XRP price trades near $2.15, having dropped over 18% since November 10. The token has spent the past month moving inside a descending channel, and with weak volume and rising long-term holder selling, the price is sitting on a critical support level that must hold to prevent a deeper slide.

Bearish Setup and Weakening Volume

- •Bearish Channel: XRP continues to move inside a descending channel, which is a bearish continuation pattern. The latest structure confirms that each attempt at recovery is weakening.

- •Volume Breakdown: The On-Balance Volume (OBV) indicator has been below its short-term trend line since November 12. This signals that market-wide buying pressure is consistently weakening and aligning with the start of the recent 18.6% price decline. The lack of buying conviction sets the stage for increased selling pressure.

Surge in Long-Term Holder Selling

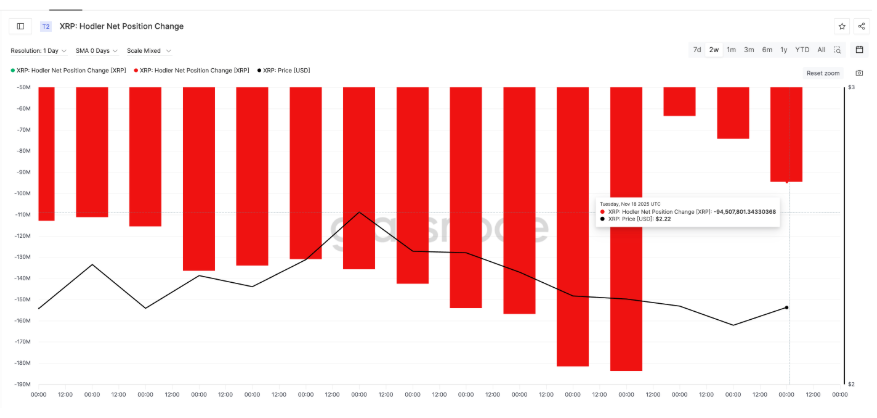

Increased Selling: On-chain data from the Hodler Net Position Change shows that long-term holders have aggressively increased their selling. Long-term outflows jumped by 48.6% in just two days, from November 16 to November 18.

- •Market Implication: This increase in long-term seller activity, combined with weak overall volume (OBV), signals that buyers are not absorbing the supply. This typically means the market has not yet found its bottom, putting all nearby support levels at extreme risk.

Critical Support and Resistance Levels

The short-term path for XRP is defined by two key thresholds:

- •Critical Support: The most important level is $2.10. This level has historically served as a reaction zone. A daily candle close below this fragile floor would confirm a bearish continuation.

- •Downside Target: If $2.10 is lost, XRP is exposed to a deeper move toward the long-term channel floor at $1.77.

- •Resistance/Bullish Invalidation: To invalidate the bearish setup, XRP must reclaim $2.41. A daily close above the higher resistance of $2.58 is required to flip the short-term trend back to outright bullish.

Final Conclusion

The current structure for XRP leans highly negative. Weakening volume and a significant surge in selling from long-term holders are placing immense pressure on the price. All eyes are now focused on the $2.10 support level; the ability of buyers to defend this fragile floor will determine whether XRP stabilizes or enters a deeper slide toward $1.77.

Important Disclaimer

This analysis is for informational and educational purposes only and is based on technical analysis and market data. It is not financial advice, nor should it be construed as a recommendation to buy, sell, or hold any security or cryptocurrency. The cryptocurrency market is highly speculative, volatile, and subject to external factors. Readers must conduct their own comprehensive research (DYOR) and consult with a qualified financial advisor before making any investment decisions.