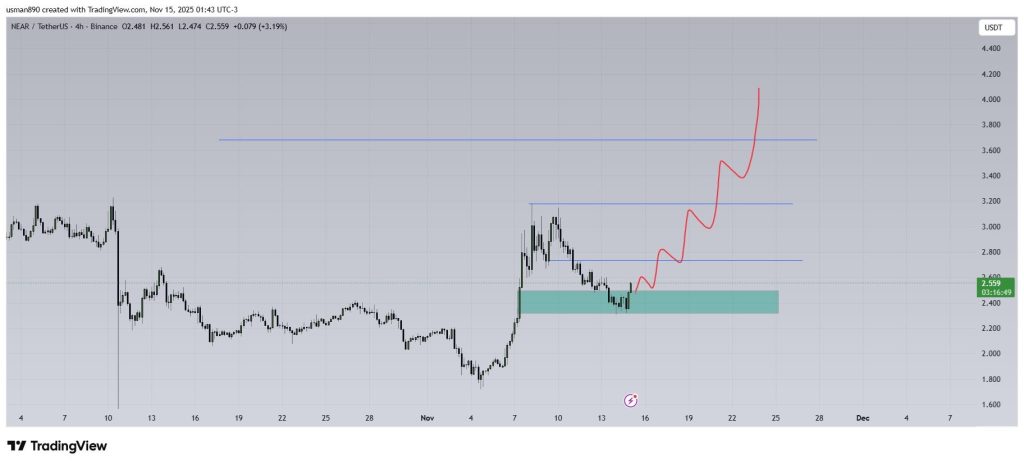

The NEAR price has returned to an accumulation zone that previously preceded a significant rally, a pattern traders are closely observing. This scenario suggests a potential for a repeat performance, with charts indicating a similar setup.

Trader Crypto Haque has identified this recurring pattern, noting that NEAR is maintaining its range effectively. His trading strategy involves buying at the lower end of the zone and selling near the top, a method that proved successful during the previous period NEAR spent in this area. Consequently, he is gradually re-establishing his position.

The NEAR Accumulation Range's Current Performance

The price action on the NEAR chart clearly illustrates the demand zone around $1.90. Each time the price has dipped into this level, buyers have consistently entered the market, preventing further declines. This same zone was instrumental in initiating the prior substantial upward movement and continues to demonstrate strong support.

Another analyst, Crypto Knight, has corroborated this observation, pointing out that NEAR has not experienced a breakdown in price despite broader market volatility. Instead, the asset has consistently rebounded toward the middle of its range, avoiding the creation of new lows.

This behavior is often indicative of quiet accumulation by investors. If this support level continues to hold, the initial target for the NEAR price is anticipated to be the $3.40 level, which previously acted as significant resistance. A decisive breach above this resistance could pave the way for further advances towards $5.80 and potentially the $8 range, levels that marked the peak of previous NEAR rallies.

Repeating Chart Patterns for NEAR

A secondary chart shared by Crypto Haque outlines a potential scenario for the repetition of NEAR's previous price structure.

The observed pattern involves NEAR establishing a base, gradually moving higher with periodic pullbacks, retesting former resistance levels, and ultimately building sufficient momentum for a significant breakout.

If the NEAR price adheres to this historical rhythm, a return above the $3 mark is considered a plausible outcome. Once market confidence in NEAR's strength is re-established, a move beyond $4 becomes increasingly likely.

NEAR Price Outlook

NEAR is currently consolidating within a critical support zone. Such accumulation ranges are not random occurrences and often precede major price movements.

Should the NEAR price replicate its past performance within this zone, the potential for upward movement towards $3, $5, and even $8 re-emerges as a strong possibility.

The immediate future of the NEAR price hinges on its behavior within this consolidation zone. Thus far, the price action aligns with the bullish expectations for this level.