Neobanks have significantly reshaped the retail banking landscape over the past decade. Digital-only institutions like Monzo and Revolut have demonstrated that a superior mobile user experience can outperform traditional high-street branches, leading consumers to confidently hold their salaries and savings with these tech-driven banks. This trend is expected to accelerate as Gen Z and Millennials become increasingly dominant consumer demographics.

However, while neobanks have excelled in improving user experience, their underlying infrastructure largely relies on legacy systems. Stablecoins are now poised to revolutionize global payments, heralding another significant financial transformation. Digitap ($TAP), an omni-banking application with a live global money app, is emerging as a strong contender for investors seeking exposure to the convergence of neobanks and stablecoin technology, and is being highlighted as one of the best cryptocurrencies to consider for 2026.

With its operational global money app, a Visa card program, and a token specifically designed for value capture, this crypto presale presents an opportunity to invest in a project that could potentially rival established neobanks. Revolut, though still private, is already valued at $75 billion, and Digitap is a project with aspirations to reach similar heights. Early investors can secure ground-floor access to this developing ecosystem.

Neobanks Revolutionized Banking; Crypto Neobanks Are Set to Do So Again

Neobanks successfully addressed key pain points in traditional banking. These digital institutions offered intuitive applications, transparent fee structures, and real-time spending insights that many legacy banks still struggle to provide. Monzo's instant notifications and budgeting tools, alongside Revolut's efficient foreign exchange services and cards, rapidly attracted younger user bases across Europe and internationally.

Despite the advanced app interfaces, the core infrastructure powering these neobanks remains rooted in older systems. While adequate for domestic transactions, this infrastructure presents limitations for global freelancers managing multiple currencies, underbanked individuals sending remittances, or businesses conducting cross-border transactions. The system is not yet optimized for these complex international financial flows.

Concurrently, stablecoins have begun to significantly impact global payment systems, with their total supply now reaching hundreds of billions of dollars. These digital currencies operate 24/7, transcend geographical borders, and settle transactions within seconds, a stark contrast to the days-long settlement times of traditional methods. This is precisely where crypto neobanks like Digitap aim to surpass existing neobanks.

Digitap is engineered to deliver a neobank-grade experience, treating stablecoins, fiat currencies, and cryptocurrencies as integral components within a unified balance from its inception. The outcome is a user experience that retains all the convenience of modern neobanks while enabling significantly faster money transfers and broader global reach.

Digitap's Approach to Building an Omni-Bank

Digitap's fundamental offering is straightforward: a single account capable of managing all forms of value. This omni-bank supports over 20 fiat currencies and more than 100 crypto assets across various blockchain networks. All these functionalities are accessible through a neobank-style application available on both iOS and Android platforms.

Internally, Digitap operates a sophisticated multi-rail system powered by an AI-driven routing engine. When a user initiates a fund transfer, the system intelligently selects the most efficient path, choosing between public blockchains or established banking networks such as SWIFT, SEPA, ACH, or Faster Payments. Transactions are optimized for both speed and cost, with these complexities entirely abstracted from the end user. Digitap leverages stablecoins to facilitate real-time settlements.

This capability holds immense significance for remittances and cross-border payments, which represent the largest global capital flows. The average remittance fee currently stands at 6.4% of the transaction value, with settlement times spanning multiple business days. Digitap's solution aims to reduce these fees to under 1% and achieve payment settlements within minutes.

An additional key feature is the integrated Visa card program, enabling crypto users to spend their on-chain balances with millions of merchants worldwide. Users can seamlessly swap between fiat and crypto directly within the app. As more financial value moves onto the blockchain, the utility and value of applications facilitating instant cross-system swaps naturally increase.

Digitap's design aligns closely with how Gen Z and Millennials currently manage their finances. Its combination of an intuitive user experience and enhanced payment rails positions the project as a compelling investment, anchored in real-world utility. The $TAP token is increasingly viewed as a standout crypto presale opportunity for investors interested in stablecoin and neobank exposure leading up to 2026.

$TAP's Value Capture Tokenomics: A Leading Crypto Presale for 2026?

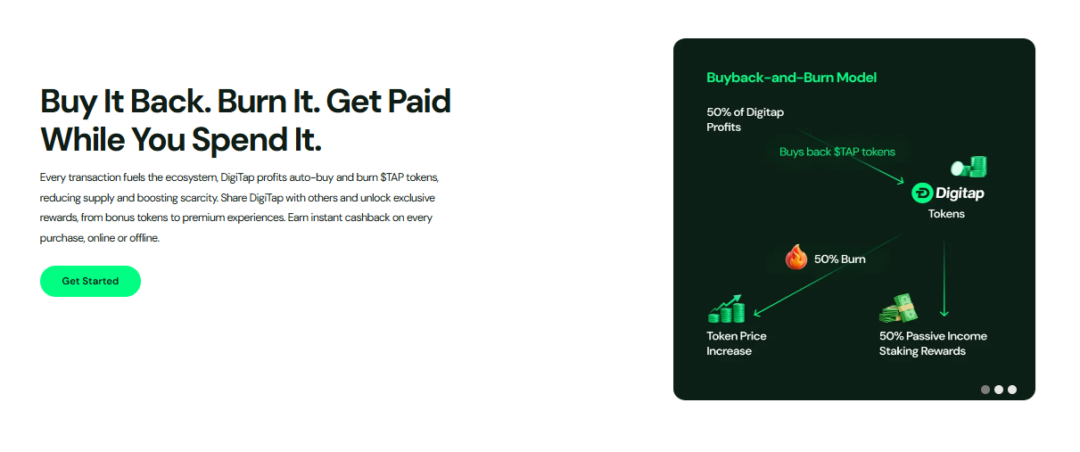

A fundamental distinction between Digitap and traditional neobanks lies in their respective value capture mechanisms. While neobanks like Monzo and Revolut direct value to private shareholders and, eventually, public equity investors, Digitap channels value directly to its token holders.

The platform has committed 50% of its profits to purchasing $TAP on the open market. Of this amount, 50% will be permanently removed from circulation (burned), while the remaining half will be distributed to users who stake their $TAP tokens, thereby providing passive income for long-term holders. This model ensures that as the platform expands its user base and transaction volume, the $TAP token benefits from sustained structural buy pressure.

Digitap appears to recognize that the era of governance-focused tokens is evolving, opting instead to deliver a token that functions more akin to an equity instrument offering dividends. The current presale price of $0.0361 seems significantly undervalued. The project's success in raising over $2.3 million amidst a challenging market climate underscores its underlying strength and investor confidence.

This crypto presale offers investors a discounted entry point into a revenue-sharing component of a live global money application that has the potential to achieve the scale of companies like Monzo and Revolut in the coming years.

Why Digitap is Positioned to Lead the Crypto Neobank Race

Neobanks have made commendable strides in modernizing financial services. However, a decade after Revolut's inception, the next phase of growth is anticipated to be driven by projects like Digitap, which effectively merge the user experience of neobanks with the efficiency of stablecoin rails.

Digitap's early success in its presale can be attributed to its omni-banking product, which offers a familiar interface to Monzo and Revolut users while providing significantly higher transaction throughput and enhanced privacy features. The project targets the substantial global market for remittances and cross-border financial flows. The $TAP token provides investors with an opportunity to participate as partial owners in this growth narrative.

Banking tokens are emerging as a particularly interesting category of altcoins to consider for investment. Digitap's omni-bank model and its revenue-sharing tokenomics make its current crypto presale an attractive proposition. With the banking sector poised for a significant bull run, $TAP could emerge as a standout cryptocurrency to acquire before the close of 2025 and the commencement of 2026.