Market Rebound Fueled by Software Transition and Strategic Shifts

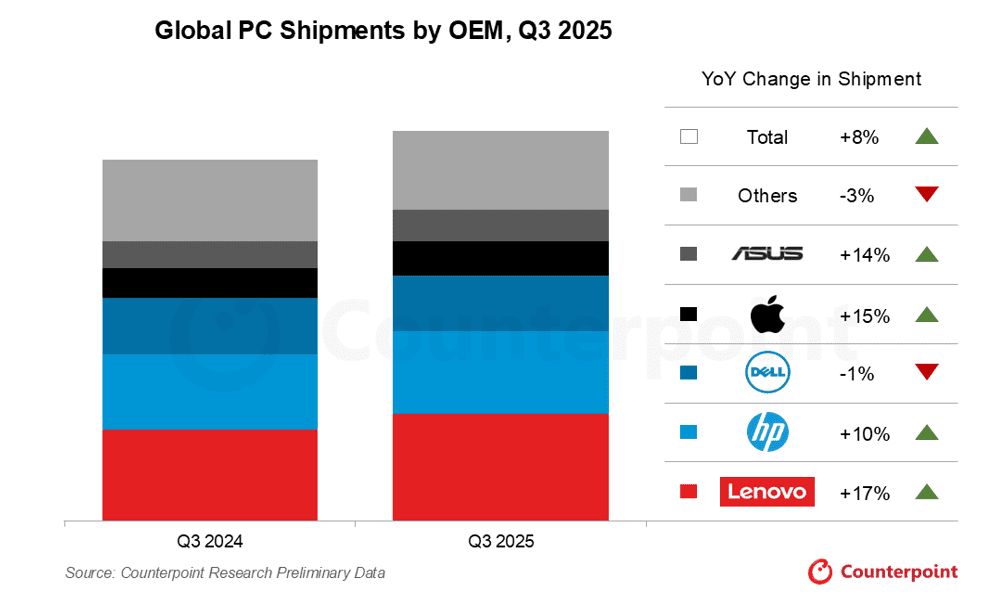

Global PC shipments experienced a significant surge of 8.1% year-on-year in the third quarter of 2025, according to preliminary figures from Counterpoint Research. This marks one of the strongest rebounds the PC market has witnessed in recent years, driven by a confluence of factors including upgrade cycles, operating system transitions, and strategic market adjustments.

The primary catalyst for this growth was the impending end-of-support for Microsoft Windows 10, scheduled for October 2025. As both enterprises and individual consumers prepare for the discontinuation of the decade-old operating system, demand for replacement hardware has escalated across various regions. Counterpoint estimates that approximately 40% of the current PC installed base still operates on Windows 10, highlighting the profound impact of this software transition on hardware sales.

Concurrently, evolving U.S. import tariff policies have prompted PC vendors to refine their inventory management strategies, adding another layer of momentum to quarterly shipments. For the first time since 2021, the global PC market appears to have navigated a period of stagnation and is now entering a phase of steady recovery.

Vendor Performance: Lenovo Leads, HP and Apple Gain Ground

Lenovo has once again secured its position as the world's leading PC manufacturer, reporting an impressive 17.4% year-on-year increase in shipments for Q3 2025. This growth rate was the highest among the top six vendors. The company's strategic emphasis on both commercial and consumer segments, combined with effective channel management, enabled it to capitalize promptly on the demand generated by the Windows 10 replacement cycle.

HP followed closely, achieving a 10.3% annual growth rate. This growth was largely propelled by strong sales to businesses undertaking corporate fleet upgrades. HP's established relationships within the enterprise and education sectors were instrumental in solidifying its second-place global ranking.

In contrast, Dell experienced a somewhat more challenging quarter. While its shipments saw a 2.7% increase quarter-on-quarter, they declined by 0.9% year-on-year. This performance reflects more cautious spending patterns among enterprises in North America and Europe.

Industry analysts suggest that Dell's significant exposure to the commercial sector, where refresh cycles are typically more deliberate, may have tempered its overall growth trajectory.

