ZuniQ, a Nigerian fintech company, aims to provide businesses with instant, borderless access for global transactions. The company was founded on the premise that businesses crucial to African trade are often penalized by the existing financial system.

Founded by Joshua Nwogodo in early 2025, ZuniQ addresses the persistent challenges faced by mid-sized African businesses involved in cross-border trade. Nwogodo highlights that these businesses frequently experience excessive delays, high costs, and a lack of attention from financial institutions. He asserts that existing payment systems were designed primarily for larger entities, leaving the real economy to manage its own payment infrastructure.

Nwogodo's motivation for building ZuniQ stems from his experience advising fintech and digital asset companies. He witnessed firsthand the limitations of traditional cross-border payment systems and the struggles of entrepreneurs and importers operating in markets with dollar scarcity, shifting compliance rules, and payments frequently lost in banking limbo.

Describing the current system, Nwogodo points out the inefficiencies of SWIFT, stating, "SWIFT is slow because your money has to pass through many hands. We remove those middle steps." This focus on efficiency is crucial for operational survival, as even a three-day delay for a logistics company can result in significant accumulating charges for goods stuck at ports.

The structural issues in African payments are significant. Transactions from African countries often route through correspondent banks in the United States before reaching destinations in Asia or other African markets. For example, a payment from Lagos to Guangzhou might unnecessarily detour through New York, adding both time and risk to the process.

ZuniQ's strategy focuses on logistical improvements: eliminating detours, establishing direct payment corridors, pre-funding liquidity where necessary, collaborating with institutions willing to operate in less conventional markets, and creating multiple liquidity pathways to prevent transaction blockages.

The Liquidity Challenge in Emerging Markets

A universal challenge for fintechs in the cross-border payment space is dollar scarcity. Countries like Nigeria, Ghana, and Kenya have experienced foreign exchange shortages that severely impact importers. Nwogodo emphasizes the reality of this issue: "FX scarcity is a real-life problem. Every operator knows it. Every importer feels it."

ZuniQ addresses this by leveraging its treasury positions and partnering with institutional liquidity providers across Africa, Europe, and Asia. The company's model relies on a network of pre-funded accounts, local partners, and strategically positioned balance sheets that align with actual trade flows. This setup allows for flexibility, enabling other corridors to compensate if one experiences constraints.

The core principle is redundancy. ZuniQ does not depend on a single payment rail, partner, or currency. It routes payments through the most accessible corridor at any given time, a level of resilience that traditional banks often do not offer to mid-sized businesses.

Nwogodo expresses his frustration with the system's neglect of these businesses: "We are built for businesses the system ignores. The mid-sized importer in Malawi or Alaba. They carry the continent’s trade on their back, but they get ignored."

Serving the "Missing Middle"

Nwogodo frequently refers to the "missing middle"—companies that are too large for consumer-focused fintech solutions but too small to attract the attention of global banks. These firms are vital to trade volumes, employment, and supply chain integrity, yet they often operate in areas where financial infrastructure is weakest, leading to breakdowns in speed, transparency, and service.

