Key Takeaways

- •Fed Governor Stephen Miran posits that rising global demand for dollar-backed stablecoins may increase demand for U.S. Treasurys, potentially lowering borrowing costs and prompting a reassessment of the neutral interest rate (r*).

- •International adoption of stablecoins is expected to be a significant driver of dollar flows, particularly in countries with limited banking access or unstable local currencies.

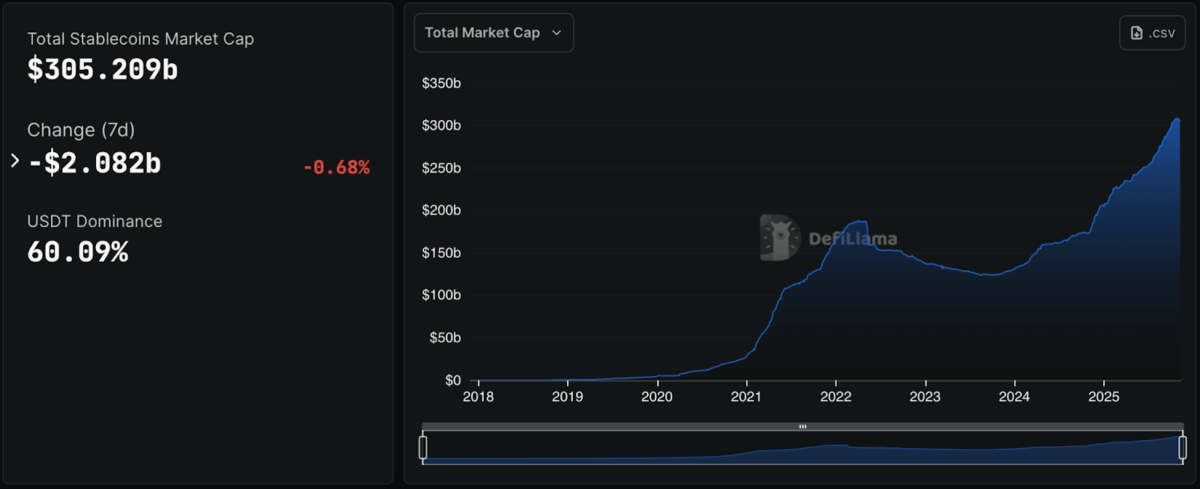

- •The stablecoin market has recovered to over $300 billion, with Tether maintaining dominance and continued usage in trading, DeFi, and cross-border payments.

Introduction

U.S. Federal Reserve Governor Stephen Miran has indicated that a growing wave of demand for dollar-backed stablecoins could significantly influence future U.S. interest rate decisions. These remarks were delivered at the BCVC Summit 2025, held at the Harvard Club in New York on November 7, 2025.

Miran explained that the increasing global utilization of stablecoins might lead to greater demand for U.S. Treasury securities, which in turn could drive down borrowing costs. He posited that if current growth patterns persist, stablecoins "may become a multitrillion-dollar elephant in the room for central bankers," directly impacting the neutral rate (r*), a key benchmark for long-term monetary policy.

Stablecoins are digital tokens designed to maintain a stable value, typically pegged to a fiat currency like the U.S. dollar. Their design facilitates easier and more cost-effective cross-border money transfers, aligning with the robust global demand for dollar transactions.

The recent passage of the GENIUS Act has further bolstered the stablecoin ecosystem by establishing a regulated framework for U.S.-based issuers. This legislation mandates that issuers maintain full reserves in safe and liquid dollar assets, thereby enhancing credibility, attracting a wider user base, and integrating stablecoins more deeply into mainstream financial systems.

Expanding Dollar Access Through Stablecoins

Governor Miran emphasized the role of stablecoins in enhancing dollar accessibility for individuals in emerging and developing economies. Many nations face challenges due to unreliable financial systems and capital controls, making it difficult for individuals and businesses to hold or transact in stable value currencies. Stablecoins operate on blockchain networks, bypassing traditional banking intermediaries and facilitating cross-border transactions. Their adoption is expected to accelerate in regions where local currencies experience high inflation and volatility.

He further suggested that the demand for these digital tokens is likely to emanate increasingly from international markets rather than solely from within the U.S. While U.S. residents have access to insured deposits and yield-bearing assets, savers in countries with stringent financial controls often lack such options. Stablecoins offer a novel avenue for saving and transacting in U.S. dollars, potentially increasing the volume of capital seeking U.S. Treasury bills and other short-term dollar-denominated assets.

Impact on the Neutral Rate and Treasury Demand

Miran elaborated that stablecoin issuers are expected to hold their reserves in assets such as U.S. Treasurys, repurchase agreements (repos), or government money market funds. This trend would consequently increase demand for these specific financial instruments.

He drew a parallel to the "global saving glut" phenomenon discussed by former Fed Chair Ben Bernanke in the early 2000s. During that period, substantial capital inflows from overseas into U.S. investments contributed to a decline in long-term interest rates. Miran proposed that stablecoins could generate a similar effect, albeit on a potentially smaller scale, by channeling increased global capital into U.S. Treasury markets.

Projections from Fed researchers suggest that the stablecoin market could expand to between $1 trillion and $3 trillion by 2030, with some experts anticipating even higher figures. Miran noted that widespread stablecoin adoption might lead to a reduction in interest rates by as much as 0.40%. This scenario could necessitate a reassessment by the Federal Reserve regarding its interest rate setting policies, as the perceived "normal" long-term interest rate might be lower than currently estimated.

Current Stablecoin Market Trends

According to data from DefiLlama, the total market capitalization of stablecoins is currently approaching $305.2 billion. While the market experienced a slight dip in the preceding week, its long-term expansion trend remains evident. Tether (USDT) continues to hold a dominant position, accounting for approximately 60% of the total stablecoin supply.

The stablecoin market experienced significant growth during the cryptocurrency boom of 2020–2021, followed by a contraction in 2022. However, it has regained momentum since mid-2023. The sector's growth is sustained by the ongoing and expanding use of stablecoins across trading markets, decentralized finance (DeFi) applications, and cross-border payment systems.

Stablecoins are increasingly transcending their status as a niche cryptocurrency trend and are beginning to influence global money movement. As dollar-backed stablecoins gain wider international adoption, it is plausible that the U.S. will consider significant policy adjustments to manage their impact on interest rates and the broader financial system.