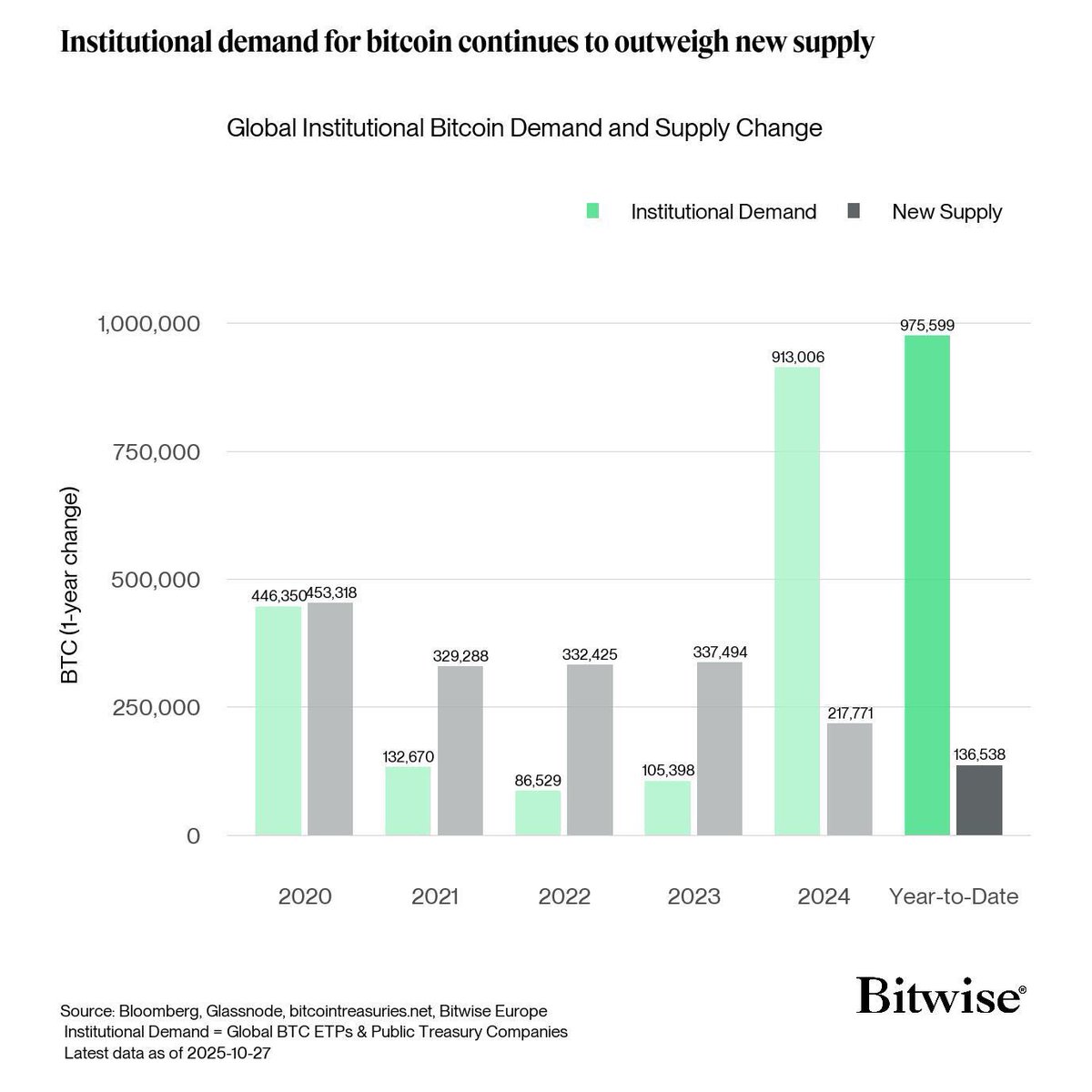

New data from Bitwise indicates a significant surge in institutional appetite for Bitcoin, reaching one of the strongest levels in years. The current demand far surpasses the newly issued supply, highlighting a structural shift where institutions are accumulating Bitcoin at a pace that the network's issuance can no longer match.

For 2025 alone, global institutional demand has climbed to 975,599 BTC year-to-date, while the new supply stands at just 136,538 BTC. This substantial imbalance is among the largest on record, signaling that significant capital continues to view Bitcoin as a strategic, long-duration asset.

Tracking the Multi-Year Demand Shift

This trend has not emerged suddenly but has steadily strengthened across multiple market cycles.

- •In 2020, institutional demand reached 446,350 BTC, nearly matching that year's new supply.

- •From 2021 to 2023, demand softened but remained positive, ranging between 86,529 BTC and 132,670 BTC annually.

- •In 2024, accumulation sharply accelerated again, reaching 913,006 BTC as ETF inflows, corporate treasuries, and sovereign purchases gained momentum.

The year-to-date surge in 2025 provides the strongest evidence yet that Bitcoin's demand profile is becoming structurally institutional.

ETFs, Corporate Treasuries, and Sovereign Interest Drive the Trend

A significant portion of the accelerating demand originates from spot Bitcoin ETFs, global asset managers, and companies incorporating BTC into their balance sheets. Publicly reported treasury purchases continue to rise, and ETFs in the U.S. and Europe collectively attract tens of thousands of BTC each month.

Sovereign interest is also expanding. Several governments have started openly accumulating Bitcoin or investing through national funds, adding another layer of consistent demand that was absent in earlier cycles.

A Supply Crunch That Gets Tighter After Each Halving

The issuance of new Bitcoin continues to decrease as the halving cycle progresses. With fewer coins being mined each year, even moderate demand can overwhelm supply. However, current demand is not moderate; it is aggressively rising.

The 2025 year-to-date figures reveal that institutions are absorbing more than seven times the amount of BTC being mined. Such an imbalance has historically preceded upward price volatility, as markets must reprice scarcity when demand exceeds available coins.

Why This Matters for the Market Outlook

If this demand-supply gap persists into early 2026, Bitcoin could enter another structural supply squeeze, reminiscent of previous post-halving environments. The key difference now is the scale: thousands of institutions and major funds are accumulating simultaneously, rather than a handful of early adopters.

The new supply is shrinking, institutional demand is accelerating, and the latest data suggests the market may be entering a phase where Bitcoin's scarcity becomes its most powerful catalyst.