Key Policy Adjustments and Market Impact

At the December 2025 FOMC meeting, Federal Reserve Chair Jerome Powell announced a 25 basis point rate cut, signaling a data-dependent, non-preset policy path. This decision influenced markets, causing a surge in U.S. stocks and crypto assets, as a weaker dollar and Treasury yield signaled favorable conditions for risk assets.

Jerome Powell announced a 25 bps rate cut while emphasizing a data-dependent approach. This stance, seen as not explicitly hawkish, may support risk assets as the Fed begins short-term Treasury purchases to maintain reserves. Market reactions highlight the influence of such policies. Stocks, precious metals, and cryptocurrencies experienced upward trends as the U.S. dollar weakened post-announcement. Fed’s data-driven strategy signals potential for changing liquidity landscapes, reflected in varied financial market responses. Industry leaders like Arthur Hayes and Raoul Pal, have previously linked such monetary shifts to crypto market impacts, though no direct reactions were sourced for this event.

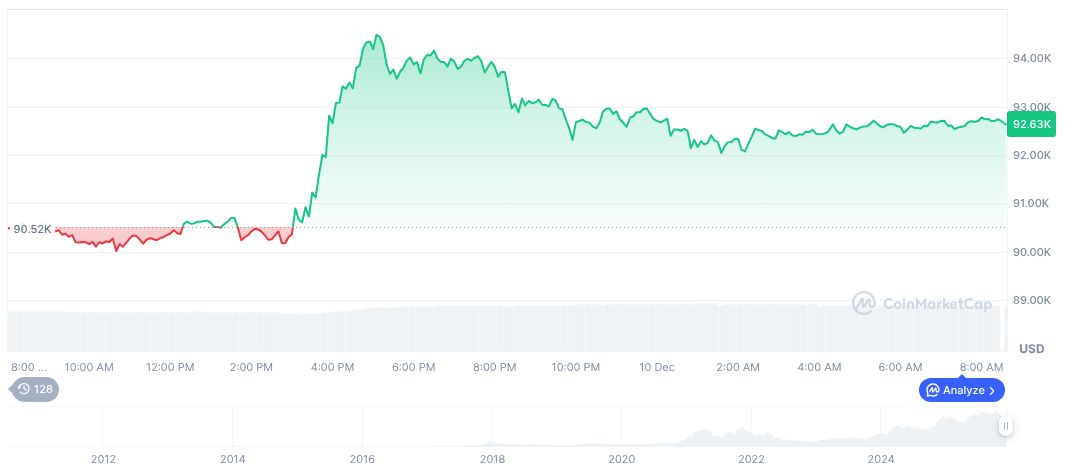

Bitcoin Performance and Future Outlook

Bitcoin (BTC) is trading at $91,777.36, reflecting a 24-hour decline of 0.84%, with a market cap standing at $1,831,912,367,421.00. Recent price trends show a 30-day drop of 13.17%. BTC's market dominance remains at 58.45%. Trading volume reached $64,853,875,853.00, though down by 1.52%. Coincu research team forecasts potential liquidity-driven increases in crypto valuations if the Federal Reserve sustains its policy approach. Historical easing trends often promote capital influx into high-beta assets like crypto, suggesting an optimistic medium-term outlook.

Did you know? Historical easing trends often promote capital influx into high-beta assets like crypto.

Recent price trends show a 30-day drop of 13.17%.

Official Statements and Visual Data

Jerome Powell, Chair, Federal Reserve, "today the Federal Open Market Committee decided to lower our policy interest rate by a quarter percentage point."

Market Commentary and Disclaimer

Coincu research team forecasts potential liquidity-driven increases in crypto valuations if the Federal Reserve sustains its policy approach.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |