Digital asset investment manager Galaxy Digital is in discussions to provide liquidity to prediction markets Polymarket and Kalshi. In an interview with Bloomberg, the firm’s CEO Mike Novogratz stated that Galaxy Digital is already participating in "small-scale" experiments with market making on these platforms and intends to offer "broader liquidity" in the future.

By functioning as a liquidity provider and market maker, Galaxy Digital would strategically place steady bids and offers. This action aims to narrow the spreads within the platforms' order books and enhance the overall depth of trading on each platform.

Institutional Interest in Prediction Markets

The venture into prediction markets by Wall Street firms remains limited. Susquehanna International Group has been recognized as one of the few institutional liquidity providers on Kalshi. More recently, Jump Trading has also commenced trading activities on the platform.

Prediction Markets' Growing Momentum

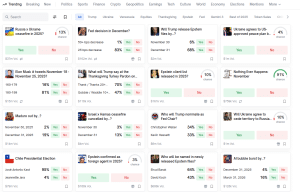

Prediction markets enable traders to place wagers on a variety of real-life events, including sports outcomes, political developments, and projected timelines. Participants trade simple yes or no contracts, with the contract prices reflecting the market-implied probability of each potential outcome.

Currently, Polymarket and Kalshi are the leading platforms in this space, having collectively recorded $42.4 billion in cumulative trading volume. These platforms saw a significant surge in activity during the 2024 US presidential election, particularly after Polymarket accurately predicted the election's outcome.

Kalshi Emerges as a Challenger to Polymarket

Polymarket, a platform initially focused on decentralization, led the prediction market space. However, its dominance is now being challenged by Kalshi, which operates under regulation by the US Commodity Futures Trading Commission (CFTC). Since September, Kalshi has consistently reported higher monthly trading volumes than Polymarket.

This lead, however, could be short-lived as Polymarket prepares for a re-entry into the US market. In July, Polymarket acquired QCX, a US-licensed derivatives exchange and clearing house, for approximately $112 million. This acquisition provides Polymarket with a regulated platform to operate within the US, having received approval from the CFTC.

Polymarket has begun a phased rollout of its platform to a select group of US users in beta mode, with reports indicating a target for a late November launch. The initial focus for this rollout is expected to be on sports prediction markets.

Furthermore, Polymarket has established a multi-year partnership with TKO Group Holdings, the owner of UFC and Zuffa Boxing. This collaboration designates Polymarket as the "Official and Exclusive Prediction Market Partner" for live fan engagement.

We are excited to announce that Intercontinental Exchange (ICE) — the parent company of @NYSE, is making a $2b strategic investment at a $9b post-money valuation.

Together, we’re building the next evolution of markets.

A special thank you to all those who have supported us… pic.twitter.com/y7Z3koj3IU

— Polymarket (@Polymarket) October 7, 2025

Adding to its strategic moves, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, has made a $2 billion strategic investment in Polymarket. This partnership also includes a deal for ICE to distribute Polymarket’s data.