HashKey Holdings Limited has successfully passed its Hong Kong Stock Exchange listing hearing, signaling a significant step towards establishing a comprehensive, licensed digital asset ecosystem. The company has secured notable joint sponsors, including JPMorgan Chase, Guotai Haitong Securities, and Guotai Junan International, to support its ambitious plans.

This initiative is designed to bolster regulated cryptocurrency offerings and is projected to impact broader digital markets. HashKey aims to increase its platform assets to over HK$19.9 billion by 2025, supporting a diverse range of 80 tokens.

HashKey's Strategic Expansion and Market Impact

HashKey Holdings Limited's successful navigation of the Hong Kong Stock Exchange's listing procedures positions it as a key player in the digital asset space. The company's strategic goal is to create a fully licensed digital asset ecosystem that will simplify transactions and enhance on-chain services. Stakeholders in this initiative include prominent entities such as Gaorong Capital, Fidelity, and Meitu, with Lu Weiding being among the major shareholders.

This listing represents a significant strategic move for HashKey, enhancing its capabilities in offering on-chain services, facilitating transactions, and managing assets. The company has set an ambitious target to support 80 tokens and manage over HK$19.9 billion in platform assets by the year 2025. Lu Weiding, a Major Shareholder of HashKey Holdings Limited, stated, "Our goal is to establish a fully licensed digital asset ecosystem that will simplify transactions and enhance on-chain services."

The announcement of the listing generated a positive response from the market, with HashKey's native token (HSK) experiencing a notable 13% increase in value. This market reaction underscores investor confidence in the company's future trajectory within the evolving digital asset landscape.

Investor Confidence and Market Parallels

The 13% surge in HashKey's token value echoes the positive market reception experienced by Circle following its Hong Kong IPO. This trend highlights a growing investor optimism surrounding regulated digital asset expansions within the region.

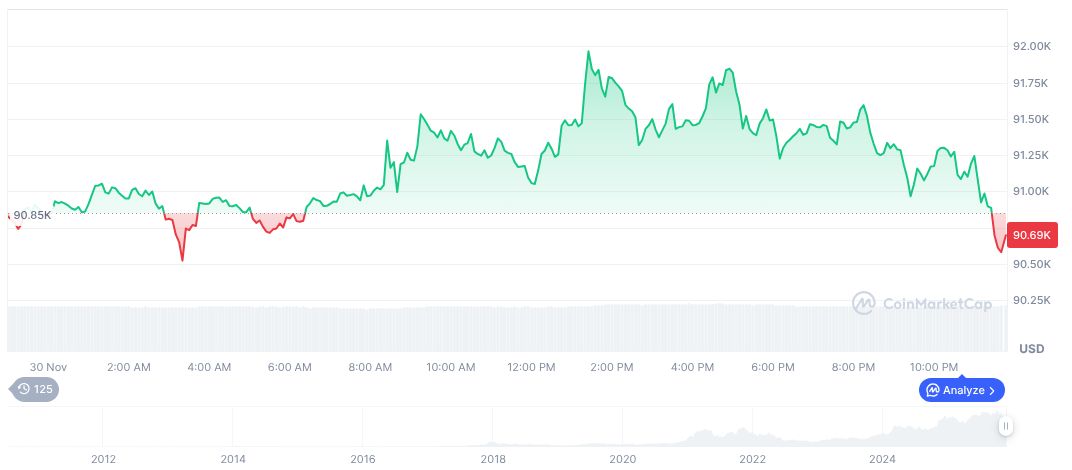

In the broader cryptocurrency market, Bitcoin (BTC) is currently trading at $87,470.50, with a market capitalization of $1.75 trillion and a market dominance of 58.75%. Over the past 24 hours, Bitcoin has seen approximately $48.37 billion in trading volume, despite a recent price decrease of 3.87%. The circulating supply of Bitcoin is close to 20 million coins.

Analysts from Coincu suggest that HashKey's successful listing aligns with Hong Kong's evolving regulatory framework for digital assets, which could attract further institutional investment. Historical market trends indicate that an increase in credibility and investment in licensed crypto platforms can contribute to greater market stability, which would support HashKey's expansion objectives.