Market Expectations and Potential Impact

The Federal Reserve is widely expected to implement a 25 basis point rate cut in December, a move that carries significant implications for financial markets. CME's FedWatch data, as of December 1, indicates an 87.4% probability of this rate adjustment occurring. This anticipated easing of monetary policy signals potential positive shifts in risk asset markets, including major cryptocurrencies like Bitcoin and Ethereum, as lower interest rates could boost liquidity and positively influence investor sentiment.

The Federal Reserve's anticipated rate cut stems from an aim to stimulate economic activities. The CME's FedWatch data reveals an 87.4% chance of this rate adjustment. In contrast, the likelihood of rates remaining unchanged by January 2026 is noted at 9.2%.

The impact of these expectations affects financial liquidity, making investment in risk assets like cryptocurrencies potentially more attractive. Lower rates historically correlate with increased demand for digital currencies, including Bitcoin (BTC) and Ethereum (ETH).

As per CME's 'FedWatch' data, the probability of the Federal Reserve cutting rates in December 2025 is 87.4% while maintaining rates is 12.6%.

Historical Effects of Federal Rate Cuts on Bitcoin

Historically, Federal Reserve rate cuts have supported increased activity in Bitcoin markets, often buoying investor confidence and driving price rallies across major digital currencies. This trend suggests that the upcoming rate cut could similarly influence the cryptocurrency landscape.

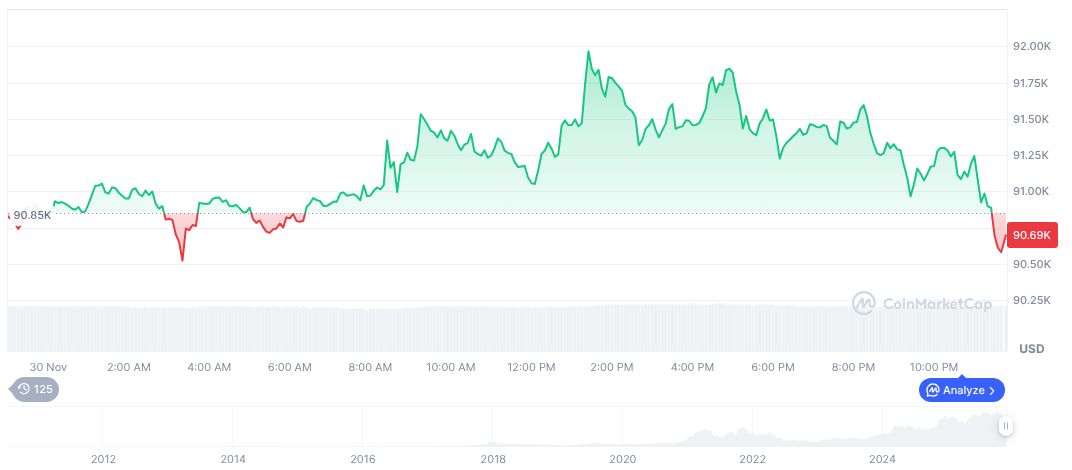

Bitcoin, currently priced at $90,625.00, has a market capitalization of $1.81 trillion and holds a 58.74% market dominance. In recent performance, it experienced a 4.40% increase over the last seven days, despite a 0.29% dip over the preceding 24 hours.

The Coincu research team suggests that the Fed's monetary policy could drive further volatility in the crypto sector. They anticipate that continued uncertainty might bring regulatory discussions to the forefront, emphasizing the need for adaptable frameworks to support innovation and mitigate risks within the digital asset space.