The Shifting Landscape of Global Remittances

The global remittance market, valued at an estimated $900 billion, is undergoing a significant transformation driven by the accelerating adoption of stablecoins. These digital assets promise to drastically reduce the costs and time associated with cross-border payments, presenting a formidable challenge to established remittance systems.

The impact of stablecoins is particularly significant for low-income individuals sending money to developing countries, where traditional remittance services often carry substantial transaction fees. Stablecoins offer a more efficient and cost-effective alternative, potentially reshaping how these vital financial flows operate.

Stablecoins: Catalysts for Industry Change

Stablecoins are poised to revolutionize the remittance sector by making international transactions considerably cheaper and faster. Current average transaction costs can exceed 6%, a figure that stablecoins aim to significantly undercut. The regulatory support provided by the GENIUS Act has been instrumental in elevating stablecoins' profile and encouraging their practical application in mainstream finance.

In response to this evolving landscape, major financial institutions like Western Union and PayPal are actively exploring entry into the stablecoin market. This strategic move aims to diversify their remittance offerings. However, these traditional providers face the complex task of integrating blockchain-driven efficiencies into their existing operations while simultaneously preserving the trust of their established customer base. Insights from the digital economy suggest that agile crypto-native firms are well-positioned to adapt to these shifts, leveraging their technological flexibility to navigate the dynamic financial ecosystem.

"Innovation and regulation are not opposing forces. Clear rules give us the confidence to treat stablecoins as part of the core settlement toolkit rather than a speculative side bet. In 2026, the conversation shifts from ‘if’ to ‘how’ we integrate regulated digital liquidity into global payments." - Chloé Mayenobe, Deputy CEO, Thunes

Regulatory Influence and Future Financial Adjustments

Stablecoins play a crucial role in lowering cross-border remittance costs, potentially bringing them below the 6% threshold and offering a substantial advantage over traditional remittance services like Western Union. This development holds historical significance for alleviating financial burdens on individuals sending money to support family and communities abroad.

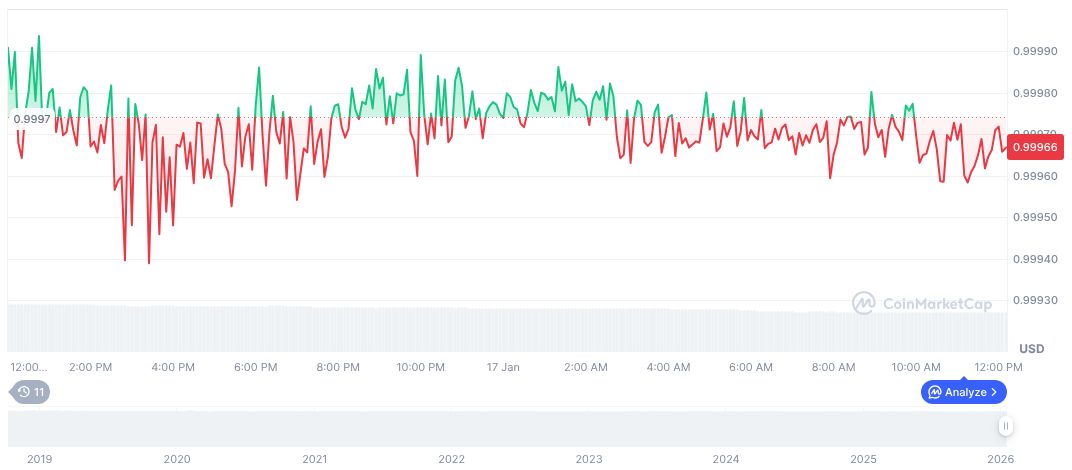

Data from CoinMarketCap indicates that USDC, a fiat-backed stablecoin, maintains a price of $1.00 and boasts a stable market capitalization of $75.97 billion, representing a significant 2.35% share of the market. While recent trading activity showed a dip in volume, the price stability observed over extended periods underscores a consistent market demand for dependable digital liquidity. Regulatory outlooks suggest a global pivot towards innovation, with financial institutions increasingly focusing on how to integrate these digital assets effectively.

Research consistently highlights the advantages stablecoins offer in terms of settlement speed and efficiency once integrated into established banking infrastructures. As financial systems adapt and align with regulatory frameworks, the deployment of stablecoins within the remittance sector is expected to see substantial growth. The influence of the GENIUS Act is particularly noteworthy, setting a global precedent that could foster international regulatory harmonization and accelerate the adoption of digital assets.