The past week has witnessed an aggressive rise in global liquidity, significantly influenced by China, the U.S. Federal Reserve, and the U.S. Treasury. This rare alignment of major economic powers historically fuels strong upside potential for Bitcoin and altcoins. While Bitcoin's price experienced a dip due to regulatory caution and institutional hedging, the broader influx of cash now points to a powerful long-term catalyst building in the background.

China, the Fed, and U.S. Treasury Flood Markets With Fresh Global Cash Injections

The world's largest economies have injected a combined trillions in capital, leading to eased financial conditions and a strengthening of risk-on assets.

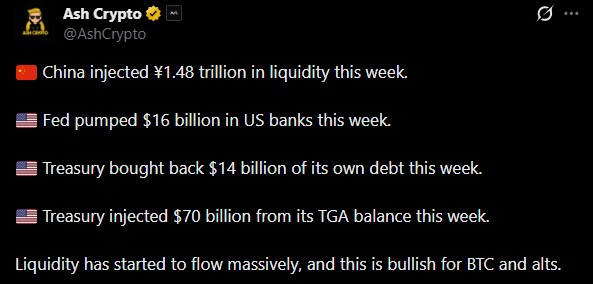

China injected ¥1.48 trillion (approximately $209 billion USD) through its Medium-term Lending Facility (MLF) operations, treasury trading, cash management, and reverse repo activities. Although the reverse-repo cycle recorded a net withdrawal, the overall market flows footprint grew significantly.

Concurrently, the U.S. Federal Reserve added $13.5 billion into the banking system through its second-largest repo operation since the COVID-19 crisis. More importantly, the Fed officially ended Quantitative Tightening on December 1. This marked a significant policy shift towards easier monetary expansion conditions, following a draining of $2.4 trillion since 2022.

Further contributing to the global liquidity surge, the U.S. Treasury conducted the largest debt buyback in American history, repurchasing $14.5 billion in a single week. Additionally, it injected an extra $70 billion from its Treasury General Account (TGA). These actions are primarily designed to stabilize funding conditions, but they also ripple outwards into broader global markets.

Collectively, these measures signify a clear shift toward expanding global liquidity, a macroeconomic signal that typically bolsters demand for risk assets. Understanding how this influence plays out in cryptocurrency markets is key.

How Global Liquidity Influences Cryptocurrency Markets

Given that cryptocurrency is one of the most liquidity-sensitive asset classes, these macroeconomic injections generally strengthen its long-term trajectory, even if short-term volatility persists.

- •Increased liquidity translates to more capital flowing into risk assets such as Bitcoin and altcoins, mirroring trends seen in the 2013, 2017, and 2020-21 cycles.

- •Reduced funding stress encourages institutions to re-enter high-beta assets.

- •The conclusion of Quantitative Tightening (QT) removes a major capital drain, often signaling the commencement of multi-year crypto bull cycles.

- •Debt buybacks and repo injections lower borrowing costs, indirectly enhancing the depth of the crypto market.

Capital Supply Effect on Broader Crypto Market

Despite the surge in cash inflows, Bitcoin experienced a 2.05% decline to $89,537 within 24 hours, while the broader market dipped by nearly 2.09%. This decline was influenced by a combination of technical and regulatory pressures:

- •China's securities regulator (CSRC) intensified crypto risk monitoring, triggering risk-off flows.

- •A major institutional strategy involved moving $1.44 billion into cash, signaling hedging activities ahead of market volatility.

- •Bitcoin slipped below key moving averages ($90.5K–$93.6K), which activated automated sell orders.

Regarding the broader altcoin market, the CMC Altcoin Season Index remains at 21 out of 100, indicating that Bitcoin continues to dominate capital inflows. Once Bitcoin stabilizes under expanding global liquidity, capital typically rotates into altcoins, often sparking a stronger altcoin season.

Global Liquidity Suggests a Multi-Year Crypto Upside Cycle

The simultaneous monetary expansion across China, the Federal Reserve, and the U.S. Treasury indicates a global shift towards easier financial conditions. Historically, periods of rising liquidity have supported major rallies in Bitcoin and strong altcoin market expansion.

As monetary conditions ease and worldwide cash supply grows, crypto markets, particularly Bitcoin, tend to experience:

- •Higher institutional inflows.

- •Increased trading volumes.

- •Stronger risk appetite.

- •Improved market supply and price support.

While short-term volatility persists due to regulatory shocks, technical triggers, and institutional hedging, the underlying macroeconomic picture appears progressively bullish.