Harvard's Growing Digital Asset Allocation

Harvard University's endowment, managed by Harvard Management Company, has significantly increased its holdings to 6.81 million shares of BlackRock’s Bitcoin ETF. This investment is valued at approximately $442.8 million as of September 2025.

This move represents Harvard's largest digital asset allocation to date, underscoring growing institutional confidence in Bitcoin and potentially influencing positive market trends and broader institutional interest.

Harvard's $442.8 Million Investment in Bitcoin Spot ETF

Harvard Management Company reported to the Securities and Exchange Commission (SEC) that its Bitcoin Spot ETF holdings have grown substantially. The current holdings amount to 6,813,612 shares, valued at approximately $442.8 million. This represents an expansion of 257% since the end of June 2025.

Market observers have identified this as a significant endorsement, particularly given Harvard's established history of conservative investment strategies.

This investment change reflects institutional confidence in Bitcoin, with Bloomberg's Eric Balchunas noting, "Harvard University holds $442 million worth of BlackRock's spot Bitcoin ETF (IBIT)"—highlighting Harvard's growing involvement with digital assets.

Market Trends and Signals of Institutional Adoption

Harvard's pronounced increase in Bitcoin holdings aligns with a notable history of digital assets gaining traction among traditional financial institutions, reflecting a paradigm shift toward widespread acceptance.

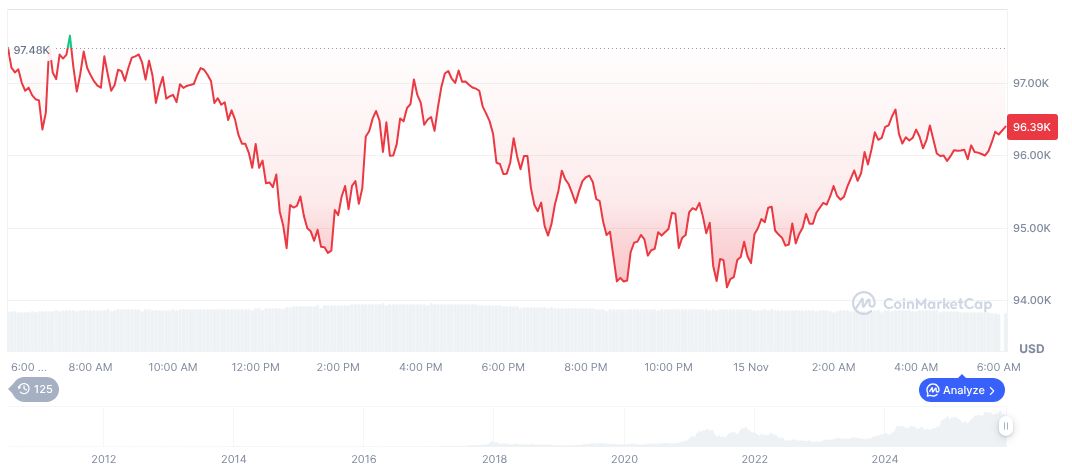

According to CoinMarketCap, Bitcoin (BTC) is currently valued at $96,262.11. Its market capitalization reached approximately 1.92 trillion, with a dominance of 58.82%. Bitcoin's price has seen decreases of 1.05% over the past 24 hours and 5.84% over the last seven days, continuing a three-month downtrend.

Analysts suggest that this investment shift could herald further institutional adoption of cryptocurrencies, potentially driving greater market stability and regulatory acceptance. Bitcoin's role as an institutional reserve asset could expand, leveraging historical patterns of institutional investment surges.