Gold has experienced its steepest one-day drop since 2013, losing 6.3% of its value and wiping out approximately $1.75 trillion. Concurrently, Bitcoin briefly surged above $114,000 before retreating to $108,000, a move that triggered over $150 million in short liquidations. These opposing movements between gold and Bitcoin this week have fueled speculation about capital rotation between these significant assets, highlighting shifting sentiment in global markets as traders reevaluate risk and liquidity.

Gold Faces Sharp Correction After Record Rally

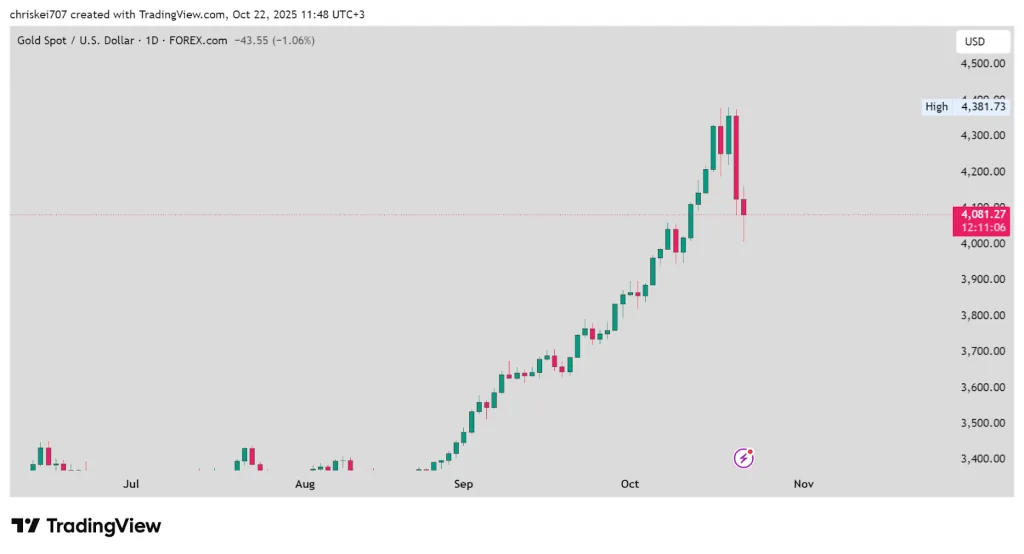

Gold's significant decline on Tuesday marked its largest single-day loss in over a decade. This sharp correction followed a record high reached on Monday, where prices reached $4,380 per ounce. The rapid reversal was attributed to strong algorithmic flows and profit-taking by investors. The rally leading up to this peak was propelled by concerns over inflation, geopolitical tensions, and substantial demand from central banks. Since early September, gold had demonstrated a consistent upward trend, characterized by higher highs and lower lows.

However, the $4,380 level proved unsustainable, leading to a swift market reversal. After a brief dip below $4,000, gold prices recovered to approximately $4,150, indicating the presence of dip buyers. The $4,000 mark now serves as a critical psychological level. A sustained break below this threshold could potentially lead to further losses, with support levels identified at $3,850 and $3,800. Currently, buyers are defending this zone, which helps maintain gold's broader upward trend. The long-term outlook for gold remains influenced by ongoing central bank accumulation and inflation trends, both of which continue to underpin demand.

Market analysts and gold advocates, such as Peter Schiff, have characterized the recent decline as a "shakeout." They argue that it represents short-term volatility rather than an end to the current cycle, emphasizing gold's role as a hedge against currency debasement and fiscal risks. For traders, however, this event underscored the fragility of market momentum when prices experience rapid increases.

Silver experienced similar downward pressure, with its price dropping nearly 9% to $48.40 per troy ounce. Silver had mirrored gold's upward movement earlier in the year, supported by demand from industrial sectors and investors seeking protection against inflation.

Bitcoin Surges Then Reverses Amid Market Volatility

In contrast to gold's sharp decline, Bitcoin experienced a brief recovery. The cryptocurrency saw a gain of over 2% on Tuesday, reaching a high of $114,000 before settling back near $108,000. This price action triggered liquidations exceeding $150 million for leveraged short positions. The surge followed positive commentary from Changpeng Zhao, co-founder of Binance, who suggested that Bitcoin could eventually surpass gold in market capitalization.

Bitcoin's rebound occurred after a significant pullback earlier in October, when the asset fell from its record high of $126,000 to $104,000. The $112,000–$115,000 range is now acting as short-term resistance. A decisive break above this level could pave the way for further gains toward $120,000 and beyond. Conversely, a failure to maintain support above $100,000 could expose Bitcoin to deeper price declines. Traders generally describe the current market sentiment as neutral to bullish, with anticipation for stronger momentum.

The diverging performance between Bitcoin and gold reflects different investor behaviors. Amidst an unstable macroeconomic environment, some funds may be shifting from traditional safe-haven assets like gold to cryptocurrencies in pursuit of higher returns. Market data indicates that both assets are highly sensitive to macroeconomic shifts. Trading dynamics continue to be influenced by fluctuations in liquidity, geopolitical stresses, and uncertainty surrounding rising interest rates. Bitcoin's inherent volatility is still largely driven by speculative activity, while gold's long-term fundamentals remain closely tied to real yields and central bank policies.

Despite the recent turbulence, Bitcoin has outperformed gold on a year-to-date basis. The digital asset has seen gains exceeding 90% in 2025, while gold has appreciated by approximately 40%. According to analysts, there is currently little evidence of a sustained, large-scale rotation from gold to Bitcoin. However, these divergent price movements clearly demonstrate how investors are adapting their strategies in response to evolving macroeconomic conditions.