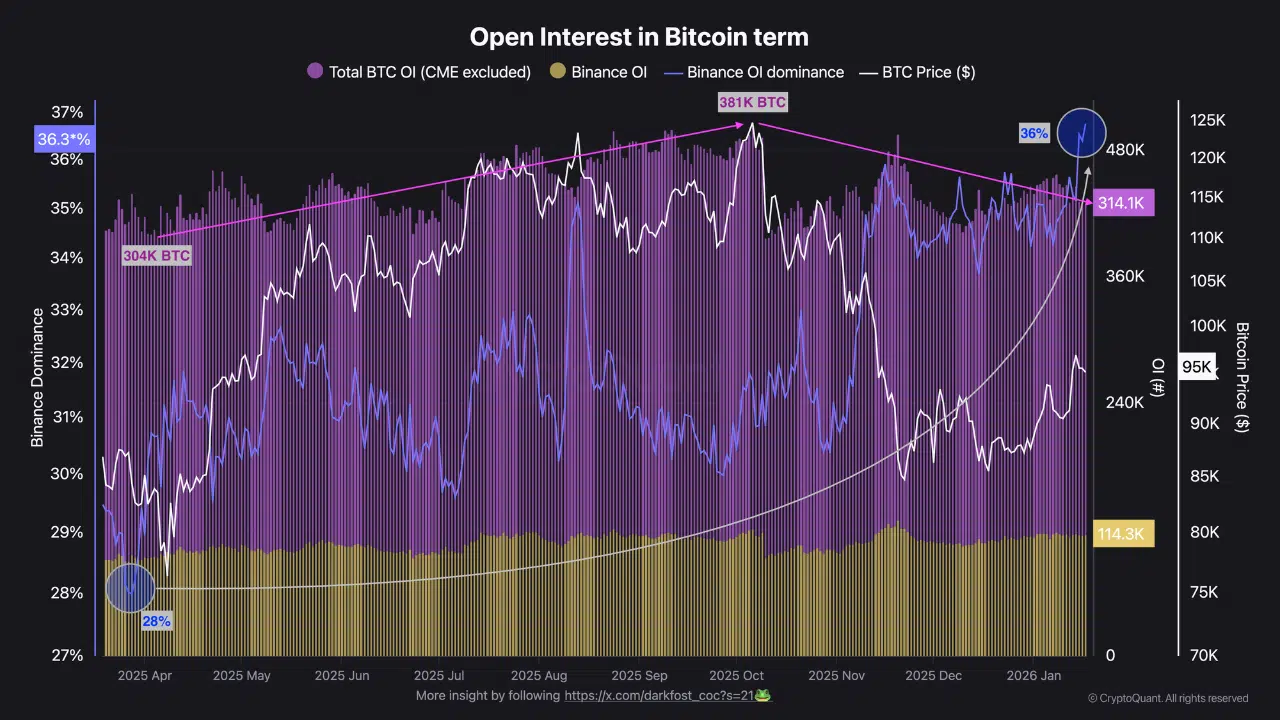

According to analysis shared by CryptoQuant, total Bitcoin open interest measured in BTC terms has declined sharply from 381,000 BTC to 314,000 BTC. That represents a drawdown of nearly 17.5%, signaling a broad reduction in leveraged exposure rather than aggressive new short positioning.

Open Interest Drops as Leverage Gets Washed Out

The decline in open interest coincided with Bitcoin’s corrective phase following its latest all-time high. During this period, BTC experienced a price correction of roughly 36%, while derivatives traders steadily reduced risk. Measuring open interest in BTC terms removes the distortion caused by price fluctuations, making the contraction in exposure clearer.

This data suggests that the recent move was driven by deleveraging, not panic selling. Large leveraged positions were unwound, cooling the market after months of aggressive futures activity.

Binance Still Dominates Futures Positioning

Despite the overall contraction, Binance continues to play an outsized role in Bitcoin’s derivatives ecosystem. Current figures show Binance accounting for approximately 36% of total Bitcoin open interest, making it the single most influential venue for futures-driven price action.

Historically, shifts in Binance’s dominance have aligned closely with broader market cycles. After the April 2025 correction, open interest hovered near 300,000 BTC, while Binance’s share dropped toward 26%. As risk appetite gradually returned, nearly 80,000 BTC flowed back into futures markets, helping fuel the rally that ultimately pushed Bitcoin to new highs.

Early Signs of Risk Appetite Returning

Recent data now shows early signs of stabilization. Open interest has stopped falling aggressively and appears to be slowly recovering, suggesting traders are beginning to reintroduce exposure, but in a far more cautious manner than before.

According to insights shared by Darkfost, this gradual recovery points to a market transitioning from forced deleveraging toward controlled risk re-entry. The rebound remains modest for now, but structurally healthier than leverage-driven spikes seen in prior cycles.

What This Means for Bitcoin’s Price Outlook

With open interest lower and leverage reduced, Bitcoin’s current price structure appears more resilient. If futures exposure continues to rebuild gradually—without a sharp spike in speculative positioning, it could provide a more sustainable foundation for further upside.

For now, the data suggests Bitcoin is not overheating. Instead, the market is digesting prior excesses while cautiously rebuilding confidence, keeping the door open for continued upside if spot demand and measured leverage continue to align.