Cardano (ADA) has recently found a measure of stability after a period of consistent decline. The ADA price has returned to the significant $0.50 support level, and buyers have successfully prevented a further drop.

Analysts like CryptoRand have highlighted that ADA is "respecting" this crucial area and is already exhibiting a strong rebound. Lucky has echoed this sentiment, observing that ADA is "looking good here."

The Cardano Price Support Remains Firm

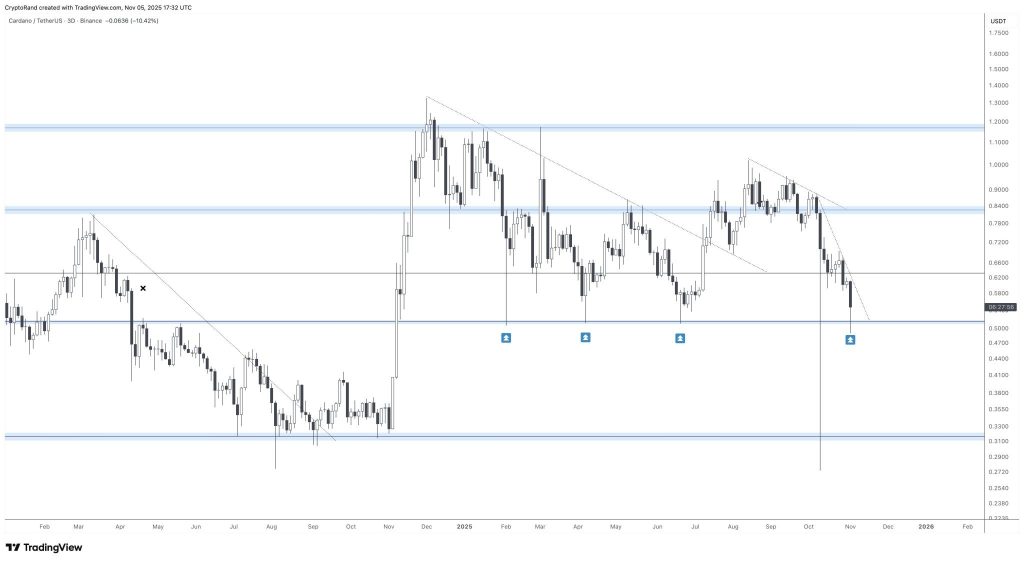

Historical data, as illustrated by Crypto Rand's chart, shows that buyers have consistently stepped in whenever the ADA price has approached this zone over the past year. This level has repeatedly been identified by the market as a point where Cardano is undervalued. This pattern is currently repeating.

Instead of widespread panic and forced selling, the current market behavior indicates accumulation. The price action is reacting precisely as bulls would hope for at a long-term demand level. If this trend continues, it suggests that the most challenging phase of the recent correction may have already passed.

Selling Pressure on ADA Is Slowing Down

Despite a downward trend that has persisted for weeks, as depicted on Lucky's chart, the momentum of selling pressure is beginning to wane. Sellers are exhibiting less aggressive behavior, while buyers are responding more rapidly. Attempts to break down the price sharply are no longer achieving significant progress.

Each instance where the ADA price fails to close below $0.50 increases trader confidence that this level holds genuine importance. This is a subtle indicator of developing strength within the market.

What a New Floor Could Mean for ADA Price

If buyers successfully defend this support area, the next objective will be to reclaim resistance levels above. The initial zone to monitor is between $0.62 and $0.65, which marked the beginning of the last downward move. A decisive breach of this range could significantly shift short-term market sentiment.

Beyond that, with improved trading volume, the ADA price has the potential to revisit the mid-$0.70s and possibly the $0.80s. A substantial breakout is not necessarily required to alter the narrative; a consistent upward push while maintaining the current floor would be sufficient.

However, certainty has not yet been established. Should the $0.50 support level ultimately break, the chart would indicate a potential decline towards $0.40, signaling that buyers have exited the market and the downtrend remains firmly in control.

Currently, however, market reactions suggest the opposite trend is developing, with traders appearing more inclined to defend the level rather than abandon it.

What's Next for ADA?

Sometimes, the most impactful market movements are not characterized by dramatic spikes but by a quiet consolidation. A stable bottoming structure can lead to significant shifts more effectively than a headline-grabbing rally.

If the market continues to perceive $0.50 as a favorable entry point, the ADA price could begin to build upward momentum. This ascent may start subtly before gaining more confidence as trading volume and overall market sentiment grow.