HBAR, the native token of the Hedera network, rose by 9.1% over the past 24 hours. The increase followed a bounce from the $0.125 demand zone, which had previously acted as support.

Currently, HBAR is trading at $0.14691, marking a slight decline of 0.66% from the day’s high. Despite the recent rebound, technical indicators suggest the broader trend remains weak. The Relative Strength Index (RSI) is at 42.31, showing limited buying momentum.

Bollinger Bands indicate the price is nearing the lower band of $0.12372, while resistance lies near $0.15831. HBAR has remained under a descending trendline that has held since September, continuing a pattern of lower highs and lower lows.

Institutional Inflows Continue as ETF Holdings Rise

Recent data has confirmed a renewed institutional interest in Hedera. Canary Capital’s HBR Hedera ETF increased its holdings as of November 23. The ETF now holds 421,473,721 HBAR, which is valued at roughly $54.86 million.

UPDATE: Canary Capital’s $HBR Hedera ETF has increased its holdings again.

— FinancialPress.com (@FinancialPress_) November 23, 2025

New Holdings (as of Nov 23, 2025):

• 421,473,721 $HBAR

• Market value: $54.86M

With Hedera’s capped supply of 50 billion, the ETF now holds roughly:

0.84% of total supply

Another steady sign of… pic.twitter.com/iG4IWhdU5J

This figure represents approximately 0.84% of the total HBAR supply. The consistent accumulation suggests institutions may see value at current levels, even as retail sentiment remains cautious. Analysts note that such inflows, while notable, have not yet shifted the prevailing trend structure.

Hedera Ecosystem Faces TVL and Stablecoin Challenges

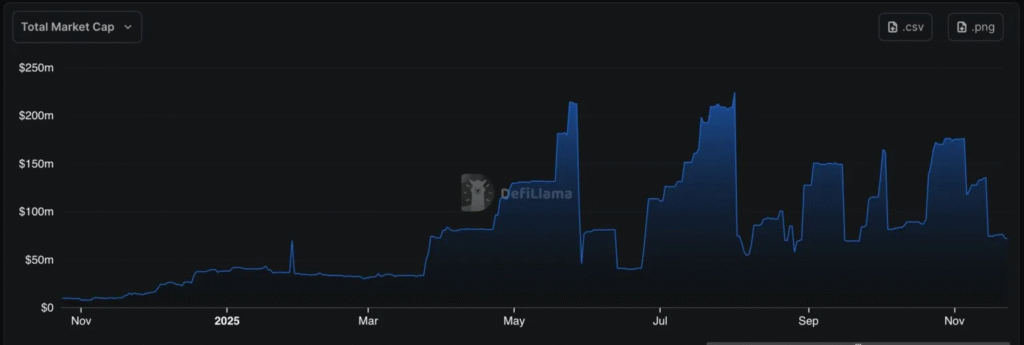

While the market shows short-term momentum, concerns remain about Hedera’s network usage. Its Total Value Locked (TVL) remains below $200 million. This is considered low for a network with a market cap above $7 billion.

Stablecoin activity has also shown high volatility. The stablecoin supply on Hedera fell from $172 million earlier this month to $72 million now. This kind of frequent fluctuation raises concerns about the consistency of user activity on the network.

Despite increased volume and ETF activity, Hedera’s technical outlook continues to lean bearish. Until HBAR breaks above the descending trendline, the broader market may remain hesitant.