Apple also reported a strong quarter, with Mac shipments increasing by 14.9% year-on-year. The company benefited from robust demand for its latest MacBook models, which feature enhanced M-series processors and energy-efficient designs.

Counterpoint also observed a growing trend of enterprise adoption of Apple devices. This trend has been steadily building as businesses increasingly seek to diversify their hardware ecosystems beyond Windows-based systems.

Asus recorded one of the most notable quarterly performances, with shipments surging by 22.5% quarter-on-quarter and 14.1% year-on-year. This growth was primarily driven by strong consumer notebook demand and competitive pricing strategies. The company's aggressive expansion into the gaming and creator laptop markets proved highly successful during the quarter.

Collectively, Lenovo, HP, Dell, Apple, and Asus now command nearly three-quarters of the global PC market. This indicates a continued consolidation trend that favors the leading manufacturers. Smaller original equipment manufacturers (OEMs), unable to match the scale and supply chain agility of the major players, experienced flat or declining shipment volumes during the same period.

Windows 10 Sunset Paves the Way for the AI PC Era

Minsoo Kang, a Senior Analyst at Counterpoint, stated that the current growth surge is not merely a short-term phenomenon. "While the current growth is primarily driven by OS migration, the industry is poised for an even more profound transformation with the rise of the AI PC," Kang commented. "However, this next wave of growth has not yet fully materialised in the Q3 2025 numbers."

Indeed, the transition away from Windows 10 is doing more than simply reviving PC sales; it is establishing the financial and technical foundation for the next significant inflection point in personal computing: the emergence of AI-powered PCs.

David Naranjo, Associate Director, highlighted that the ongoing refresh cycle is as much about future-proofing as it is about immediate upgrades. "The PC market’s rebound in 2025 is not just about replacing outdated systems," Naranjo explained. "It’s about preparing for what’s next. Many enterprises are choosing AI-capable PCs to future-proof their fleets, even if they do not yet need those capabilities immediately."

Across the industry, PC manufacturers have begun introducing new models equipped with neural processing units (NPUs) and on-device AI acceleration capabilities. These systems are designed to run AI assistants, large language models, and other generative AI workloads locally, reducing reliance on cloud connectivity. However, for the present, these features are more of a selling point for future readiness than a primary driver for purchase decisions.

Current buyers remain focused on practical considerations such as OS compatibility, performance enhancements, and battery life. Nevertheless, the trend towards AI-enabled hardware is clearly in motion. Businesses are increasingly opting for PCs capable of handling AI tasks, not out of immediate necessity, but to avoid obsolescence in the future.

While AI PCs are already entering the market, analysts anticipate that a significant ramp-up will commence after 2026, coinciding with the volume arrival of next-generation processors specifically engineered for AI workloads.

Qualcomm has already unveiled its Snapdragon X2 Elite PC processor, which integrates advanced NPUs designed for sustained on-device AI inference.

Intel, meanwhile, is preparing its "Panther Lake" Core Ultra chips, which feature enhanced neural acceleration capabilities. NVIDIA, in collaboration with MediaTek and other semiconductor firms, is also developing Arm-based CPU architectures that incorporate built-in GPU AI engines optimized for PC performance.

Counterpoint projects that mass shipments of these AI-centric chips will reach full momentum by late 2026, with broader consumer availability expected in 2027. Consequently, the true AI PC boom is anticipated to take off in the latter half of the current decade.

By that time, AI integration is expected to fundamentally redefine user interaction with devices, shifting the focus from pure performance metrics to intelligence delivered at the edge.

Analysts predict that CES 2026 will serve as a platform for showcasing a new wave of AI PC models, officially marking the dawn of a new computing era.

For the present, however, 2025 stands as a pivotal transitional year, characterized by the replacement of aging systems, the sunset of Windows 10, and the foundational work being quietly laid for the age of AI-enabled personal computing.

As Kang aptly summarized, "The current refresh cycle is about preparing for transformation. What comes next will be the most significant leap the PC industry has seen since the rise of the notebook."