Key Insights

- •Franklin Templeton anticipates a significant increase in institutional cryptocurrency adoption by 2025.

- •Stablecoins are identified as a primary driver for innovation in payment systems and as a base currency for tokenized assets.

- •Regulatory developments, such as the GENIUS Act, are expected to boost institutional confidence in the crypto market.

Institutional Adoption Accelerates

Christopher Jensen, Head of Digital Asset Research at Franklin Templeton, shared insights in a Binance interview indicating that institutional adoption of cryptocurrency is accelerating, with substantial progress projected by 2025. This growth is largely attributed to the increasing adoption of stablecoins and the pursuit of regulatory clarity.

This evolving landscape is poised to reshape financial systems, fostering greater integration between traditional finance and blockchain technology. The rising institutional interest in stablecoins and tokenized assets is a key indicator of this trend.

Stablecoins Redefining Payment Systems

Jensen highlighted the pivotal role of stablecoins, projecting them to become the primary currency for tokenized assets. The large-scale implementation of stablecoins is actively reconfiguring payment systems, signaling a broader entry of institutional players into the cryptocurrency space. The year 2025 is anticipated to be a significant turning point, making the integration of traditional finance into blockchain technology more probable. Improvements in the regulatory climate, particularly the GENIUS Act, are further strengthening institutional confidence and encouraging engagement with cryptocurrencies.

According to Jensen, the growing reliance on stablecoins signifies wider shifts in the financial sector. Tokenization is actively reshaping financial landscapes, and future investors may find their portfolios including a diverse range of assets such as U.S. Treasuries and NFTs. Institutional entities appear to be shedding previous hesitations, indicating a progression towards a structural adoption phase for digital assets.

"Institutions are actually coming now … Stablecoins were the first ‘killer app’ in crypto, not just for payments but as a base currency for tokenized assets. The regulatory climate—particularly the GENIUS Act—is a catalyst for institutional confidence.” — Christopher Jensen, Head of Digital Asset Research, Franklin Templeton

Stablecoin Growth Fuels Institutional Shift

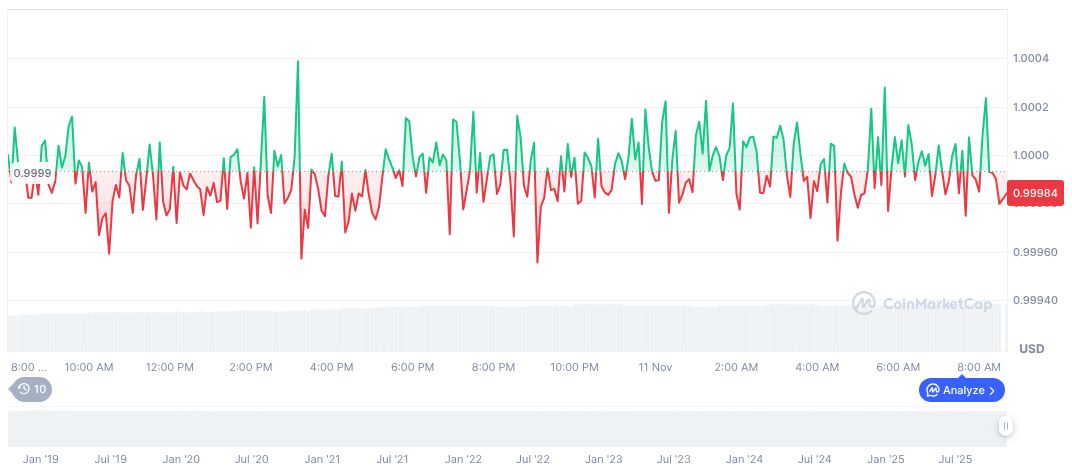

Stablecoins like USDC have consistently maintained price stability, mirroring the evolution of Eurodollar markets in traditional finance. This stability provides a robust foundation for ongoing financial innovations and broader market acceptance.

Data from CoinMarketCap indicates that USDC currently holds a market capitalization of $76.10 billion, maintaining a stable price of $1.00. The stablecoin has seen a 24-hour trading volume of $16.15 billion, representing a 24.98% increase, with its market dominance at 2.15%. This data illustrates minimal price fluctuation, aligning with USDC's established stability standards.

Research suggests that regulatory clarity derived from legislative efforts like the GENIUS Act could lead to widespread adoption of stablecoins as secure transactional units. The emergence of diversified on-chain portfolios, leveraging tokenized assets, has the potential to redefine asset management paradigms and facilitate further integration of traditional financial systems with blockchain innovations.