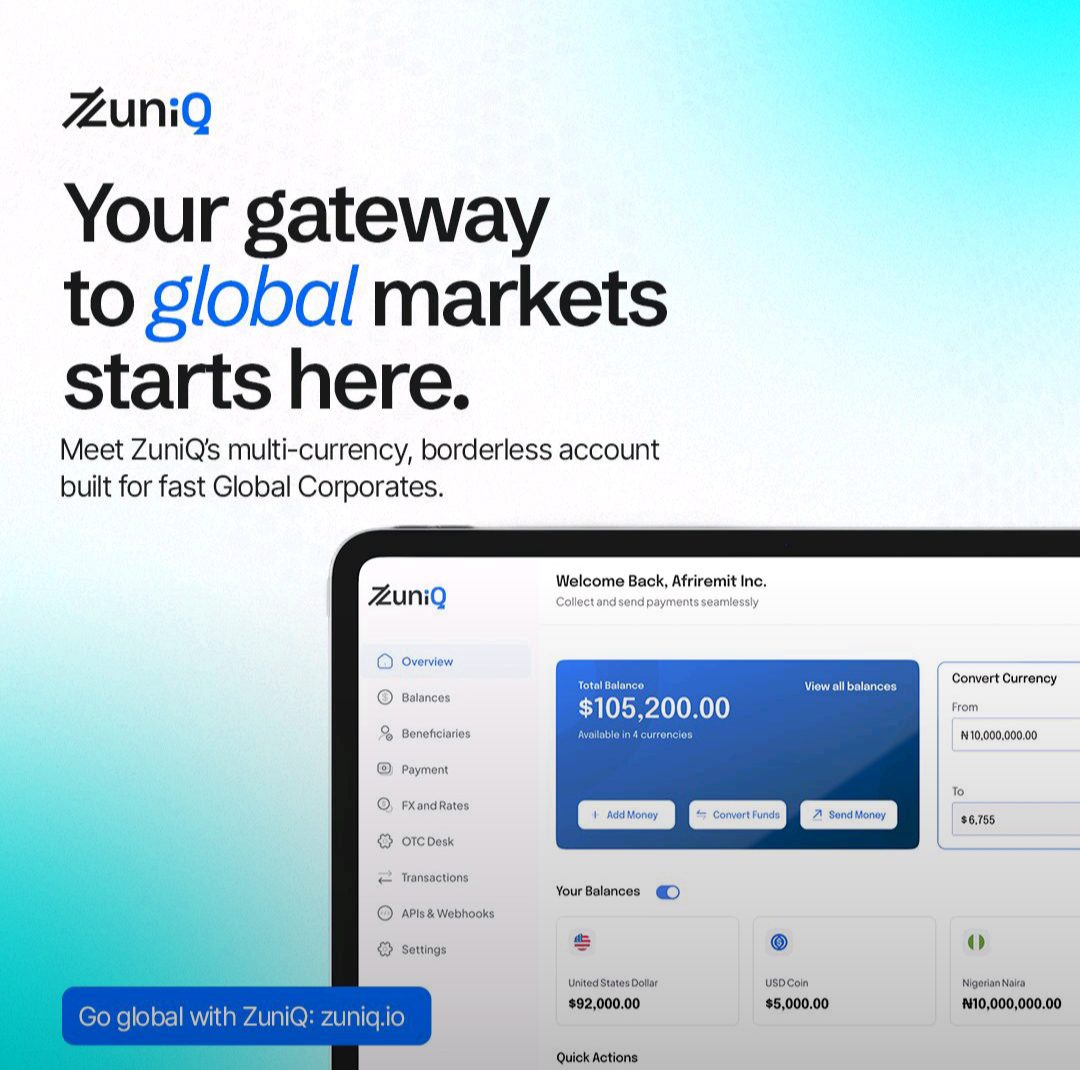

For this segment of businesses, ZuniQ prioritizes visibility and control, offering instant settlement, multi-currency wallets, real-time tracking, and dedicated support teams. Nwogodo views these offerings not as innovation but as overdue fairness, stating, "If you’re moving money globally, you don’t have to beg a traditional bank to confirm if your payment got to your supplier. That era is getting over." The implication is that if traditional banks were capable of resolving these issues, they would have already done so.

Localized Compliance Strategies

Operating with speed in emerging markets requires stringent compliance measures, as a lack of adherence can lead to severe consequences in cross-border payments. African financial flows face intense scrutiny, and regulatory frameworks vary significantly across regions. Compliance requirements, such as KYC in Nigeria or AML in the UK, differ greatly, as do monitoring standards in Kenya compared to the UAE.

ZuniQ's approach to compliance is decentralized and localized. The company builds a tailored compliance stack for each market, adhering to local regulations and working with local partners. Nwogodo explains, "We build our compliance layer country by country." This involves utilizing local KYC partners for automated checks and employing real-time monitoring tools to identify anomalies proactively. In instances where ZuniQ lacks a direct license, it collaborates with licensed local entities.

While this localized strategy may slow expansion, it mitigates the regulatory risks that have impacted many nascent payment firms. Nwogodo states, "Instant payment, but the right controls behind the scenes." This measured approach underscores the delicate balance between ambition and regulatory compliance.

ZuniQ's objective is not to replicate SWIFT but to circumvent it. The company is currently processing millions of dollars monthly across Nigeria, Ghana, and between USD and GBP corridors. The next strategic expansion targets Asia, aiming for direct corridors such as Nigeria-Vietnam and Kenya-Brazil, and Africa-UAE, all without relying on USD intermediation.

"Not everything has to pass through USD," Nwogodo notes. He envisions a future with a network of direct corridors connecting emerging markets. This model capitalizes on the commercial incentives that traditional banks have historically overlooked.

Regarding blockchain's role in cross-border payments, Nwogodo takes a pragmatic stance. He acknowledges that stablecoins are already integrated into ZuniQ's settlement layers, chosen for their practical benefits in speed, transparency, and traceability. He points to initiatives by major financial institutions like JP Morgan Coin, Citi's experiments, Stripe's acquisition of Bridge, and SWIFT's blockchain pilots as evidence of the industry's shift. ZuniQ is positioning itself to align with this evolving landscape.

Nwogodo views blockchain as a more efficient ledger technology that will eliminate traditional delays and lack of transparency, offering real-time, trackable settlement.

Despite being less than a year old, ZuniQ is already handling millions in monthly transactions across various currencies. The company maintains a low public profile, preferring to focus on quiet growth rather than publicizing milestones.

Future plans include expanding liquidity access, enhancing automation, and streamlining intra-African payment rails. New product launches are anticipated before the end of the year, followed by expansion into new markets, with necessary licensing to be pursued.

Nwogodo reiterates ZuniQ's core mission: "We are here to make cross-border payments simple, fast and fair for businesses that have been struggling in silence for too long."

ZuniQ's potential success lies not in reinventing payment systems but in its focused attention to the needs of businesses that have been underserved by the financial industry.