Pudgy Penguins Faces Backlash in India

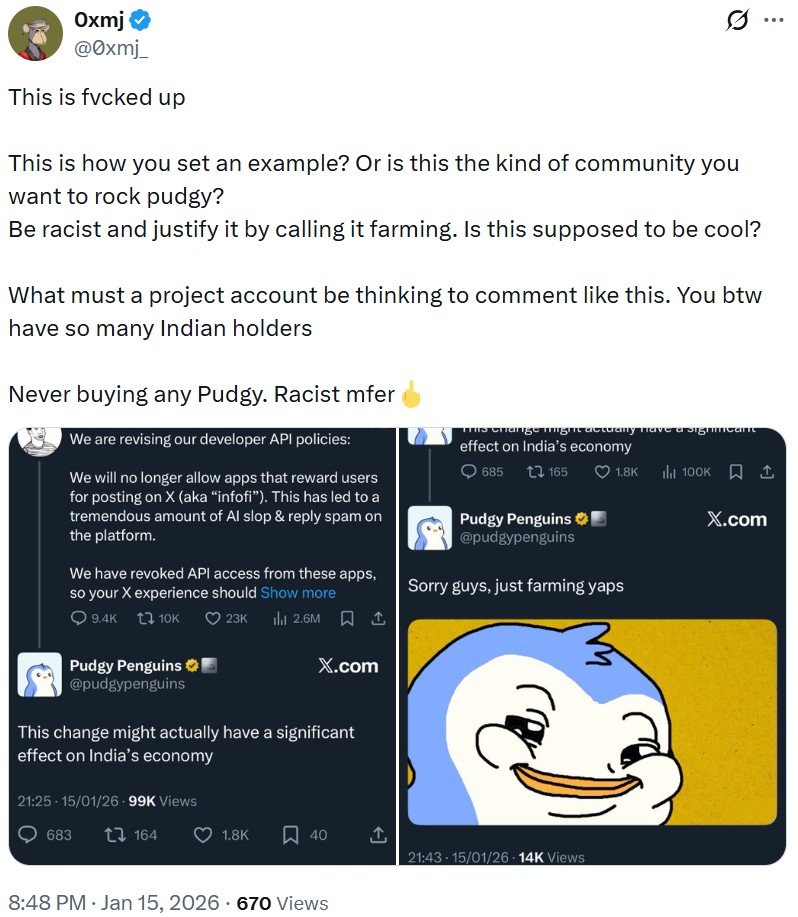

Non-fungible token brand Pudgy Penguins has drawn backlash over a now-deleted post on X that singled out Indian social media users.

The controversy followed a recent announcement by X product head Nikita Bier that the platform will prohibit applications from rewarding users for posts, a category often referred to as infofi, citing the spread of AI-generated spam and low-quality content.

In crypto circles, the change affects users who earn rewards by farming engagement, including so-called yaps on platforms such as Kaito.

In response to Biers announcement, the Pudgy Penguins X account posted, "This change might actually have a significant effect on Indias economy."

While some users identifying themselves as Indian said they found the post humorous, others did not take it as lightly. Several accused the brand of promoting racist stereotypes, prompting further criticism after the Pudgy Penguins account manager appeared to follow up by saying the post was intended for farming yaps.

Other commenters said the issue went beyond racism, arguing the post reflected poor brand judgment for a project that markets itself as family-friendly.

Pudgy Penguins later deleted the post. The company did not respond to Magazines request for comment.

Former Digital Yuan Boss Accused of Receiving Ether Bribes

A state television documentary has alleged that former Peoples Bank of China official Yao Qian accepted 2,000 ether in bribes and later cashed out part of the holdings.

According to state broadcaster CCTV, Yao received 2,000 ether in 2018 from a crypto entrepreneur with the surname of Zhang in exchange for using his influence to help facilitate a token issuance and overseas exchange listing. Investigators also said Yao accepted an additional 12 million yuan (about $1.72 million) in cash bribes.

Yao later liquidated 370 ETH in 2021, generating roughly 10 million yuan, or $1.43 million. Investigators said their suspicions intensified after funds traced to the ether liquidation were used to help pay for a Beijing villa worth more than $2.9 million, which was registered under the name of Yaos relative.

Authorities said the case was established through a combination of onchain transaction analysis, tracing of fiat flows and the seizure of hardware wallets from Yaos office.

