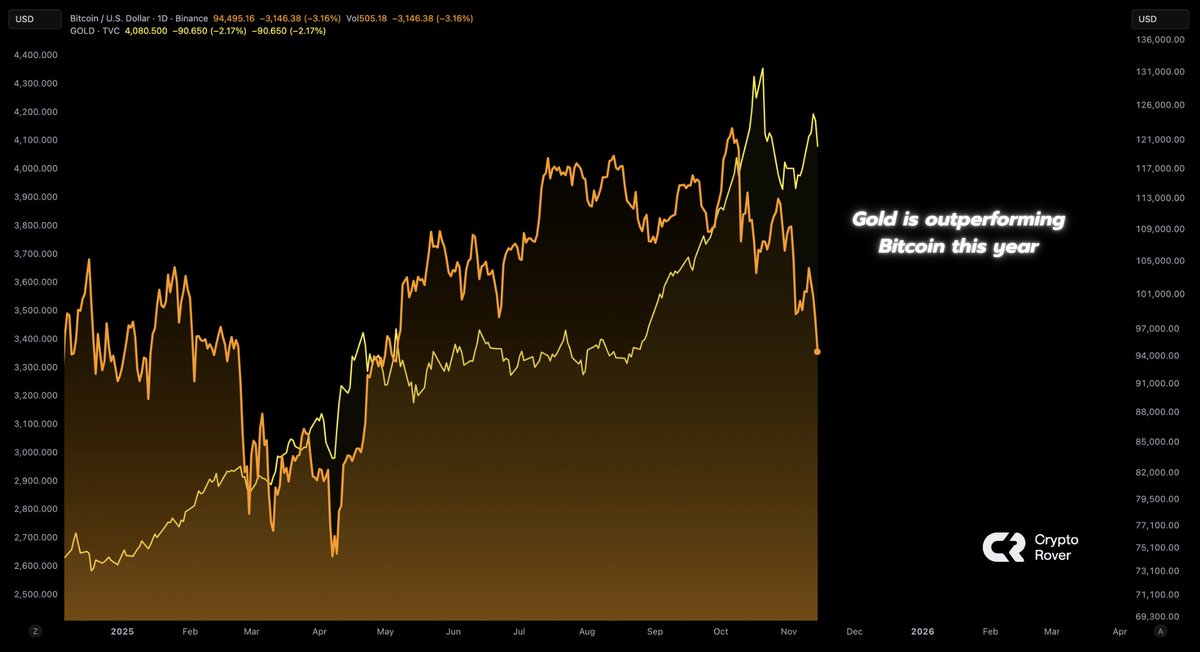

New data highlights a rare market twist: for the first time in years, gold is outperforming Bitcoin year-to-date, and by a wide margin.

As of mid-November 2025, gold’s YTD performance sits near 36%, fueled by fresh all-time highs, persistent geopolitical tension, and a renewed global bid for hard assets. Bitcoin, while still positive on the year, is up only 15%–16%, weighed down by violent drawdowns, ETF outflows, and tightening macro conditions.

The chart comparison underscores a striking dynamic: both assets sit at the top of this year’s performance leaderboard, but gold has taken the crown, something that has never happened before in the modern BTC era.

Gold’s rally has been steady, grinding higher throughout 2025 as central banks increased purchases and investors sought stability. Bitcoin’s trajectory, meanwhile, has been far more volatile, with new highs followed by steep corrections that erased large portions of yearly gains.

This divergence doesn’t necessarily signal fading confidence in Bitcoin. Instead, it reflects the market’s shift toward safety. In a year marked by liquidity stress, higher-for-longer interest rates, and global political instability, gold’s historical role as a defensive asset has reasserted itself, while Bitcoin’s risk-sensitive flows have thinned.

Both assets remain core macro barometers, but for now, gold is setting the pace, and Bitcoin is playing catch-up.