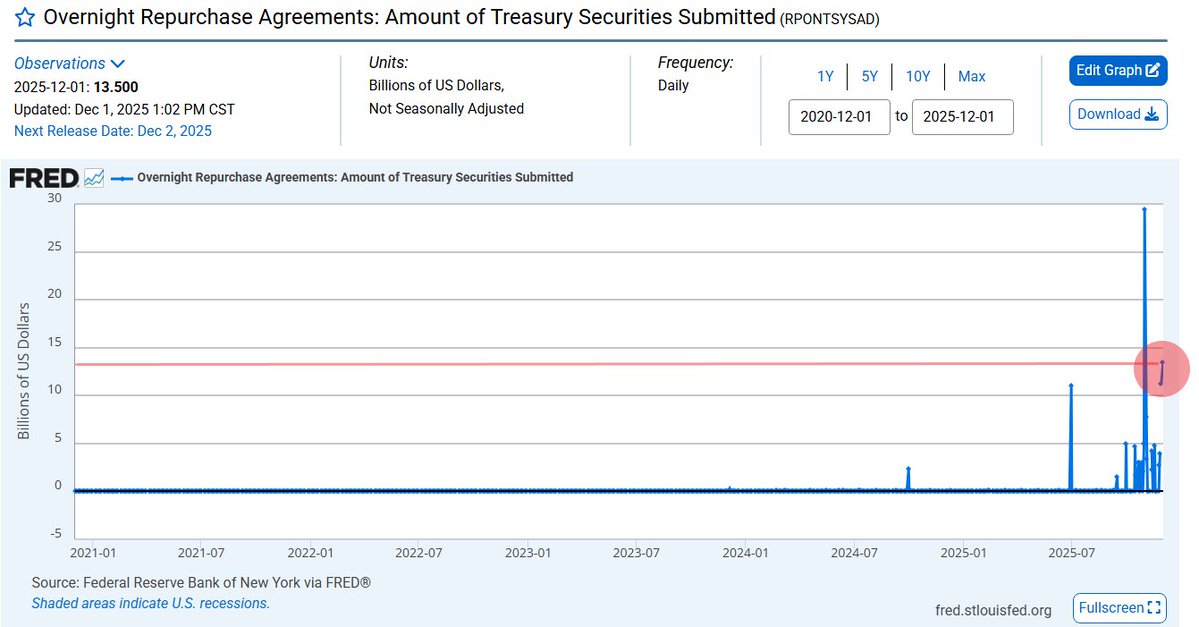

Financial markets were jolted overnight after the Federal Reserve quietly injected $13.5 billion into the U.S. banking system through overnight repurchase (repo) agreements. The chart shared by Barchart shows a dramatic spike, one of the largest repo submissions in modern history.

This move marks the second-biggest liquidity injection since the 2020 pandemic, significantly larger than operations seen during the Dot-Com bubble. The repo market is the deepest source of short-term dollar funding, and a surge of this magnitude generally indicates that banks urgently needed liquidity to stabilize their balance sheets heading into the new month.

While the Fed did not release a public statement explaining the cause, such repo demand typically signals tightening credit conditions or sudden collateral pressures across key institutions.

Why This Matters: Stress Signals in the Banking Sector

The repo market acts as the plumbing of financial markets. Banks borrow cash overnight by pledging U.S. Treasuries as collateral. When repo demand spikes unexpectedly, it can mean:

- •Banks are facing short-term cash deficits.

- •Liquidity conditions tightened sharply.

- •Institutions are hoarding collateral.

- •Funding markets are under stress.

Historically, major repo spikes have appeared before periods of market instability. During September 2019, for example, a sudden repo shock forced the Fed into emergency operations for months. The COVID crisis triggered similar injections.

The fact that today’s spike is even larger than the Dot-Com panic levels is a meaningful stress signal, even if markets have not yet reacted sharply.

What This Could Mean for Stocks and Crypto

Liquidity injections can have two short-term impacts:

- •They mask underlying issues in the banking system by supplying immediate cash.

- •They act as fuel for risk assets, as added liquidity frequently pushes money back into stocks and crypto once the immediate funding squeeze stabilizes.

This dynamic is particularly relevant given the current divergence between traditional equities and digital assets. U.S. stocks have been recovering strongly, while Bitcoin and altcoins recently suffered a sharp correction. If liquidity continues to expand, crypto could benefit, especially once panic around funding stress cools.

At the same time, repo spikes of this magnitude sometimes precede tighter regulatory oversight or deteriorating macro indicators.

Conclusion

The Federal Reserve’s $13.5 billion overnight repo injection is a clear sign that short-term funding pressures flared sharply inside the U.S. banking system. Whether this proves to be a one-day anomaly or the start of a deeper liquidity issue remains to be seen. For now, markets are watching closely, and history suggests that such outsized interventions often arrive at pivotal macro moments.