The digital asset market commenced 2026 with a valuation approaching $2.4 trillion, accompanied by daily trading volumes exceeding $120 billion amidst significant volatility. While the Ethereum price today in 2026 maintains high benchmarks and interest in Shiba Inu price predictions remains constant, these established trades present limited avenues for substantial growth. Investors are now actively seeking out where the genuine opportunities lie.

Market analysts and researchers are increasingly directing their attention toward Zero Knowledge Proof (ZKP), a novel asset class built upon pre-funded infrastructure and actively functioning systems. The primary focus has shifted to Proof Pods, which are physical hardware units designed to secure the network. Specialists in this area predict a potential for 6000x growth, driven by inherent mechanical supply shock dynamics.

Each $249 hardware unit connects to a power source, generates a daily yield, and locks tokens to facilitate level upgrades from 1 to 300. Technical experts assert that this internal mechanism for reducing circulating tokens inherently pressures the price, differentiating ZKP from other prominent cryptocurrencies that primarily rely on social momentum or unsubstantiated claims of scarcity.

The Mechanics of ZKP and the Proof Pod Scarcity Engine

Zero Knowledge Proof is a Layer-1 blockchain project established with notable institutional conviction. Data indicates that over $100 million was invested prior to its public launch to support privacy protocols, decentralized storage, and essential infrastructure development. By January 2026, analysts suggest this positions ZKP considerably ahead of competitors that are still operating with incomplete or theoretical frameworks across the global market.

Strategic researchers examining capital flow argue that Zero Knowledge Proof is designed for scalability rather than speculative trading. Unlike many leading cryptocurrencies, this network launched with fully operational systems and integrated hardware economics. This foundational approach fundamentally alters demand behavior before mainstream retail attention fully saturates the global cryptocurrency markets.

The principal driver of value is the Proof Pod, a physical device priced at $249. Hardware specialists emphasize that plans are in place for the worldwide deployment of thousands of these units. This physical presence establishes a structural scarcity that software-only networks are unable to replicate on a global scale. Because these devices generate daily rewards, their owners frequently reinvest their tokens to upgrade Pod levels from 1 to 300.

Analysts observe that this user behavior leads to aggressive locking of the circulating supply. In comparison to other prominent cryptocurrencies, ZKP experiences a continuous removal of tokens from circulation through burning and locking mechanisms, thereby tightening liquidity with mechanical certainty.

