Market Uncertainty and Potential Policy Shifts

CME's "FedWatch" data indicates a nearly even split in market expectations regarding the U.S. Federal Reserve's interest rate decision for December. Currently, there is a 48.9% chance of a 25 basis point Fed rate cut, while the probability of rates remaining unchanged stands at 51.1%. This indicates significant market uncertainty surrounding the Fed's monetary policy direction.

Such speculations about monetary policy often precede notable shifts in financial markets, including cryptocurrencies. Leading digital assets like Bitcoin and Ethereum could witness significant price reactions depending on any Fed announcement.

Market reactions remain cautious amid this uncertainty. The crypto community is focused on potential ripple effects across asset prices, highlighted by recent major liquidation events tied to speculative positioning.

Bitcoin and Ethereum: Navigating Potential Policy Changes

In past cycles, crypto markets have experienced sharp volatility surges ahead of FOMC meetings, reflecting trader positioning in anticipation of outcomes.

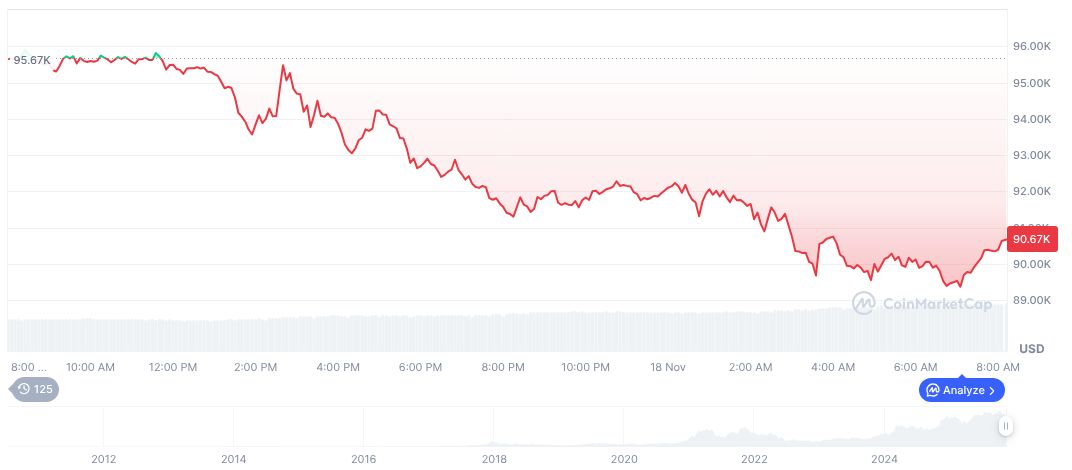

Bitcoin (BTC) currently trades at $91,457.44, with a market cap of $1.82 trillion and a dominance of 58.32%. Over the past 24 hours, BTC saw a trading volume of $86.42 billion, marking a decrease of 19.55%, with its price rising by 1.97%. However, a seven-day decline of 11.31% continues to reflect broader market nervousness.

Analytical insights indicate the potential for financial market upheaval if the Federal Reserve shifts its rate policy. Cryptocurrencies, being highly sensitive to macroeconomic cues, are expected to react sharply based on these rate decisions, influencing both their valuation and volatility trends.

"To be frank, as someone who has traversed all bull and bear markets in the crypto space since 2015, this is the first time I have not felt substantial fear in a bear market.... Global regulation is evolving to foster industry growth rather than suppress it, with more and more institutional investors recognizing the value of such assets. The Harvard endowment fund listing IBIT as a top holding is highly symbolic..."

Simon Kim, CEO of Hashed