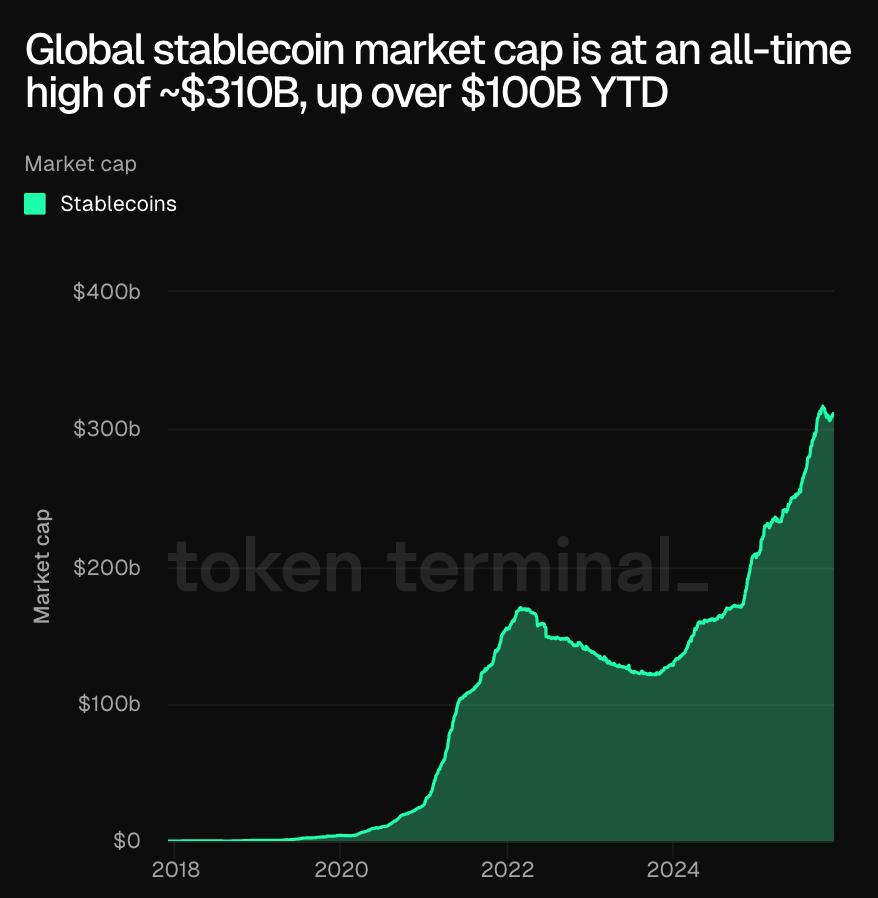

Global stablecoin capitalization has reached its highest level on record, climbing past $310 billion after expanding by more than $100 billion since the start of the year. The data, highlighted by Token Terminal, shows how quickly stablecoins have re-established themselves as one of crypto’s most important liquidity anchors following two years of consolidation.

Market Trends and Growth Dynamics

The chart illustrates a steep, renewed uptrend beginning in early 2024 and accelerating through 2025. After the sector’s previous peak in 2022, stablecoin supply contracted sharply during the industry’s risk reset. The graphic reveals how that drawdown has now fully reversed: supply has surged to a fresh all-time high, surpassing the prior cycle’s maximum and forming the steepest growth arc since stablecoins began scaling in 2019.

The rising curve reflects more than market sentiment. It signals real capital flowing back into tokenized dollars, with market cap growth occurring consistently, not through rapid spikes, but through steady month-over-month expansion that suggests durable demand.

Significance of Stablecoin Resurgence

Stablecoins are the primary settlement layer for crypto trading, on-chain liquidity, and an increasing share of cross-border payments. Their return to record levels underscores the broader resurgence of digital asset activity and the sector’s tightening link with real-world finance.

With stablecoin adoption expanding across exchanges, DeFi platforms, and payment networks, the latest milestone demonstrates how deeply embedded tokenized dollars have become in global crypto infrastructure, setting the stage for even larger growth as regulatory clarity and institutional usage continue to advance.