EGRAG Crypto, a market technician, has suggested that Bitcoin is entering the second phase of a radical uptrend, drawing parallels between current market conditions and those observed in 2019. This analysis aims to correct a widespread sentiment that the present Bitcoin price action resembles the peak of the 2021 bull cycle.

Misconception of Market Peak

EGRAG Crypto has strongly refuted the notion that the market may have peaked, as it did in 2021, calling it the most significant misconception in today's market. This view is held by several prominent commentators who predict a severe price correction by next year as the pattern allegedly forms.

The technician bases his argument on the distinct liquidity behavioral differences between 2021 and the current period. The closing stages of the previous Bitcoin cycle coincided with the end of the quantitative easing (QE) efforts in the United States. In late 2021, the US Federal Reserve concluded its economic stimulus measures implemented after the COVID-19 outbreak and began quantitative tightening (QT) in early 2022. EGRAG noted that this marked the top of the 2021 bull cycle, initiating the Bitcoin market's distribution phase.

In contrast, the US Federal Reserve has recently reversed its policy this year by ending quantitative tightening (QT) on December 1. The central bank has already injected $13.5 billion into the banking sector. EGRAG concluded, "Two cycles…opposite liquidity conditions," when comparing the 2021 and 2025 market cycles.

He further highlighted that the most accurate comparison to current market conditions can be found in 2019, when the US Federal Reserve also ended QT in December of that year. The analyst also addressed skepticism surrounding the COVID-19 market crash, characterizing it as a black swan event that should not be considered a normal market occurrence.

Technical Analysis of Bitcoin's Trajectory

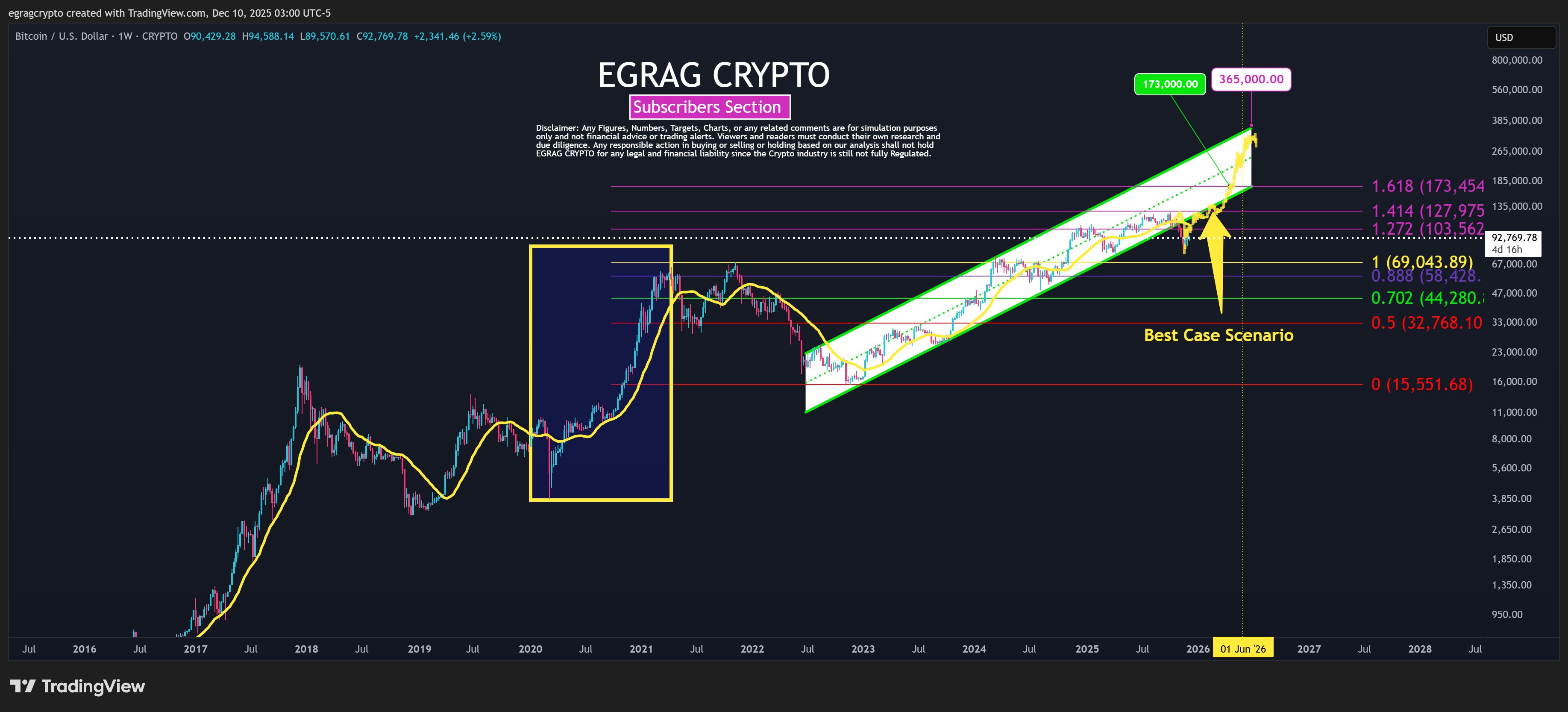

EGRAG Crypto further supported his bullish macroeconomic outlook with technical analysis. He pointed out that Bitcoin is currently trading outside a multi-year ascending channel after recently falling below the $100,000 psychological level. According to his analysis, this represents a higher-low formation, indicating continuation rather than exhaustion.

The analysis suggests that as liquidity strengthens, the price of Bitcoin is expected to follow suit, initiating the second phase of an explosive price movement. In an accompanying chart, EGRAG highlighted an "expansion fractal" that Bitcoin is likely to follow next year, estimating a 72% probability of this occurring. This fractal reportedly began around March 2020, with Bitcoin rising from a low of $3,880 to the April 2021 high of $64,900.

EGRAG's price targets for this next Bitcoin rally include a recovery to $103,000, followed by $128,000, and a conservative push towards a new all-time high of $173,000. His chart also presented a best-case scenario for Bitcoin, projecting a rally to $365,000 per coin.