HYPE token is currently consolidating within a tight range, with buyers defending key support levels and increasing pressure. On-chain whale activity has risen, marked by large orders and exchange outflows, indicating strengthening demand. A break above the $41–$43 price range could unlock momentum towards a $45 target and potentially higher.

Price Holds Steady as Symmetrical Triangle Tightens

The HYPE token has been trading within a symmetrical triangle pattern since mid-October, a formation often preceding significant price movements due to compressed volatility. Recently, the token retested the support zone between $36 and $33, where buyer interest emerged, leading to a four-day bullish trend. This rebound brought HYPE back to its short-term resistance level near the 50% Fibonacci retracement at $41. This Fibonacci level acts as a critical technical barrier; a clear breach above it would signal renewed bullish strength and pave the way for a move towards the next technical target at $45.

Conversely, if bulls are unable to overcome this resistance, the market may experience another test of the $36 support region, which has been consistently defended since late October. Momentum indicators are showing early signs of improvement, with the daily RSI currently at 51 and trending upwards. This suggests the potential for continued upward movement towards 60, which would confirm a stronger bullish trend. While still in neutral territory, the RSI indicates that HYPE has room for upside before reaching overbought conditions.

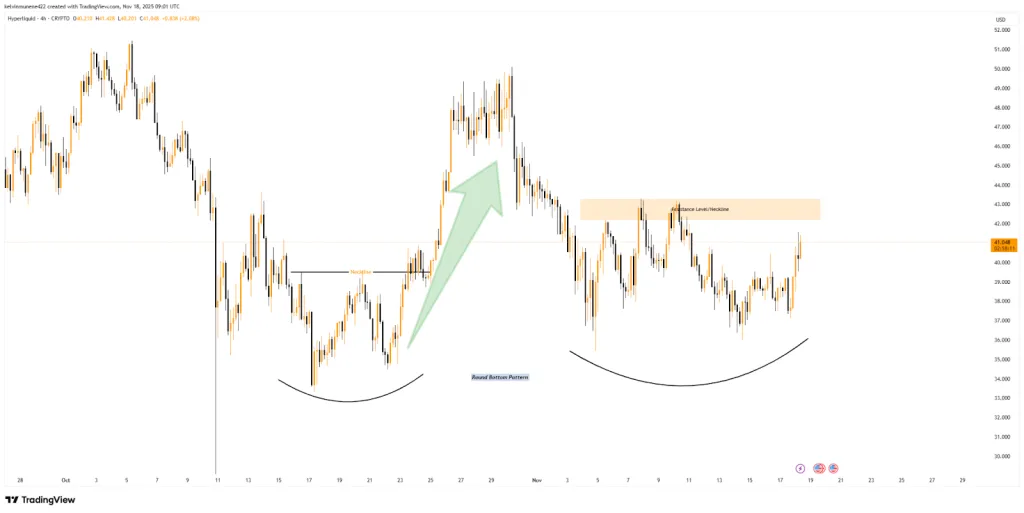

Rounded-Bottom Structure Echoes Previous Rally

Intraday price action is mirroring a strong reversal pattern observed earlier this year. A rounded-bottom structure is forming, similar to the setup in October that preceded a nearly 28% surge to the $50 zone after the neckline was broken. The current neckline is situated between $42 and $43, overlapping with significant resistance. A decisive move above this band would align both daily and intraday chart patterns, creating the necessary conditions for a measured move towards the $45 to $50 range. Until this neckline is breached, HYPE is expected to remain within its consolidation phase.

Whale Activity Rises as Order Sizes Expand Across Markets

Recent trading data reveals increased participation from significant market players. According to CryptoQuant, Hyperliquid's order-flow charts show a consistent rise in oversized green trades across both spot and futures markets since late October. These inflows intensified as prices stabilized around the $40–$45 region, indicating active accumulation by whales. Throughout 2025, the average order sizes in both spot and futures markets have continued to grow, supporting the notion of increasing liquidity entering the market. Historically, sustained whale activity during periods of flat price action often precedes significant trend expansions.

Additional on-chain metrics corroborate this observation. Exchange outflows are on the rise, the number of active large addresses is increasing, and the average transaction size is trending upwards. These indicators typically appear when larger participants are positioning themselves in anticipation of increased market volatility.

Technical and On-Chain Metrics Point Toward a Critical Break

Despite HYPE's current subdued price action, its internal market structure suggests a different narrative. Consolidation, increasing order-flow strength, accumulation patterns, and tightening volatility are converging simultaneously. The critical resistance zone remains between $41 and $43. A clear move above this area would align the symmetrical triangle, the rounded-bottom neckline, the strengthening RSI, and the consistent whale inflows. Such confluence of factors often precedes significant directional movement, making $45 a plausible target based on historical price behavior.

Currently, HYPE is situated within one of its narrowest consolidation ranges of the quarter. Pressure is building, and all attention is focused on the resistance band that will ultimately determine the direction of the next price expansion.