Yao previously led the early development of Chinas central bank digital currency, the digital yuan. He was placed under investigation in April 2024, expelled from the Communist Party and removed from public office in November over crypto bribery allegations.

Several major cryptocurrency-related activities have been banned in phases in China, including a crackdown on mining and trading in 2021.

Japan's Largest Card Company Tests Stablecoin Payments

Japanese credit card network JCB, banking group Resona Holdings and fintech firm Digital Garage have announced a stablecoin pilot aimed at retail payments.

The pilot will test in-store payments using US dollar and Japanese yen-denominated stablecoins at physical retail locations.

JCB, Japans largest domestic card network, will oversee the infrastructure needed for merchants to accept stablecoin payments from both local consumers and tourists. While widely used in Japan, JCBs international reach is more limited than that of Visa or Mastercard.

Japan was among the first major economies to approve and launch a regulated stablecoin pegged to its local currency. Other jurisdictions have since accelerated their own stablecoin regulatory efforts following the passage of the GENIUS Act in the US.

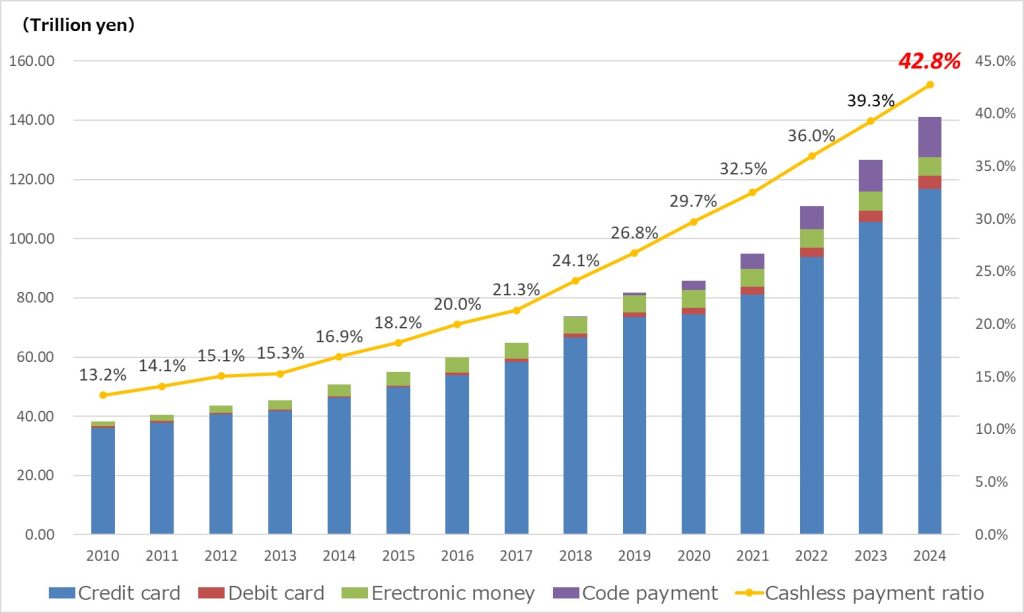

Japan remains more reliant on cash than its East Asian peers such as South Korea and China, although that dependence has been declining. Cashless payments accounted for about 30% of transactions in 2020, rising to 42.8% in 2024.

Japans stablecoin drive comes as part of broader government efforts to digitize Japans economy. Updated cashless payment figures for 2025 are expected to be released in the first quarter of 2026.

South Korea Crypto Exchange Association Clashes with Government Over Ownership Stakes

South Koreas cryptocurrency exchanges have reportedly opposed a government proposal to cap ownership stakes held by major shareholders.

The Digital Asset Exchange Alliance (DAXA), an industry group representing the countrys five largest crypto exchanges, said that it has serious concerns about apparent government plans to limit major shareholders ownership to between 15% and 20%.

Such a regulation could hinder the development of the domestic digital asset industry and market, DAXA said.

The group added that the proposal could drive domestic traders to overseas platforms, potentially diluting the major shareholders accountability for the custody and management of user assets, thereby undermining the stated goal of user protection.

South Korean regulators are still drafting the countrys cryptocurrency regulatory framework, after missing a December deadline. Lawmakers from the ruling party have said they plan to submit their own proposal in January.

According to industry sources cited by local media, the Financial Services Commission recently submitted a proposal to lawmakers that included the ownership cap. The FSC reportedly argued that crypto exchanges function as critical market infrastructure, making it necessary to prevent excessive concentration of profits.