Qivalis Initiative Aims for 2026 Release, Targeting €50 Billion Liquidity Market

Nine major European banks have formed Qivalis in Amsterdam to launch a MiCA-compliant Euro stablecoin, aiming for a 2026 release to enhance regional payment sovereignty.

This strategic move challenges the dominance of U.S.-dollar stablecoins, with the objective of bolstering Europe's financial autonomy, reducing transaction costs by an estimated 40%, and projecting a liquidity of €50 billion by 2027.

Strategic Objectives and Market Impact

Qivalis, registered in Amsterdam and spearheaded by nine European banks, intends to issue a Euro stablecoin. This collaborative effort is designed to provide a robust alternative to existing U.S. dollar-pegged stablecoins, thereby strengthening Europe's payment sovereignty.

The project's core aims include facilitating instant, low-cost cross-border payments and optimizing the settlement of digital assets. By targeting a €50 billion liquidity market by 2027, Qivalis seeks to diminish Europe's reliance on dollar-denominated assets.

The initiative has garnered significant support from policy stakeholders. Qivalis benefits from the backing of the European Banking Federation, and Dutch regulatory bodies have expressed confidence in its development. Industry experts acknowledge the project's geopolitical significance while anticipating potential competitive responses.

MiCA Compliance and Technological Advancements

The development of the European stablecoin, Qivalis, aligns with a broader strategy observed in historical central bank digital currency initiatives. This approach mirrors the regulatory frameworks employed by central banks in their digital currency endeavors to mitigate reliance on foreign currencies.

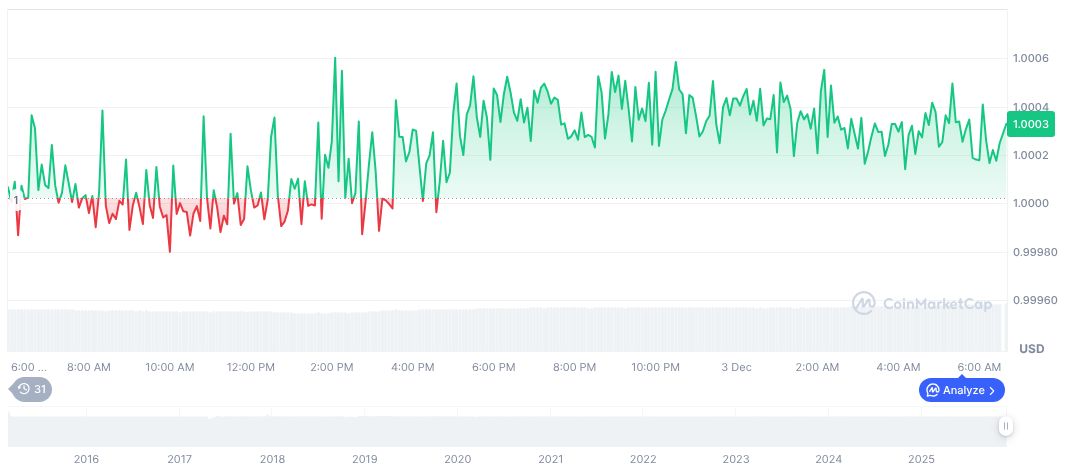

Current market data from CoinMarketCap indicates that Tether USDt (USDT) holds a 5.90% market dominance, with a market capitalization of $184.72 billion. The stablecoin has maintained stable pricing, experiencing a 23.19% change in its 24-hour trading volume, which totaled $127.59 billion as of the latest update.

Insights from Coincu Research suggest that the introduction of a MiCA-compliant stablecoin by Qivalis could serve as a catalyst for technological advancements and the refinement of regulatory frameworks within the EU. This development is expected to pave the way for more sophisticated Eurozone digital asset strategies.