JPEX Fraud Case and Regulatory Response

Hong Kong police have charged 16 individuals tied to the JPEX cryptocurrency exchange fraud. The first trial is scheduled for December 15 at the High Court.

This case highlights Hong Kong's push for tightened cryptocurrency regulations, particularly affecting stablecoins and digital asset dealers, in response to growing digital asset fraud concerns.

Christopher Hui, Secretary for Financial Services, cited the JPEX incident as a catalyst for tougher rules in trading and digital assets. The ongoing trial, set to proceed with eight defendants, underscores the broader implications of the alleged fraud, while the mastermind remains at large. Hui's proposal suggests updating regulations to mirror risks and activities. Law enforcement's actions have catalyzed discussions on investor protection measures.

“The recent JPEX incident is a reminder of the importance of staying ahead of new developments with effective regulation and investor protection measures.” - Christopher Hui, Secretary for Financial Services and the Treasury, Hong Kong Government

Regulatory Proposals and Market Impact

Regulatory proposals are focusing on key areas including trading, stablecoins, custody, and digital assets. The Financial Services Secretary has highlighted the necessity of updating these regulations in response to emerging threats and market activities.

The regulatory response to the JPEX incident draws parallels to the 2022 TerraUSD collapse, prompting similar consumer protection reforms.

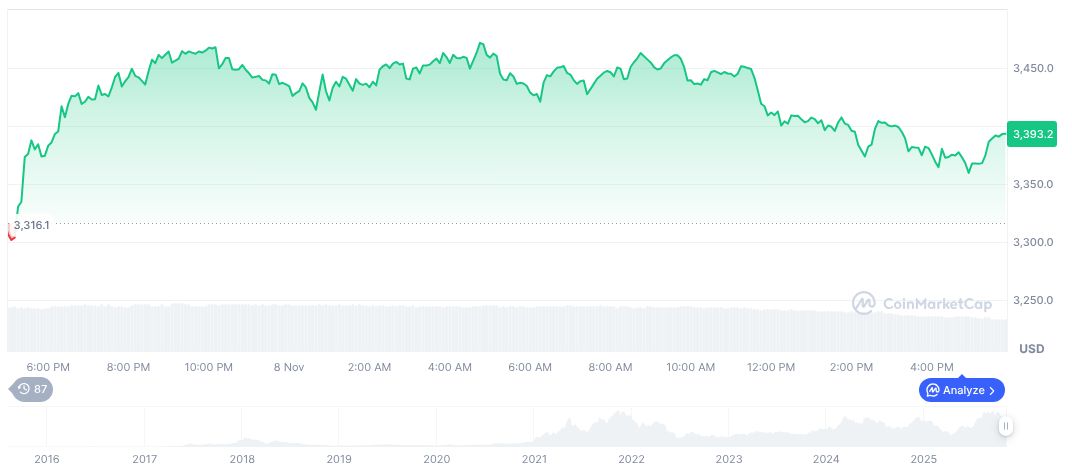

As per available data, Ethereum (ETH) prices saw a decline to $3,372.09 with a market cap of $406.99 billion. This represented a 2.09% decrease over the last 24 hours, with significant decreases also observed across 7, 30, and 60-day periods. The data also indicated Ethereum's 11.92% market dominance.

Research insights suggest that renewed policies could stabilize consumer trust and strengthen market resilience. This regulatory shift focuses on aligning risk assessment with evolving technology, aiming to prevent future market disruptions.