While XRP continues to hold its ground as a leading institutional payment token, the market is rapidly evolving. A new wave of projects, such as Digitap, are emerging with a strong focus on onboarding retail users and driving stablecoin adoption through user-friendly, digital-first platforms.

The market narrative is shifting from solely focusing on payment infrastructure tokens to valuing projects that demonstrate clear revenue capture and robust user growth. This signifies a broader change in how the market evaluates payment-focused cryptocurrency projects.

As demand for stablecoins continues to surge, the next phase of adoption is expected to be driven by projects offering superior money products. Digital-first applications are at the forefront of this movement, explaining the significant interest in Digitap's presale, which has already raised over $4 million. This trend indicates a clear market preference for applications over infrastructure.

Among the most promising cryptocurrencies to invest in are those that emulate fintech products: easy to use, with simple interfaces, better outcomes, and, crucially, tokens that capture value as the platform scales. Digitap appears to be positioning itself to outshine XRP in the 2026 payment race.

Ripple's Continued Institutional Appeal

Ripple has established a strong legacy in the cryptocurrency space, primarily due to its mission to modernize cross-border payments. Since its inception in 2012, Ripple has aimed to facilitate frictionless global fund transfers.

While enabling users to send stablecoins is a common feature in crypto, traditional finance (TradFi) often grapples with slow and costly legacy transfer systems that can take multiple business days. Ripple has effectively addressed this pain point, contributing to its substantial market capitalization.

Furthermore, Ripple is actively attracting institutional adoption. Notably, Bank of America has begun processing Ripple (XRP) transactions, signaling a potential shift in how money is transacted. Integrating blockchain technology into traditional finance could lead to enhanced efficiency and reduced transactional costs.

Despite these innovations, regulatory approvals remain a challenge. Nevertheless, Ripple's ongoing advancements and strategic partnerships are instrumental in bridging the gap between traditional finance and cryptocurrency, solidifying its position as a top altcoin for many investors.

XRP Price Dynamics and Market Sentiment

Historically, when banking-related narratives gain traction in the market, XRP is often among the first tokens to react. However, bulls have been contending with a persistent bearish trend. The altcoin has been trading around $1.90, following a peak of $2.40 in early January.

The recent rally, which saw the price jump from $1.85 to $2.40, appears to have been driven by distribution rather than accumulation, with many large holders selling into strength. Consequently, the price has since declined. The XRP chart exhibits lower highs and lower lows, indicative of a downtrend rather than consolidation.

XRP's trading volume has also diminished, suggesting weak buying interest. This pattern could be forming a bear flag, rather than a reversal pattern. While XRP remains a strong contender in the crypto market, the primary headwind this year is the shift in the payment race from institutional focus to stablecoin distribution and consumer adoption.

Until the XRP price surpasses the $2.32 mark, it is likely to continue its bearish trajectory.

Digitap's User-Centric Approach Versus Ripple's Institutional Focus

The payment sector is fundamentally a grassroots business, encompassing remittance, family transfers, freelance payouts, and cross-border spending – all activities heavily influenced by everyday user behavior. Digitap emerges as a pioneering omnibank solution, designed to bridge the gap between fiat currency and cryptocurrency.

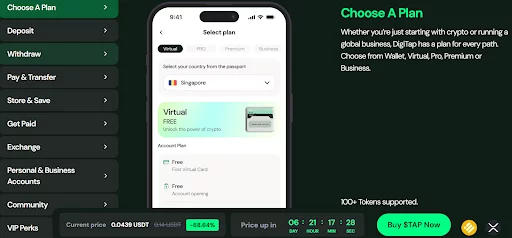

The Digitap app, available on both iOS and Android, features a modern banking interface, with stablecoins and blockchain technology operating seamlessly in the background. The next wave of adoption seeks a more intuitive crypto experience where users are not burdened by the underlying infrastructure. The priority is for money to arrive quickly, efficiently, and at a low cost.

Digitap's multi-rail settlement system ensures that transfers are routed through the most efficient path available. This could involve traditional banking rails, facilitated by TAP's banking partners, or blockchain rails for cross-border transactions.

This innovative approach addresses a significant pain point in the global payments sector, explaining why Digitap's crypto presale has become the fastest-growing consumer application this year.

Digitap's Tokenomics Position TAP as a Leading Cryptocurrency for 2026

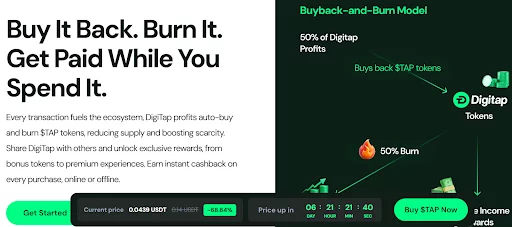

Governance tokens are currently facing waning interest. In this market cycle, tokens that do not demonstrate value capture tend to lose investor attention. The most engaging tokens are those that share revenue with holders and implement substantial token burn campaigns.

TAP is emerging as one of the top cryptocurrencies to buy now due to its innovative tokenomics. The project allocates 50% of its revenue to buy TAP tokens on the open market. These tokens are then distributed between staking rewards and burns. This mechanism ensures that as the platform scales and attracts new users, token holders benefit from the upside.

The project has garnered significant market attention, having sold over 191 million tokens since its presale campaign launch. TAP is currently priced at $0.0439 and is scheduled to increase to $0.0454 in the coming days.

With a confirmed listing price of $0.14, Digitap presents substantial upside potential for investors acquiring tokens at the current presale valuation.

Can Digitap Surpass XRP in the 2026 Payment Race?

While XRP remains a recognized player in the payment sector, its dominance appears to be waning as the market evolves. Stablecoin growth is accelerating, with projects featuring digital-first applications at the forefront of this adoption trend. This shift could lead to institutional-focused projects like Ripple being perceived as undervalued.

Digitap offers a live product, widespread adoption potential, and tokenomics designed to reward holders as TAP scales. XRP may experience a rally to $2.50 if the market sentiment turns bullish. However, the potential for significant upside difference between the two tokens is considerable.

TAP's current valuation is relatively low, meaning it requires less substantial inflows to achieve significant price appreciation. This positions it as a potentially overlooked cryptocurrency investment. Even modest adoption can have a material impact on its price, particularly during its early distribution phases.