Shiba Inu Price Prediction: Analyzing Momentum Thresholds

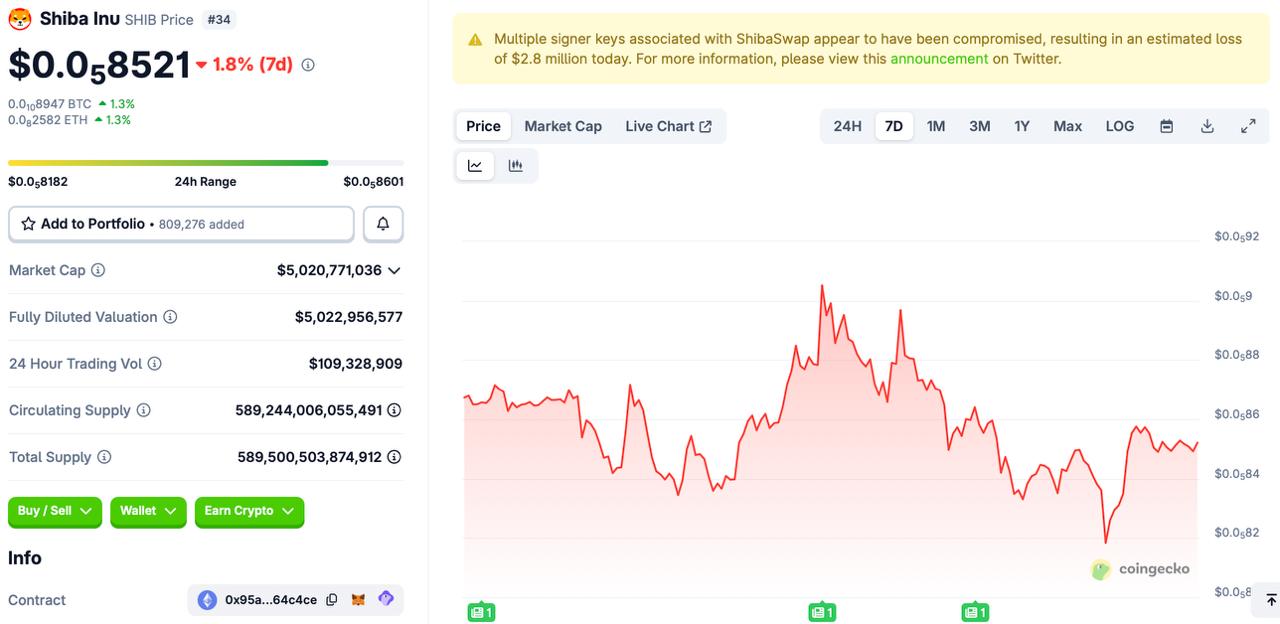

At the time of this report in mid-January 2026, Shiba Inu was valued at approximately $0.0000085, trading within a corridor between $0.00000842 and $0.00000904. While trading volume remains healthy and the Relative Strength Index (RSI) near 58 indicates mild bullish sentiment, the token currently lacks the breakout strength necessary for a significant re-evaluation of its price. On-chain metrics reveal whale accumulation and a decrease in exchange balances, which contribute to current price stability. Many models within the Shiba Inu price prediction sphere set short-term targets near $0.000010, contingent on overall market sentiment.

Further projections suggest a potential movement towards $0.0000125 by February 2026, although such gains are entirely dependent on broader market trends. The token's exceptionally large circulating supply necessitates substantial and sustained capital inflows for price appreciation, which inherently restricts explosive upside potential when contrasted with newer, more streamlined projects.

Consequently, analyses focused on Shiba Inu price prediction often concentrate on incremental gains rather than a complete market re-valuation. SHIB continues to be a liquid asset, but its risk-reward ratio is now dictated by market cycles rather than unique structural scarcity.

Ethereum Price Today 2026: Evaluating Stability and Scale

In mid-January 2026, Ethereum traded within a range of $3,280 to $3,330, successfully maintaining its support floor above $3,000. The Ethereum price today in 2026 reflects steady institutional demand, with daily trading volumes frequently exceeding $30 billion across major exchanges. Following a retracement from its 2025 peaks near $4,900, ETH has entered a phase of sideways consolidation rather than a bearish trend. Technical indicators suggest neutral momentum, with price action largely mirroring Bitcoin and general market sentiment.

Network fundamentals remain robust, with record-breaking wallet creation that has yet to translate into a significant price surge. The Ethereum price today in 2026 also reflects investor caution, as capital appears to be rotating towards platforms offering higher growth potential. While analysts regard ETH as the industry's foundational utility platform, its sheer size now acts as a constraint on rapid returns, favoring long-term stability. This defensive profile shapes investor expectations for ETH's performance across global markets throughout the year.

Final Thoughts

Shiba Inu continues to fluctuate within narrow price ranges, and most reports concerning Shiba Inu price prediction now focus on minor, steady improvements rather than the historic rallies observed in the past. The token remains active and accessible, but its substantial supply imposes a mathematical ceiling on the speed of its valuation.

Ethereum maintains a strong position above $3,000, and the Ethereum price today in 2026 highlights a stability underpinned by massive network usage. Analysts acknowledge its high trading volume, but its considerable scale moderates potential for rapid multiples, positioning ETH as a defensive asset for new capital inflows.

In contrast, experts argue that Zero Knowledge Proof is shifting this balance of power. Its integration of hardware-based security, a limited number of deployable devices, and mandatory token lockup mechanisms generates a form of market pressure absent in other leading cryptocurrencies. This architectural design benefits those who position themselves early, transforming hardware ownership into a sophisticated strategy for long-term growth supported by global economic incentives.