After a five-year regulatory journey, the U.S. Commodity Futures Trading Commission (CFTC) has approved the Gemini Titan platform to enter the regulated prediction market in the United States. This development positions Gemini at the forefront of a rapidly growing sector where traders can bet on binary event contracts based on real events, under federal oversight.

Prediction Market Approval: What It Means for Gemini

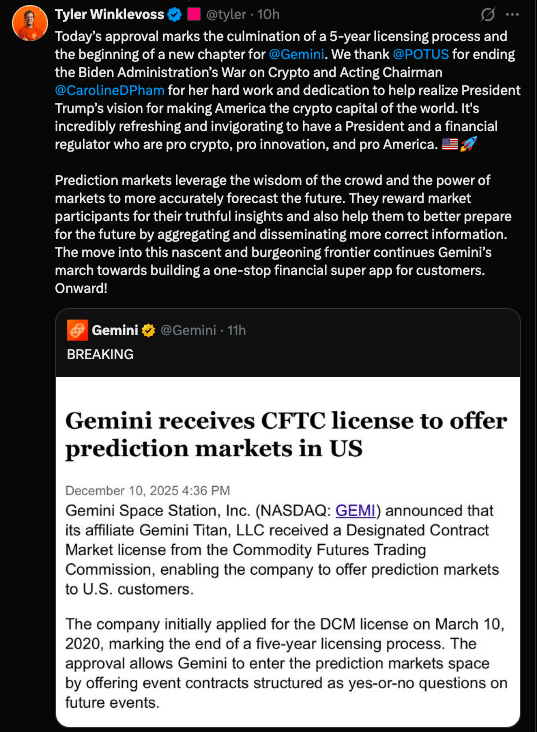

Gemini Titan, a subsidiary of Gemini Space Station, Inc., has been granted a Designated Contract Market (DCM) license by the CFTC, the primary regulatory pathway for operating derivatives markets in the U.S. This license specifically enables Gemini to offer binary "yes/no" event contracts, allowing customers to trade on the outcome of future events, such as measuring a network's hash rate or an election result. Gemini's CEO, Tyler Winklevoss, stated that this achievement is the culmination of a five-year licensing process and marks the beginning of a new chapter for Gemini.

This approval follows Gemini's successful initial public offering (IPO) in September 2025, indicating the company's aspirations to vertically integrate financial products within a regulated platform.

How Gemini Titan Will Be Accessed by Users

With the prediction market now approved, Gemini Titan-1 is set to begin rolling out its services to American users in phases. Initially, users with USD balances in their Gemini accounts will be able to trade event contracts directly on the web. Mobile access via the Gemini app is expected to follow the web launch. These event contracts are designed to be straightforward. For instance, traders might take positions on whether Bitcoin will end the year above a certain price or if a regulatory decision will be announced regarding a major corporate fine. The simplicity of yes or no markets is intended to reduce barriers to entry and make trading significantly easier compared to other non-regulated betting markets.

Regulatory Context and CFTC’s Role

The approval of Gemini Titan's platform and the path for prediction markets in the U.S. is highly significant. The CFTC's decision to award a DCM license, after years of cautious oversight, reflects a more open federal approach to new financial products. According to the official press release, CFTC Chair Caroline D. Pham received praise from Cameron Winklevoss, Gemini President, who stated that the agency is "pro-business, pro-innovation" and is positioning the U.S. at the forefront of these new markets.

Competition and Industry Expansion

Gemini is entering a competitive prediction market landscape that is experiencing renewed vigorous activity. Polymarket, a blockchain-powered prediction market, has also recently received CFTC approval to operate as a regulated intermediated market, enabling it to directly onboard U.S. customers and introduce new markets for event-based contracts. Weekly trading volumes on Polymarket have exceeded $1 billion as of mid-2025, demonstrating strong market interest. Polymarket's return to the U.S. follows its departure in 2022 after paying a $1.4 million penalty for operating without registration.

With new regulatory approval and several partnerships, Polymarket is now available on a mobile app for the first time, starting with markets related to sports events and promising future expansion. Furthermore, traditional financial and market players have shown interest in this space, with companies like Fanatics and Robinhood entering the prediction trading arena in 2025. This creates an environment where regulated event trading is accessible to both retail and institutional participants.

Conclusion

The CFTC's granting of prediction market approval to Gemini Titan represents a significant win not only for the company but also for the broader cryptocurrency sector. After a five-year regulatory process, Gemini is now a regulated member of the cohort of platforms offering federally approved event contracts to U.S.-based users. These regulatory changes are making real-world outcome markets more accessible, establishing the legal status of crypto-linked contract trading, and further affirming the role of federal regulators.

Glossary

Prediction market approval: Federal permission for a platform to offer regulated, event-based contracts in the United States.

Designated Contract Market (DCM): An exchange registered with the CFTC where futures, options, and event contracts are offered.

Event contract: A tradable contract that settles according to the outcome of a real-world event, often in a "yes/no" format.

Binary contract: A type of financial contract where the payoff is determined by whether an event took place or not.

Regulated market: A trading platform that is supervised and must adhere to rules established by a federal agency, such as the CFTC.

Frequently Asked Questions About Gemini Prediction Market Approval

What is prediction market approval?

Prediction market approval is a form of regulatory clearance from the CFTC that permits a company to offer federally regulated event-based contracts in the U.S.

What will Gemini Titan serve up first?

Gemini Titan will begin with binary yes/no event contracts, where users can trade potential outcomes of future events using USD in their accounts.

When is the mobile version coming?

Gemini will be opening access to prediction markets on mobile after the initial web launch.

Who regulates prediction markets in the U.S?

Prediction markets are legally supervised by the Commodity Futures Trading Commission (CFTC).

What does this mean for crypto markets?

This is a positive development, as it brings trading in crypto-linked and real-world events under a regulated umbrella, offering more legitimacy and accessibility for participants.

References

CoinDesk

Cryptopolitan

The Block

Decrypt

Gemini

Nasdaq