Key Insights

- •Franklin XRP ETF has gone auto-effective with its S-A filing with the US SEC.

- •Franklin Templeton has set a management fee of 0.19%, which is lower than Canary XRP ETF’s fee of 0.50%.

- •An analyst predicts XRP price risk falling to $2 amid a drop in market sentiment.

In significant XRP news, the Franklin XRP ETF has secured automatic approval following the issuer's submission of a new filing with the U.S. Securities and Exchange Commission (SEC).

This XRP ETF will join the Canary XRP ETF as the crypto community anticipates the launch of other XRP ETFs this week. Previous delays in these launches had triggered a selloff in XRP's price.

Franklin XRP ETF Prepares for NYSE Arca Listing

According to the SEC filing, the asset management firm Franklin Templeton submitted a Form 8-A for its XRP ETF. This submission represents the final step before the XRP ETF's launch, pending a CERT filing for the trading date details.

The issuer has received accelerated automatic approval, aligning with the latest post-government shutdown guidance from the US SEC. The Franklin XRP ETF is set to become auto-effective in 18 days, following Franklin Templeton's amended S-1 filing on November 4.

The Franklin XRP ETF will be listed under the ticker symbol "XRPZ" on NYSE Arca and is expected to commence trading later this week.

The Canary XRP ETF (XRPC) was the first XRP ETF to launch, experiencing massive demand from the crypto community. It surpassed the debut inflows and trading volume records previously set by the Bitwise Solana Staking ETF and others.

Franklin Sets Lower Fees Than Canary XRP ETF

Franklin Templeton has established a management fee of 0.19%, a rate significantly lower than the Canary XRP ETF's fee of 0.50%. Additionally, the Franklin XRP ETF will waive fees until May 31, 2026. The sponsor intends to waive the entire sponsor's fee on the initial $5 billion of the fund's assets.

The XRP ETF will track the spot price derived from the CME CF XRP-Dollar Reference Rate. Coinbase Custody will serve as the custodian, and BNY Mellon will act as the cash custodian for the trust. BNY Mellon is also designated as the transfer agent and administrator for the Franklin XRP ETF, with Franklin Distributors acting as the marketing agent.

XRP Price Shows Signs of Weakness

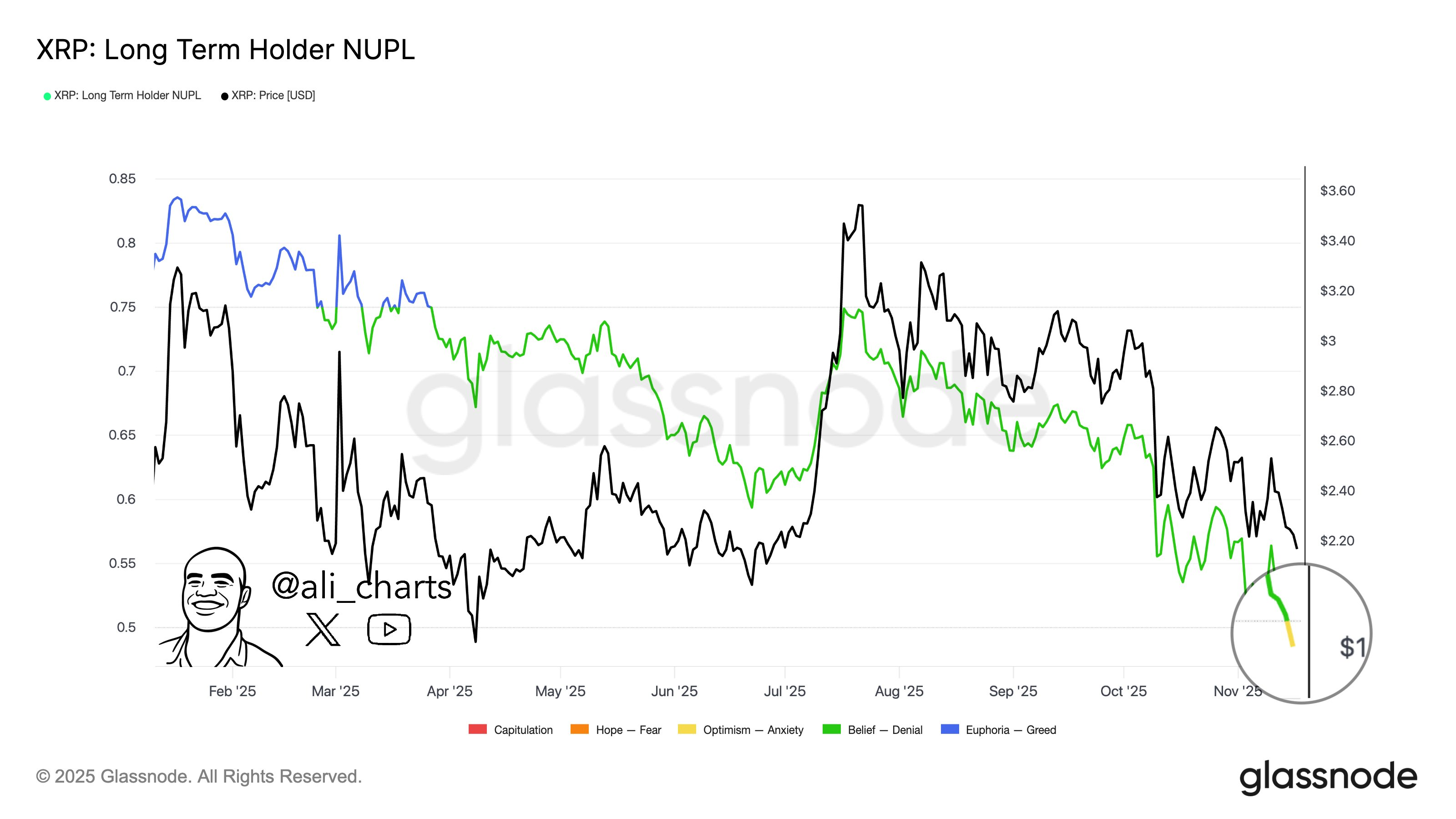

Despite the significant news surrounding the XRP ETF, the price of XRP has declined by more than 2% in the past 24 hours, trading at $2.13 at the time of reporting. The 24-hour low and high were recorded at $2.13 and $2.24, respectively.

Furthermore, trading volume has decreased by 37% over the last 24 hours, suggesting a reduction in trader interest. In the daily timeframe, XRP's price is currently trading below the 50-SMA, 100-SMA, and 200-SMA. Crypto analyst Ali Martinez has predicted a potential fall in XRP's price to $2, citing a drop in market sentiment to the "anxiety" stage.

Data from CoinGlass indicates that the derivatives market has shown buying sentiment in the last few hours. The total XRP futures open interest has increased by more than 0.52% to $3.79 billion over the past 4 hours.