Hawala Technology, a fintech startup focused on serving the MENA region, has successfully raised $3 million in a funding round spearheaded by Pharsalus Capital, with additional investment from Alumni Ventures. This capital infusion is earmarked for the revitalization of the platform and the enhancement of the Hawala app.

The funding round also saw participation from prominent angel investors including Naguib Sawiris, Chairman of Orascom Development Holding; Hany Rashwan, Co-Founder & CEO of 21.co; Arnold Lee, Co-Founder & CEO of Sphere Labs; and Carl Lin, Founding Engineer of Solana, among others.

Hawala's Mission and Focus on MENA

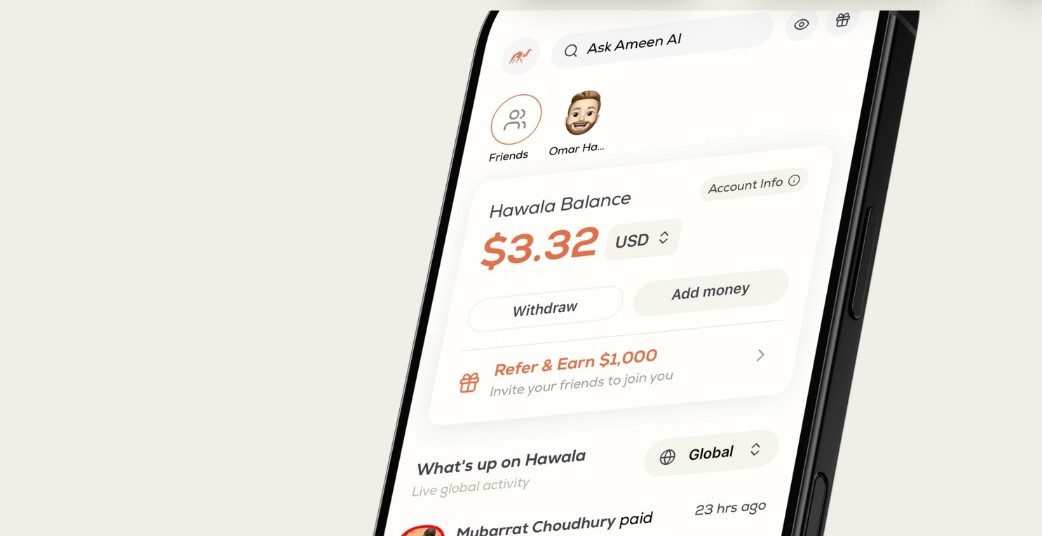

Founded by Omar Hamade in January 2025, Hawala is committed to establishing a robust financial infrastructure that bridges the Middle East and North Africa (MENA) region with global markets. The startup's immediate strategic objective is to gain significant traction in Egypt, recognized as one of the region's largest and most dynamic economies.

In a discussion about the implications of the $3 million pre-seed round for Hawala's growth, CEO and Founder Omar Hamade emphasized that the funding reinforces the company's dedication to building the essential financial infrastructure that connects the MENA region to the worldwide economy.

"Hawala is redefining what global access means. The company prides itself not only on its broad coverage but also on the speed, cost, and reliability that make cross-border finance finally feel local."

Omar Hamade highlighted that while regions like Latin America and Southeast Asia have experienced substantial fintech innovation over the past decade, MENA has lagged. "This funding allows us to change that by building fair, accessible, and transparent products for the next generation of global users across MENA," he stated, adding that Hawala aims to tackle challenges such as currency volatility, capital restrictions, and limited access to modern financial tools.

Key Features and Services

The Hawala platform empowers users in over 200 countries to establish U.S. bank account and routing numbers or a European IBAN. This capability enables them to receive and hold digital USD and EUR directly within their Hawala Wallet.

Additionally, the startup offers an infrastructure that facilitates instant money transfers to both Hawala and non-Hawala users, requiring only an email address.

Omar noted that withdrawals from user wallets are processed with remarkable speed, with many transactions completed in real time and the vast majority settled within one to two business days. He clarified that withdrawal speeds can be influenced by local banks and partners, factors beyond Hawala's direct control.

"We continue to partner with regulated financial institutions and licensed providers to expand our coverage, enhance transaction speed, and deliver faster, more accessible financial connectivity to users worldwide," Omar added.

Future Developments and Vision

With its inaugural funding round, Hawala intends to address a critical issue in the MENA region: the lack of access to stable currencies and globally connected financial tools.

Omar explained that the funding will enable the startup to accelerate the deployment of new features. Among these is the Hawala Card, which will allow users to make direct purchases from their Hawala Wallet at over 150 million merchants and ATMs that accept Visa.

Another upcoming feature is an interest-free savings product designed to assist users in preserving and growing their wealth transparently and responsibly. "Whether someone is earning remotely, sending money home, or trying to save in a stable currency, Hawala should be the simplest and most trusted way to do it," Omar stated.

Hawala's ambition is to become the primary financial platform for individuals in emerging markets who are globally engaged but underserved by local financial services. This vision centers on creating a future where everyone enjoys equitable access to stability, opportunity, and growth, irrespective of their geographical location.