On Thursday, the leaders of the largest banks in the United States will convene to discuss the current state and future of the cryptocurrency market. With cryptocurrencies gaining global traction and continuing to expand, their adoption remains robust despite the volatile graphs. This meeting invites us to delve into both the newly announced meeting of bank CEOs and the present conditions of cryptocurrencies.

Bank CEOs Meet On Cryptocurrency Regulations

The CEOs of three major banks will meet with Senators to discuss the regulatory framework of the cryptocurrency market. According to Punchbowl’s announcement, these top executives from the world’s largest financial companies will express their opinions on the rules to be introduced for the crypto market. The list of attendees includes:

- •Citigroup CEO Fraser

- •Bank of America CEO Moynihan

- •Wells Fargo CEO Scharf

Executive orders that Trump signed regarding cryptocurrencies and the appointment of crypto-friendly individuals to key positions significantly reduced the pressure on the market. The critical aspect remains the implementation of supportive cryptocurrency laws that would have long-term effects.

Remember, a few days ago, Trump suddenly annulled all executive orders enacted by Biden’s e-signature. This might repeat if Trump loses the elections again in about three years, especially if the incoming president is a Democrat, who could annul all of Trump’s crypto-related orders at once. However, abolishing or tightening laws would require Senate and House of Representatives approval, necessitating the completion of other cryptocurrency laws like GENIUS.

Current State of Cryptocurrencies

The news of the U.S. allowing the export of Nvidia’s H200 chips to China temporarily pushed BTC back over $90,000, yet it consistently dips below this critical threshold. Each day BTC fails to overcome the $94,000 resistance intensifies investors’ fears of hitting a deeper low.

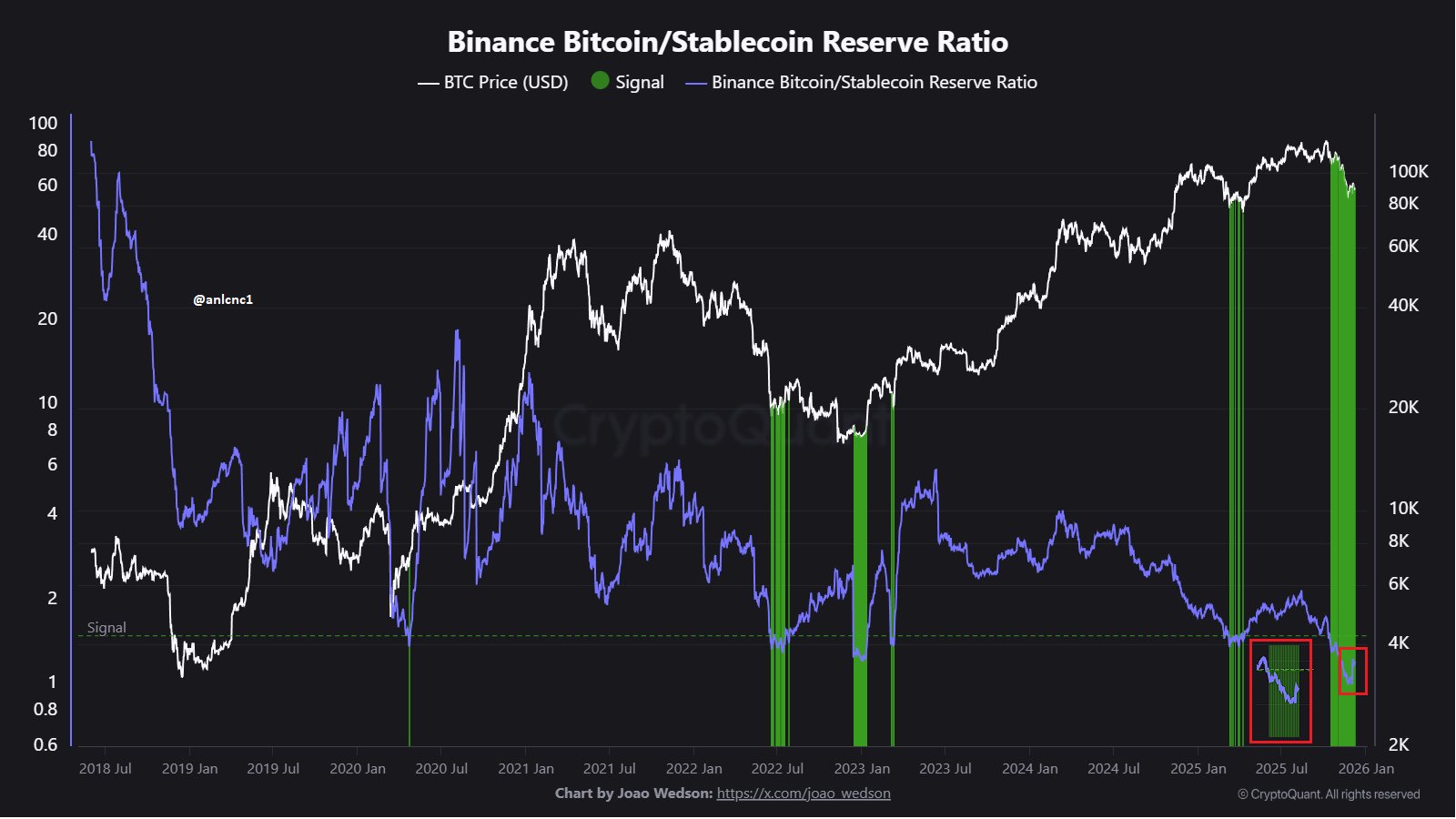

Turkish on-chain analyst anlcnc1 points to the Binance BTC/Stablecoin Reserve Ratio chart, signaling the potential formation of a bottom. However, it’s still early to be certain.

The Binance BTC/Stablecoin Reserve Ratio began to curve upwards after forming a bottom in the $86-$88K range. Transitioning from Bitcoin > Stablecoin to Stablecoin > Bitcoin around December 1, this may indicate a dip formation. Continuity is crucial, like in all data, and we need time and patience for these metrics as they show direct trends. If the Reserve Ratio keeps rising despite price retreats, showing Bitcoin > Stablecoin transitions, we may be witnessing classic dip-buying behavior. Currently, the upward diversion hints at a positive start. We must continue monitoring further developments.