Simon Kim, the CEO of Hashed, has developed a novel dashboard designed to ascertain the intrinsic value of Ethereum, the world's largest altcoin. This comprehensive tool employs 12 distinct valuation methodologies, encompassing both traditional finance frameworks and crypto-native metrics.

The methodologies include traditional finance approaches such as Discounted Cash Flow (DCF), Price-to-Sell (P/S) ratio, Revenue Yield, and Validator Economics. Alongside these, crypto-specific metrics are utilized, including Total Value Locked (TVL) Multiple, Market Cap to Total Value Locked (MC/TVL), Metcalfe's Law, Staking Scarcity, L2 Ecosystem, Commitment Premium, App Capital, and Settlement Layer.

Analysis Indicates Significant Undervaluation

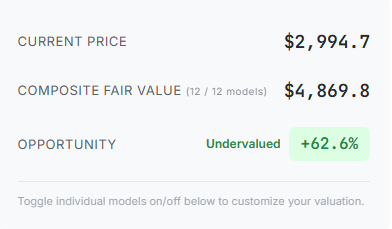

Based on Kim's analysis, the composite fair value of ETH is estimated at $4,869 as of the current reporting period. Considering its market price is just under $3,000, this suggests that the asset is currently undervalued by over 62%.

A deeper examination of the individual metrics reveals further insights. Metcalfe's Law, which posits that a network's value is proportional to the square of its users, indicates a fair value of $9,869 for ETH. This law suggests that as the network expands, its value should increase exponentially, enhancing its utility for each participant.

The second-highest valuation comes from DCF (staking), which values staking rewards as perpetual cash flows, effectively merging traditional finance valuation with crypto-native yield generation. This method suggests a fair value of $8,995 for ETH. Validator Economics follows, estimating a fair value of $6,984. Additionally, the Settlement Layer and Commitment Premium metrics both place Ether's fair value above $5,000.

Metrics Suggesting Overvaluation

Conversely, only two of the twelve metrics utilized in the dashboard suggest that ETH might be overvalued at its current market prices. In traditional finance, the P/S ratio compares a company's market value to its total sales over a specific period. However, its application to Ethereum differs due to the absence of a traditional corporate structure and sales revenue.

For ETH, the P/S ratio is adapted to compare the market capitalization against annual transaction fee revenue. This adjusted metric indicates that ETH's fair value should be below $930. The Revenue Yield metric, which calculates fair value based on the current Annual Percentage Rate (APR) of staking and treats ETH as a yield-bearing bond, also suggests potential overvaluation, placing the asset's price at $1,433.