Bridging Crypto and Neobanks in France

While the French state remains hesitant about integrating cryptocurrency into its official reserves, the private sector is rapidly embracing the decentralized trend. Startups, investors, and neobanks are actively participating, propelled by the wave of decentralization. Some traditional banks are observing the developments, while others are testing and adapting. In this landscape, the French fintech company Deblock has committed entirely to the blockchain model. Their objective is clear: to simplify cryptocurrency finance, support it with familiar banking services, and make it accessible to a much broader audience beyond just industry insiders.

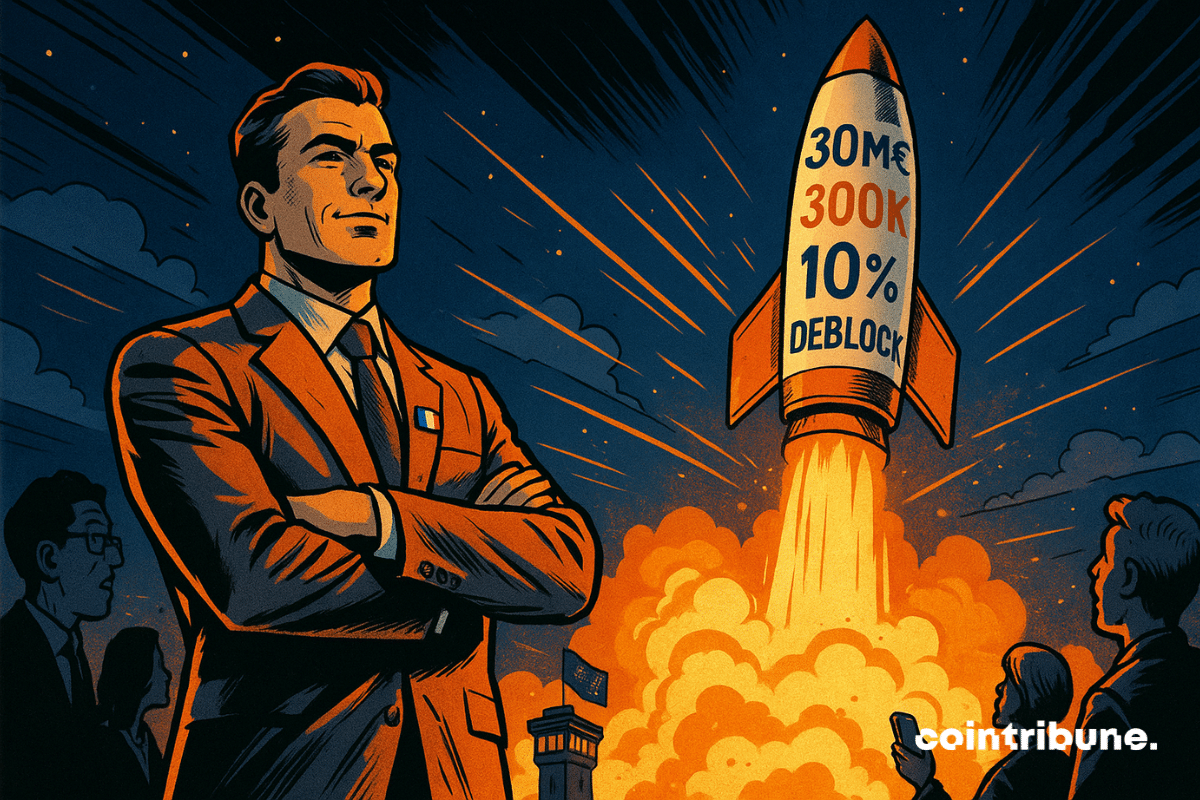

In brief

- •Deblock offers a bank account linked to a self-custody crypto wallet and operates entirely on the blockchain.

- •The company has raised 30 million euros to accelerate its development and expand across Europe.

- •Its DeFi vaults offer potential annual interest rates of up to 10%, automatically paid in euros.

- •The startup holds licenses in France and Europe, including approval from the Banque de France, PSAN, and MiCA.

Deblock aims to do more than just allow euros and cryptocurrencies to coexist; it seeks to merge them. Established in April 2024 by former members of Revolut and Ledger, this French fintech provides a conventional current account, complete with a French IBAN, integrated with a self-custody crypto wallet. This means users maintain complete control over their digital assets, with no intermediary holding them on their behalf.

With a client base exceeding 300,000 and 100,000 monthly active users, Deblock has experienced a threefold increase in revenue in under a year. The €30 million fundraising round announced in November 2025, spearheaded by Speedinvest, Commerzbank, and Latitude, is intended to fuel its European expansion. The company's goal is to reach over one million users within six months, commencing with Germany and Austria in 2026.

Jean Meyer, co-founder, articulated their vision:

Users no longer want to choose between their bank and their cryptos: they want both, in the same place, simply. We are going to massively democratize access to the best decentralized financial services, making them as simple to use as an instant transfer.

Decentralized Finance: Simplicity as the Key in France

Deblock's strength extends beyond its hybrid model; its user experience is a significant differentiator. By integrating DeFi protocols such as Morpho and Yield.xyz into user-friendly savings vaults, the startup offers potential annual interest rates of up to 10%, which are disbursed directly into the account in euros.

Individuals can begin depositing funds with as little as 1 euro, with no upper limit. These services are available without charge for premium subscribers, while free users incur a 50% performance fee.

While Deblock did not invent DeFi, it has effectively removed the associated complexities. Strategy director Claire Balva explained:

We wanted to reduce the complexity of using DeFi for novice users.

This commitment is realized through a streamlined interface designed for individuals who may be new to using crypto wallets.

Paul Frambot, founder of Morpho Labs, commented:

Deblock removes all the complexity of DeFi for its users, giving them magical one-click access to the best yields through Morpho.

Digital Sovereignty: The Crypto Counterpart to Traditional Banking

Deblock positions itself at a critical intersection: where traditional banks impose restrictions, it offers liberation; where conventional finance can be restrictive, it provides freedom. The company has met all regulatory requirements in France and Europe, holding the status of an electronic money institution authorized by the Banque de France, along with the MiCA license obtained in May 2025.

However, the core innovation lies in self-custody. Users are no longer reliant on a bank as a custodian; they are the sole masters of their assets. This represents a significant statement in an era where banking data is frequently monitored, analyzed, and monetized.

Deblock is not competing directly with giants like Revolut or Chime. Instead, it is forging its own path—a domain where the user experience mirrors that of a contemporary neobank, but where the underlying architecture is built upon decentralized components. This approach facilitates frictionless finance combined with a strong sense of user conviction.

Key Figures and Milestones:

- •€30 million raised to support European expansion.

- •Over 300,000 clients acquired within a few months of operation.

- •Potential annual yield of 10% offered through DeFi vaults.

- •Minimum investment requirement of only 1 euro to begin.

- •Full regulatory compliance, including MiCA, PSAN, and approval from the Banque de France.

While the European Central Bank views the digital euro as a crucial element for strengthening the Union's economy, Deblock's proposed path takes a different direction. This initiative is founded on the principle of financial autonomy facilitated by blockchain technology. In contrast to the ECB's vision of a programmable and centralized euro, Deblock champions a fluid, decentralized financial system that directly aligns with the aspirations of digitally connected citizens. These represent two distinct visions for the future, each with fundamentally different promises.