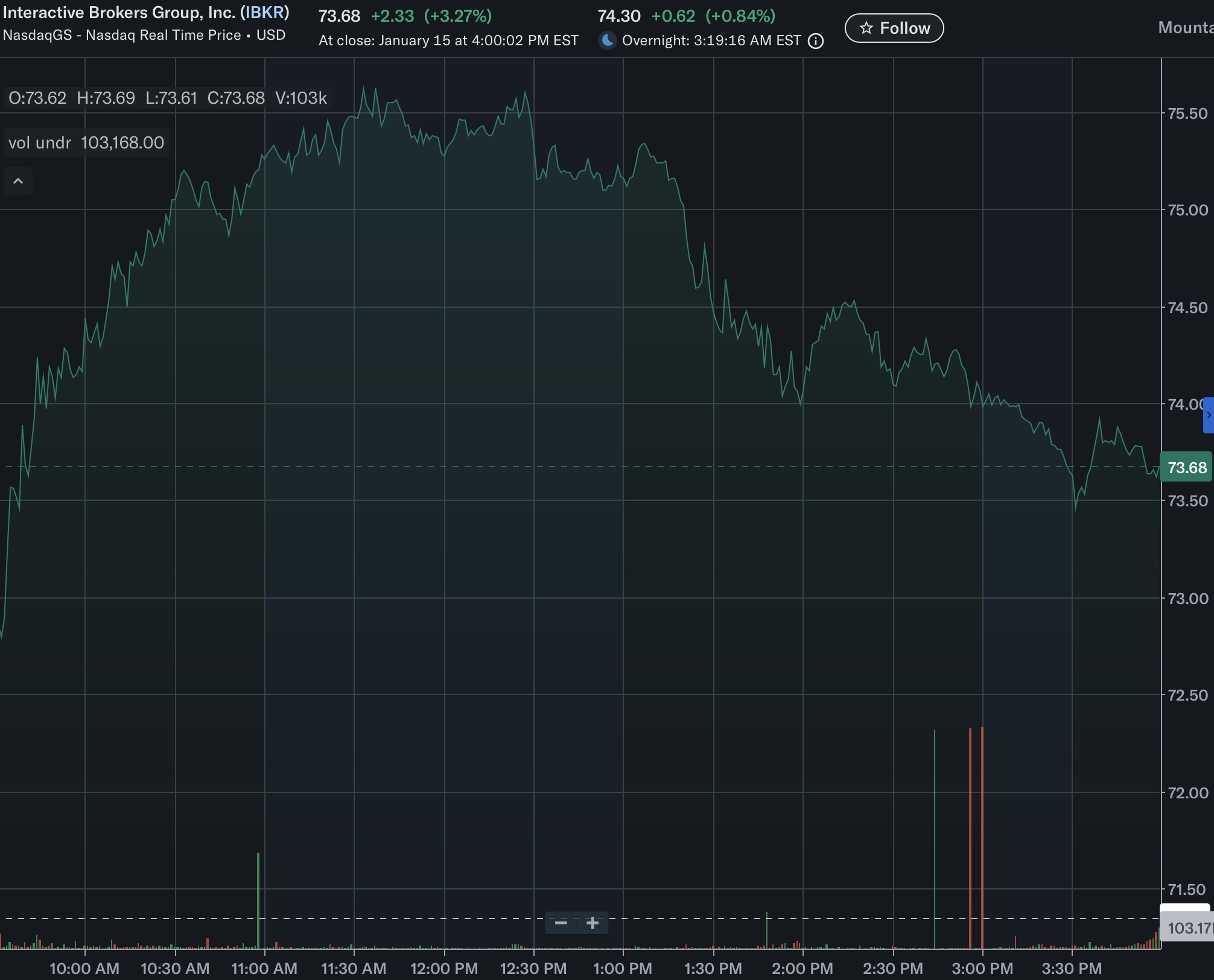

The update was announced on January 15, 2026, and immediately drew attention from markets. Shares of Interactive Brokers climbed to a record high, trading near $73.7 at the time of writing.

How the New Funding Works

The service initially supports deposits in USD Coin, with additional assets scheduled to follow. Support for RLUSD and PayPal USD is expected during the week of January 19, 2026.

Account funding is powered by ZeroHash, which processes transfers across the Ethereum, Solana, and Base networks. Once received, stablecoins are converted into U.S. dollars and credited to the client’s brokerage account.

Interactive Brokers does not charge deposit fees for the service. ZeroHash applies a 0.30% conversion fee, with a minimum charge of $1, to convert stablecoins into USD.

Addressing a Core Friction for Global Traders

The move directly targets one of the most persistent pain points for international investors: funding delays and costs tied to traditional wire transfers. Cross-border wires often take one to three business days to settle and can carry fees ranging from $25 to $50 per transaction. Those delays can leave traders sidelined during fast-moving market conditions.

By contrast, the stablecoin-based process allows capital to be deployed almost immediately after transfer, regardless of banking hours. According to CEO Milan Galik, the goal is to deliver “the speed and flexibility required in today’s markets.”

Broader Implications

The rollout extends Interactive Brokers’ push toward digital asset integration without changing its core brokerage model. Clients are not trading crypto directly through the feature; instead, blockchain rails are being used to modernize how cash enters the system.

The market reaction suggests investors see the move as a competitive advantage, particularly for globally active clients who rely on fast access to capital. With 24/7 funding now live, Interactive Brokers is positioning itself to operate on the same clock as the markets its clients trade.