The cryptocurrency market is showing signs of recovery, with a general upward trend observed over the past day. Hedera (HBAR) has emerged as a significant performer, experiencing a notable price increase.

The HBAR price has climbed by almost 10%, currently trading around $0.1493. This surge is accompanied by a substantial increase in trading volume, up by 193%, indicating strong buyer interest. This momentum has propelled HBAR to the second position among the day's top gainers.

Key Drivers Behind HBAR's Price Action

A primary catalyst for Hedera's recent performance is the upcoming launch of 24/7 HBAR futures trading on Coinbase, scheduled for December 5. This development is expected to provide institutions and advanced traders with more accessible avenues for engaging with HBAR, including hedging and position building, which typically enhances liquidity and price action.

Historically, similar futures launches for other cryptocurrencies like Solana (SOL) and Ripple (XRP) have preceded significant volatility spikes, leading many traders to position themselves in anticipation of such movements.

Further bolstering HBAR's appeal is the evolving landscape of Exchange Traded Funds (ETFs). The Internal Revenue Service (IRS) now permits staking within ETFs, which could allow future HBAR ETFs to generate yield while retaining tax advantages. Additionally, the Securities and Exchange Commission (SEC) has approved new listing standards, simplifying the process for launching additional HBAR-based products.

Hedera's integration into real-world applications is also contributing to increased confidence. Wyoming's decision to utilize Hedera for its state-backed stablecoin and the tokenization of its HBAR ETF directly on the network underscore Hedera's growing role in mainstream adoption.

$HBAR

— ElonTrades (@ElonTrades) November 23, 2025

• IRS now allows staking inside ETFs, letting HBAR ETFs earn native yield while keeping tax advantages, similar to other PoS ETF's

• SEC approved new generic listing standards, making future HBAR ETFs faster and easier to launch

• Coinbase Derivatives added 24/7 HBAR… pic.twitter.com/u3H3yQfPeq

Technical Analysis: What the HBAR Chart Indicates

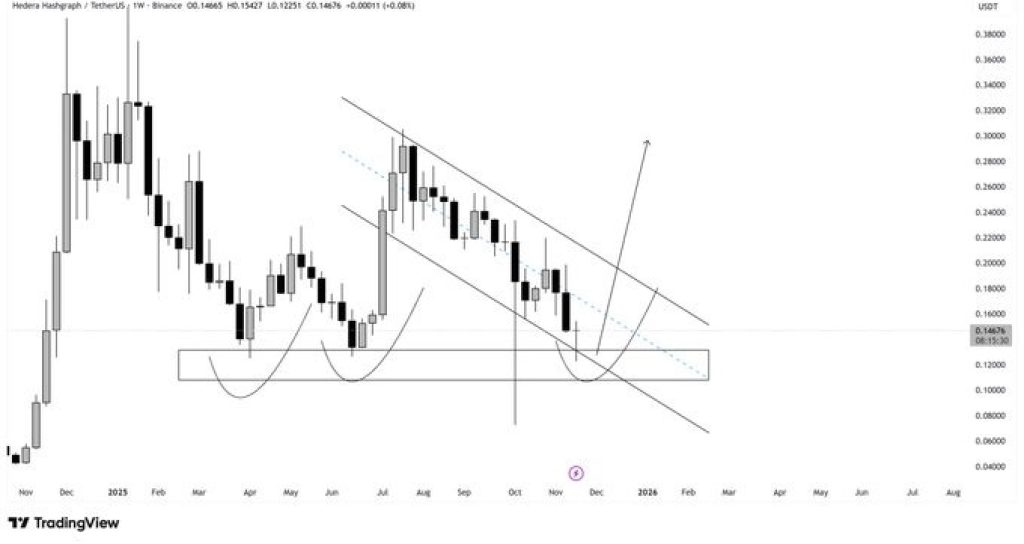

Technical analysis suggests a bullish pattern is forming on the weekly HBAR chart. Analyst Marzell highlights the formation of a potential triple bottom situated within a significant demand zone, an area historically characterized by strong buyer activity. While the price is currently contained within a falling channel, it continues to adhere to this structure.

This confluence of technical factors often precedes robust reversals, as it can lead to a trapping of bearish sentiment. A decisive breakout from the channel could signal a shift in momentum, potentially driving the price upward.

Short-Term Price Outlook for HBAR This Week

If the current upward momentum persists, the Hedera price may target subsequent resistance levels around $0.16 and potentially $0.18. A confirmed breakout from the falling channel would lend further support to this trajectory.

Conversely, should the rally lose steam, traders will be closely monitoring support zones between $0.13 and $0.12, the region where the triple bottom has formed. For the time being, the overall outlook appears promising, with increasing market interest, upcoming futures trading, progress in ETF developments, and a supportive chart structure all contributing to a positive sentiment.

Hedera (HBAR) may be positioned for further significant gains, and the broader market is beginning to recognize its potential.