Hyperliquid's native token, HYPE, experienced a significant surge today, climbing 25% to reach $48.70. This price increase was accompanied by a substantial rise in daily trading volume, which soared to $624 million, marking a 9.93% increase in the past 24 hours, according to data from CoinMarketCap.

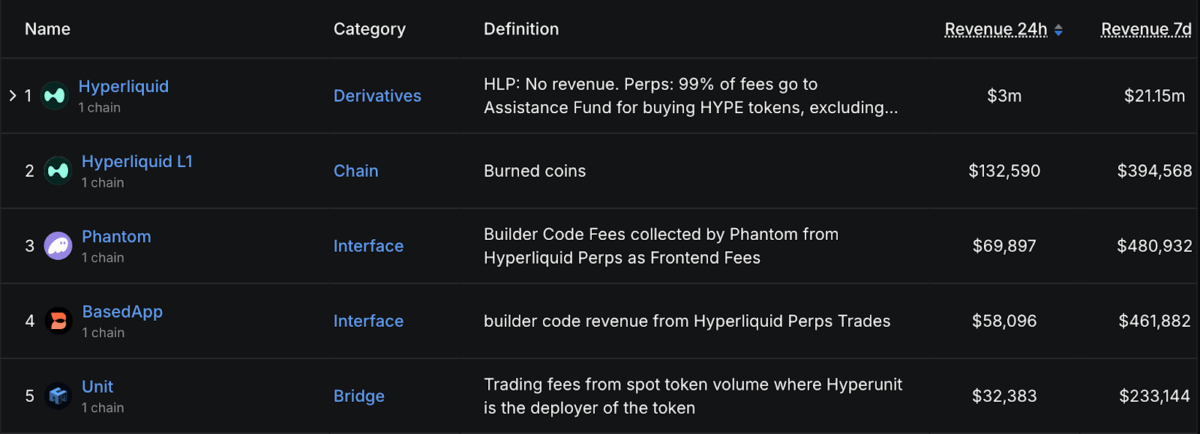

The Hyperliquid platform has established itself as a leader in revenue generation across all protocols, both on a daily and weekly basis, as reported by DefiLlama. The platform generated approximately $3 million in revenue over the last 24 hours and accumulated $21.15 million throughout the week.

Interface Projects Boost Ecosystem Growth

Beyond the main platform, Hyperliquid's dedicated blockchain, Hyperliquid L1, has also shown strong performance, earning about $132,590 in revenue in a single day and $394,568 over the course of the week. Unit, a bridge platform within the Hyperunit network, contributed significantly with $32,383 earned in a day and $233,144 over the week. These impressive gains position Hyperliquid's ecosystem among the most profitable projects in the entire Decentralized Finance (DeFi) space.

Other projects within the ecosystem are also demonstrating robust revenue streams. Phantom, for instance, generated $69,897 in a day and $480,932 for the week from trading fees. BasedApp earned $58,096 daily and $461,882 weekly, with its revenue boosted by builder code tied to Hyperliquid trades.

Market Sentiment Shows Mixed Whale Positions

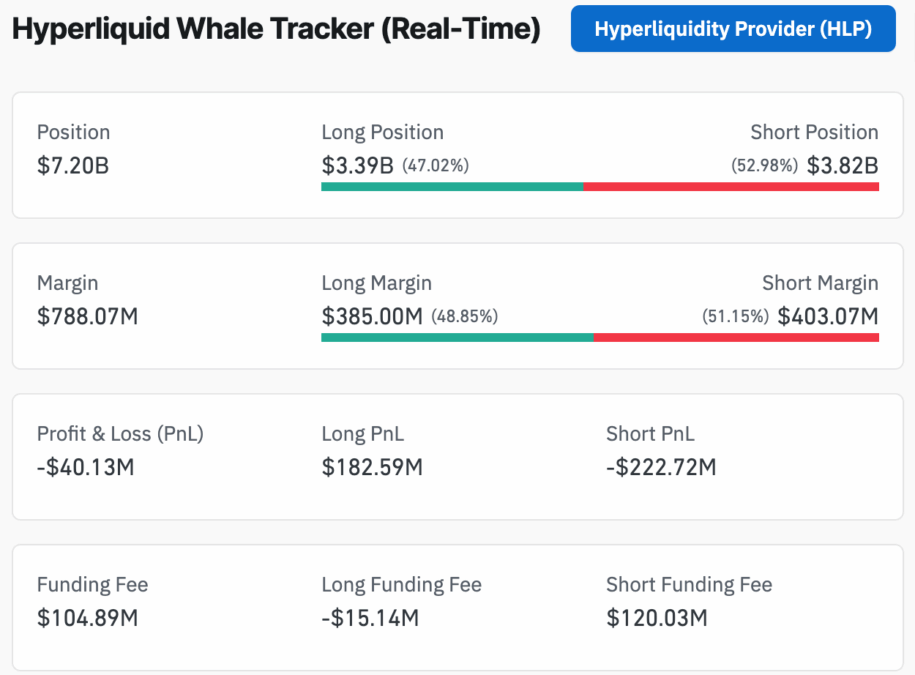

Data from CoinGlass, specifically the Hyperliquid Whale Tracker, indicates a nearly even division among major traders regarding their market outlook. The total value of their open trades has reached $7.2 billion, with 47.02% in long positions and 52.98% in short positions, suggesting a slight lean toward bearish sentiment.

Despite this slight bearish lean, the market has recently moved against short positions, resulting in long positions realizing $182.6 million in profit while shorts incurred losses totaling $222.7 million. Funding fees have amounted to $104.9 million, with short-sellers paying more than long-sellers, which hints at a mild shift towards bullish momentum.

A significant factor contributing to the token's price appreciation is its recent listing on Robinhood. The trading application even established a dedicated landing page for HYPE prior to the official listing confirmation on X.

Furthermore, Hyperliquid Strategies recently filed paperwork with the U.S. Securities and Exchange Commission, seeking to raise $1 billion for the purpose of acquiring more HYPE tokens. This new crypto treasury firm, with backing from Sonnet BioTherapeutics and Rorschach I LLC, intends to expand its investment within the Hyperliquid ecosystem.

The combination of Hyperliquid's rapidly growing revenue, the active participation of major traders, and the anticipated Robinhood listing has propelled HYPE into becoming one of the most actively discussed and sought-after tokens this week.

Also Read: Bitcoin Reclaims $115K as Bulls Test Key Resistance