Amid increasing attention to decentralized trading, Hyperliquid is holding the leading position in the perpetual DEX market, reporting $1.2 billion in annual profits. Its trading activity and liquidity levels are notably higher than its competitors: Aster and Lighter, showing a strong market presence.

As of October 2025, Hyperliquid had spent over $645 million repurchasing its native HYPE tokens from the secondary markets. Data highlighted by Hyperliquid Daily on X shows the exchange recorded $12.9 billion in daily trading volume and $9.76 billion in open positions on October 30, indicating strong trading activity on the platform.

CZ will not like this@HyperliquidX dominates the perpetual DEX arena, with 24-hour open interest surging to 3x that of Aster and 5x that of Lighter.

— Hyperliquid Daily (@HYPERDailyTK) October 31, 2025

Hyperliquid has racked up over $1.2 billion in annual profits—and as of October 2025, it has already deployed $645 million to… pic.twitter.com/dLhg8ZU3jt

This puts it well ahead of other decentralized perpetual trading platforms, showing high user activity and strong liquidity. By comparison, Aster had the same level of trading volume but only $3.2 billion in active contracts. Lighter recorded $11.4 billion in trades and $1.8 billion in open contracts, indicating less overall market engagement.

Growing Market Share and Trading Momentum

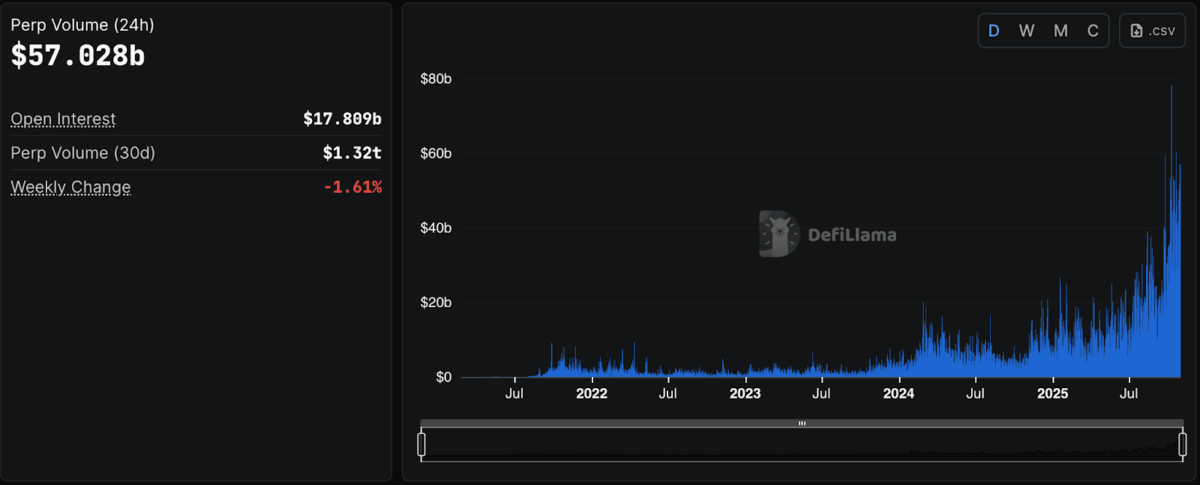

DeFiLlama data shows the 24-hour perpetual trading volume across the market at $57.02 billion, with total open interest at $17.81 billion. Over the past 30 days, cumulative trading hit $1.32 trillion despite a minor 1.61% weekly decline. Hence, the figures confirm that perpetual products remain a major driver of on-chain activity.

The long-term trend also supports this growth story. Trading remained steady through 2022 and 2023 before surging sharply from mid-2024 onward. Consequently, 2025 has become a breakout year for Hyperliquid, setting new highs in both user participation and volume.

Strong Buyback and Liquidity Expansion

In a separate post on X, Hyperliquid Daily emphasized the project’s unique buyback approach. “While most projects hype buyback programs to drive price pumps… HyperliquidX is a standout exception,” it said. The platform’s $645 million in repurchases accounts for 46% of all crypto token buybacks this year.

While most projects hype buyback programs to drive price pumps—only for those gains to crash hard, as the repurchases pale in comparison to the massive token supply— @HyperliquidX is a standout exception.

— Hyperliquid Daily (@HYPERDailyTK) October 30, 2025

This top-tier DEX is projecting nearly $1.2 billion in annual profits, and… pic.twitter.com/ECe9J8ZL65

Token buyback programs involve a company repurchasing its own tokens from the market, typically to reduce supply, support price stability, and signal confidence in long-term value.

Hyperliquid’s Continued Growth

According to Dune Analytics, $4.54 billion USDC has been bridged to Hyperliquid so far, accounting for 62.26% of all USDC deployed on Arbitrum. Deposits were increasing at a steady rate up until 2024 and then reached their peak between July and September 2025, indicating the fast-expanding role of the platform as one of the major hotspots of liquidity.

This week, 21Shares filed for a Hyperliquid ETF with the U.S. Securities and Exchange Commission (SEC), following Bitwise’s earlier proposal in September. HYPE token now ranks as the 11th largest crypto asset by market cap, currently trading at $44.55, as per CoinMarketCap data.

Hyperliquid’s rise signals a noticeable change in the decentralized finance market. Its consistent profits, large buybacks, and expanding liquidity reflect a broader shift in how traders use perpetual DEXs.

Ondo Integrates Chainlink to Support Tokenized Securities