Key Takeaways

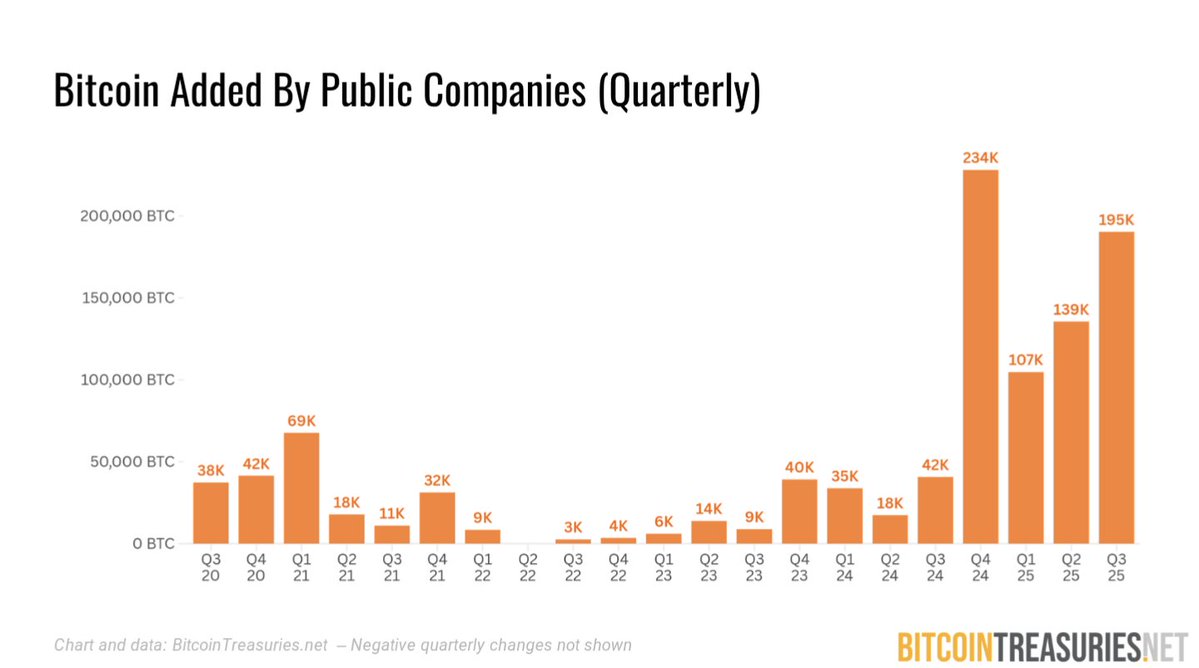

- •Public companies accumulated 195,000 BTC in Q3 2025, worth over $20.5 billion at current prices.

- •Institutional Bitcoin holdings have surged 80% year-to-date, continuing a wave of corporate accumulation since late 2024.

- •The shift reflects a broader “Bitcoin Treasury Era”, as listed firms treat BTC as a balance sheet reserve asset.

- •Analysts note this trend could tighten supply ahead of 2026’s projected cycle peak.

Publicly listed companies are deepening their exposure to Bitcoin at a historic pace. According to BitcoinTreasuries.NET, corporations collectively purchased 195,000 BTC – valued around $20.5 billion, during the third quarter of 2025.

The latest figures mark the second-highest quarterly accumulation in history, following the record 234,000 BTC added in Q4 2024. By comparison, quarterly inflows throughout 2022 and early 2023 averaged below 10,000 BTC, underscoring how sharply institutional participation has rebounded since spot Bitcoin ETFs and treasury adoption accelerated.

This data positions Q3 2025 as a pivotal period for corporate engagement in digital assets, an evolution reminiscent of Bitcoin’s 2020–2021 institutional breakout, but on a much larger scale.

The Bitcoin Treasury Era Expands

The surge in corporate holdings reflects a maturing trend often referred to as the “Bitcoin Treasury Era.”

Companies now view BTC not only as a hedge against currency depreciation but also as a strategic liquidity reserve capable of outperforming fiat assets during macro tightening cycles.

Major adopters such as Strategy Inc., American Bitcoin Corp., and CleanSpark have expanded their holdings through direct purchases and mining-related inflows. Meanwhile, firms outside the crypto industry, spanning tech, energy, and fintech, have joined the accumulation trend, treating Bitcoin as a non-sovereign reserve asset aligned with inflation-resistant balance sheet strategies.

With publicly traded firms now collectively holding hundreds of thousands of BTC, their influence on market liquidity and volatility has increased substantially, reinforcing Bitcoin’s status as a macro-grade asset class.

Institutional Demand Tightening Market Supply

The pace of corporate accumulation could have direct implications for Bitcoin’s price structure heading into 2026.

Unlike retail investors, most public companies employ long-term custody and multi-year lockup strategies, meaning the vast majority of newly acquired BTC is removed from liquid circulation.

This supply contraction effect, combined with continued ETF inflows and sovereign-level purchases, has already begun to compress available spot supply on major exchanges. Analysts suggest this dynamic could fuel a potential supply squeeze, similar to patterns observed during the 2020–2021 rally that drove BTC to new all-time highs.