Professional investors are becoming increasingly polarized on the future of gold, with new data showing deep disagreement over where prices are headed by the end of 2026. The latest Bank of America Global Fund Manager Survey reveals that conviction around gold remains surprisingly weak, even as macro uncertainty rises and institutional portfolios continue shifting toward defensive assets.

Sentiment Splits on Gold’s 2026 Price Path

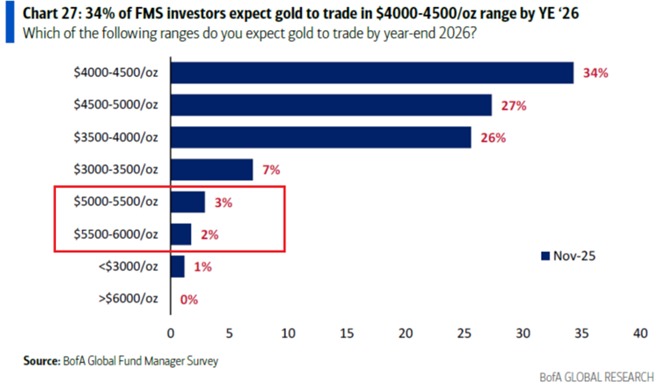

Only 5% of global fund managers believe gold will break above $5,000 per ounce by 2026, a remarkably small group given strong long-term demand drivers such as rate-cut expectations, rising geopolitical tension, and persistent inflation concerns.

The largest cluster of investors, 34%, projects gold to trade in the $4,000–$4,500 range. Another 27% expect a slightly higher band between $4,500 and $5,000, signaling that most professionals see moderate upside but not a dramatic breakout.

On the bearish side, 34% anticipate gold prices falling below $4,000, while 26% expect a decline into the $3,500–$4,000 zone. This split highlights a market where opinions on inflation, rates, and growth vary widely, and where conviction remains elusive.

Institutional Exposure Remains Surprisingly Low

Despite gold’s strong performance this year, 39% of survey participants still do not hold any gold in their portfolios. That lack of exposure is noteworthy given gold’s role as a hedge during monetary easing cycles. The metal is also no longer the “most crowded” trade, losing that title for the first time since October, when investors briefly piled in expecting aggressive rate cuts.

Wall Street Still Isn’t Convinced

The survey results show that professional investors remain cautious about committing to gold, largely because the macro backdrop is shifting faster than consensus can adjust. Markets are wrestling with whether inflation will remain sticky or decline, how quickly central banks may cut rates, and how geopolitical risks could drive safe-haven flows.

The chart from Bank of America underlines this uncertainty: while the majority clusters around mid-range price targets, only a small minority expects either extreme bullish or bearish outcomes. Gold may be in demand globally, but Wall Street appears far from united on where it goes next.