Introduction to Proposed Regulations

Federal Reserve Governor Michelle Bowman will address the House Financial Services Committee, outlining plans for new stablecoin regulations to ensure fair competition in the evolving financial landscape.

This initiative aims to establish regulatory clarity, affecting stablecoins and promoting safe innovation while maintaining competition among banks, fintech, and crypto firms.

Key Developments and Regulatory Framework

The proposed regulations seek to align stablecoins such as USDC and USDT with traditional banking standards through capital and liquidity requirements. This move is designed to make the financial space more competitive and safe, addressing potential systemic risks posed by digital assets. Michelle Bowman, Federal Reserve Governor, said, "We must encourage innovation in a responsible manner while enhancing our regulatory capabilities to manage risks from innovation."

This regulatory framework emphasizes maintaining a balance between fostering innovation and ensuring safety in the financial system. Reactions from the market are mixed, with some stakeholders welcoming the initiative for adding systemic safety, while others voice concerns over potential stifling of innovation. Figures in the industry, like regulators and crypto forums, have echoed a variety of sentiments regarding the balance between innovation and oversight.

Reactions from the market are mixed, with some stakeholders welcoming the initiative for adding systemic safety, while others voice concerns over potential stifling of innovation. Figures in the industry, like regulators and crypto forums, have echoed a variety of sentiments regarding the balance between innovation and oversight.

Stablecoin Market Context and Historical Parallels

The current regulatory push echoes past initiatives following the TerraUSD collapse in 2022, which spurred calls for increased oversight and reserve backing for stablecoins globally.

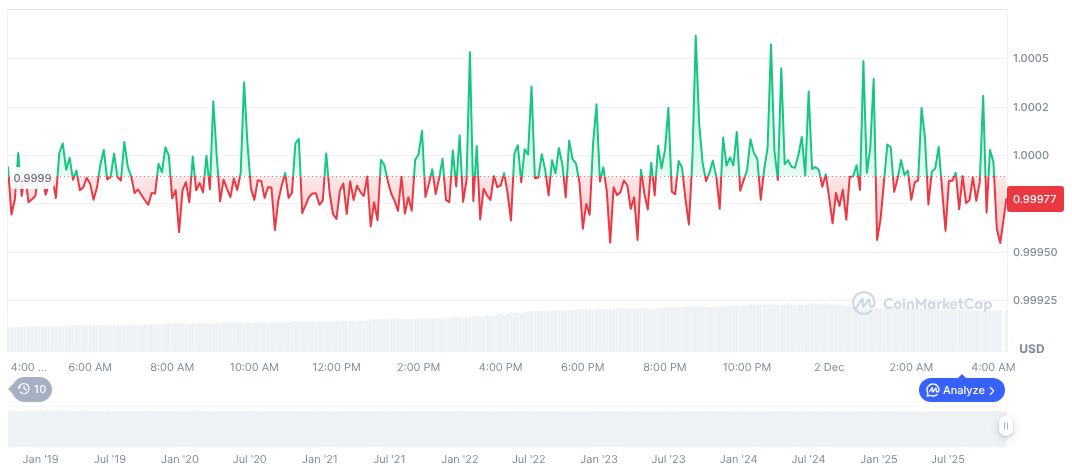

USDC maintains a steady price of $1.00 with a market cap of $77.42 billion. The stablecoin experiences a 2.63% market dominance and a 30.78% change in 24-hour trading volume, despite a slight 1.83% decline in price over the past 24 hours. The supply chain remains unbounded with 77.45 billion tokens in circulation.

Coincu research indicates that the GENIUS Act could fundamentally alter stablecoin markets and associated DeFi protocols. Historical data suggests similar regulations have previously increased transparency and potential interest in the technology. Future developments may lead to new blockchain innovations, balancing security and creativity.